DONATIONS AND THEIR DEDUCTIONS

Speed up your business with these expert tips on "Donations and deductions". Analyse and discover this TIP!

Donations are a form of voluntary contribution that a person makes to a non-profit entity to support a cause they believe in. These entities can be associations, foundations, NGOs, political parties, churches, among others. In many countries, donations have tax incentives and can be deducted on tax returns, which means that the donor can reduce his or her tax burden through these donations. Deductions vary depending on the country and its tax laws.

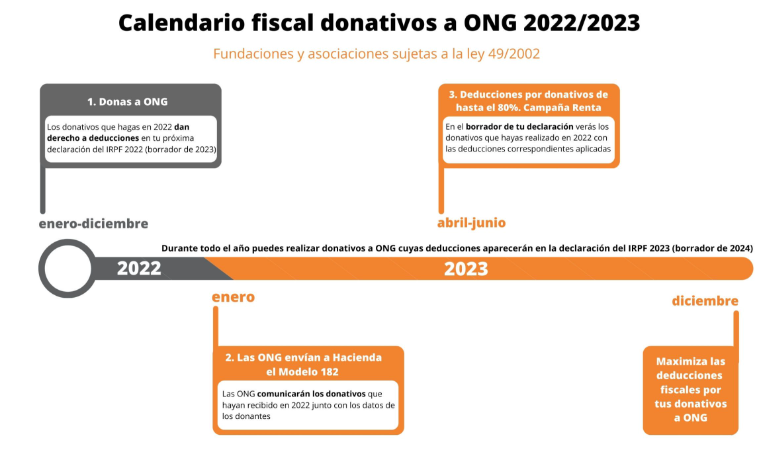

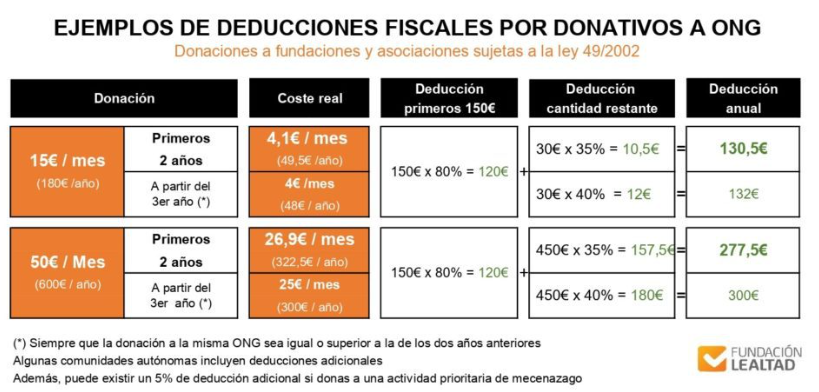

For example, in Spain, donations to non-profit organisations are deductible from the taxable base of personal income tax (IRPF), subject to certain limits and conditions. In general, a deduction of 75% of the donation base is allowed for the first 150 euros donated and 30% for the remaining amounts, with a limit of 10% of the IRPF taxable base. In addition, there is the possibility of making periodic donations, which have a more favourable tax treatment and can be deducted up to 35% in some cases. In other countries such as the United States, donations also have tax incentives and can be deducted from tax returns. Deductions are governed by the Internal Revenue Code (IRS) and set limits based on income and the nature of the gift. In general, Donations are a way to contribute to a cause you feel is important and at the same time reduce your tax burden. However, it is important to inform yourself about the tax regulations and the conditions for taking advantage of these deductions.

Benefits of donations to ngos

Donations have a number of advantages for NGOs, among them:

- Financing: Donations are an important source of funding for NGOs, enabling them to carry out their activities and projects.

- Flexibility: Donations are a flexible form of funding, as NGOs can use them to fund any activity or project they consider important.

- Independence: Donations allow NGOs to be independent and not dependent on government or other institutional funding.

- Acknowledgement: Donations can be a form of recognition for the work NGOs do, which can increase their visibility and reputation.

- Loyalty: Donations can be a way to build donor loyalty, as donors may feel more committed to the cause and be willing to donate in the future.

- Tax deductibility: Donations may be tax-deductible, which may encourage donors to donate.

In a nutshell, Donations are an important source of funding for NGOs and have several advantages, including flexibility, independence, recognition, loyalty and tax deductibility.

Advantages of donations for the donor

The advantages of donations for the donor are:

- Tax benefits: In many countries, donations to non-profit organisations are tax-deductible, which means that the donor can reduce his or her tax burden and obtain significant tax savings.

- Sense of contribution: Donating to a charitable cause can provide a sense of emotional well-being and a feeling of contributing to social welfare. This can have a positive impact on the donor's self-esteem and happiness.

- Opportunity to get involved: Donors can choose specific charities and projects that are important to them, giving them the opportunity to become actively involved in a cause they believe in and make a meaningful contribution to it.

- Sense of belonging: By contributing to a charity, donors can feel a sense of belonging to a wider community that shares their values and beliefs. This can generate a sense of solidarity and empathy with others and enhance a sense of social connectedness.

- Acknowledgement and gratitude: Many charities recognise and thank their donors, which can bring a sense of satisfaction and appreciation to the donor. This can be especially rewarding if the donation is in honour of someone or to commemorate a special event.

How can a person or company make a donation?

An individual or company can make a donation to an NGO or non-profit organisation in a number of ways, including:

- Direct donations: donations can be made directly to the NGO or non-profit entity through bank transfers, credit card payments, cheques, cash, among other means.

- Periodic donations: This is a regular form of donation, in which a commitment is made to donate on a monthly, quarterly or annual basis.

- Donations in kind: is the provision of goods or services instead of money. For example, a company may donate office supplies or food products to an NGO.

- Matching grants: This is a form of donation in which the NGO or non-profit organisation offers some form of consideration to the donor, such as a T-shirt or a calendar.

In any case, it is important to verify that the NGO or non-profit entity is legal and registered to receive donations, and that donors keep proof of the donation in order to claim the corresponding deduction on their tax return.

Grants to entrepreneurs to create jobs

A donation to encourage entrepreneurship and job creation could be made through a non-profit organisation that is dedicated to supporting entrepreneurs, or through specific government programmes that encourage job creation. Donations to incubators, accelerators or venture builders that support entrepreneurs in launching and growing their businesses can also be considered. It is important to research and choose a reputable organisation that has a proven track record of successful work and is aligned with the donor's objectives. In addition, it is important to be aware of the possible tax deductions and legal requirements associated with donations.

An individual can make a donation to an NGO through different methods. Firstly, they can do it directly by bank transfer, cash deposit or via online payment platforms. Alternatively, it can be done through your company or business, as corporate donations are also subject to tax deductions. In addition, some NGOs offer the option of making regular donations via direct debit. It is important that the NGO is covered by Law 49/2002 on the tax regime for non-profit organisations and tax incentives for patronage, which establishes a series of conditions for non-profit organisations to receive tax-deductible donations. Therefore, it is advisable to check whether the NGO is eligible before making a donation.

Maria is a person who has always wanted to support entrepreneurs and help create jobs in his community. After researching different options, he decided to make a donation to a non-profit organisation that supports local entrepreneurs. To this end, first informed about the organisation and its work through its website and social media. He then contacted them via a contact form on their website and asked for information on how to make a donation. The non-profit organisation pointed out the different donation options they offer, such as monthly donations, one-off donations or even the possibility to make an in-kind donation. Maria decided to make a one-off donation and was instructed on how to make the bank transfer.

Once the donation was made, Maria received a personalised thank you from the organisation and was informed about how her donation will be used to support local entrepreneurs. She was also offered the chance to visit the organisation and see first-hand the projects and entrepreneurs they are supporting. Maria is very happy to have contributed to job creation in her community and will continue to support the organisation in the future.

APPLY THIS TIP TO YOUR PROJECT

QUIZZES

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP