FLAT RATE FOR THE SELF-EMPLOYED

Speed up your business with these expert tips on "Flat rate for freelancers". Check it out and discover this TIP!

We are going to explain the flat rate of 80 euros for new freelancers applicable from January 2023, as well as the one that has been applied previously. We will tell you about the requirements, the amount of the flat rate for new freelancers with the entry into force of the new contribution system, and the flat rate for new freelancers with the entry into force of the new contribution system, and the flat rate for new freelancers with the entry into force of the new contribution system. self-employed (see+). According to the new text of the royal decree, all self-employed workers who register for the first time from 1 January 2023 would pay a monthly fee of 80 euros for the first 12 months. And the same amount for another 12 months, as long as their income in this second year does not exceed 1,125 euros per year (i.e. the SMI). This translates into a total sum of 1,920 euros after two years.

What is the flat rate for the self-employed?

The flat rate for the self-employed is a measure to promote self-employment that consists of paying a reduced monthly Social Security contribution as a self-employed person (for one or two years), before becoming part of the contribution system based on actual income. It is a This is a very attractive bonus that greatly reduces the cost of becoming self-employed for the first time, and has helped many new self-employed people to take their first steps.

How much is the flat rate for the self-employed?

The flat rate for the self-employed consists of starting with a monthly payment of 80 euros to the Social Security, instead of the corresponding contribution in the system of contribution by brackets according to actual income (in force since 1 January 2023). This is a measure that has had It has been very popular since it was launched and has helped more than 1.5 million self-employed people since then. However, it has undergone many changes over the years.

HOW TO APPLY FOR THE FLAT RATE?

If you are going to register as self-employed soon and you meet the requirements for accessing the flat rate, you can do so without any problem by applying to the Social Security when you register as self-employed.

REQUISITOS DE LA TARIFA PLANA PARA AUTÓNOMOS:

Those who initially register in the Special Regime for Self-Employed Workers (RETA) during the period 2023 - 2025 will be able to apply for the application of the flat rate of 80 euros at the time of registration.

THE REQUIREMENTS ARE:

- Not having been registered in the 2 years immediately prior to the effective date of the new registration, or 3 years, in the case of having previously benefited from this deduction.

- Not to be self-employed contributor (+). The collaborating self-employed person is a self-employed person who provides services to a company as if he/she were an employee, but without having the legal status of an employee. The company contracts their services directly and pays remuneration for them, but the collaborating self-employed person maintains their self-employed status and their responsibility before the Social Security. This model may be appropriate in cases where the company requires greater flexibility or for workers who prefer to maintain their autonomy.

- Not having outstanding debts with the Social Security and Tax Authorities (+).

CUANTÍA DE LA TARIFA PLANA PARA AUTÓNOMOS:

The flat rate for the self-employed is now 80 euros for the first 12 months of activity, regardless of the self-employed worker's income. And, in the following 12 months, the self-employed will be able to continue paying the 80 euros monthly fee as long as their net income is below the Minimum Interprofessional Wage (SMI). To make this extension effective, you will have to apply to the Social Security through Importass. It is important for you to know that all applications for extension must be accompanied by a declaration that the net income expected to be obtained will be lower than the current minimum wage (SMI).

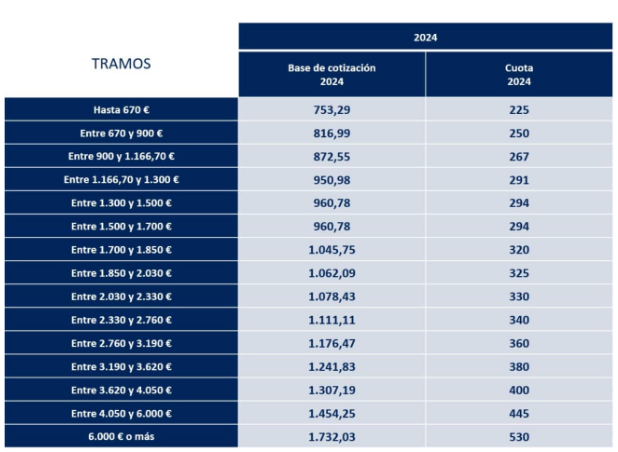

And, once the 80-euro flat rate period has elapsed, the self-employed will be included in the new system of contributions by brackets according to their real income. You will then start to pay contributions according to the contribution bracket that applies to you. Therefore, if your net income (after deducting expenses) exceeds the SMI, the monthly self-employment tax you will have to pay in 2024 will be as follows:

As you can see, the jump in your contribution once your flat rate for self-employment comes to an end is going to be considerable, so you need to plan well.

IMPORTANT:

Don't forget that the flat rate of 80 euros applies to new self-employed workers from 1 January 2023. Therefore, self-employed workers who, on 31 December 2022, were beneficiaries of the old flat rate, will continue to enjoy it until the maximum established period expires, under the same conditions.

FLAT RATE FOR THE SELF-EMPLOYED IN MUNICIPALITIES WITH LESS THAN 5,000 INHABITANTS:

Self-employed people living or working in municipalities of less than 5,000 inhabitants can apply for the flat rate of 80 euros for two years, with no income requirement of less than the SMI in the second year.

THE REQUIREMENTS FOR DOING SO ARE:

- Be registered in a municipality of less than 5,000 inhabitants at the time of registration as self-employed with the Social Security.

- Register with the tax authorities with a tax address in that municipality.

- Work as a self-employed person in the region where you live or are registered.

- Flat rate for self-employed workers with multiple jobs

- Self-employed persons with multiple jobs, who are both self-employed and employed at the same time, can choose between applying for the flat-rate self-employed rate or requesting a discount on their contribution.

- This discount lasts up to 3 years. Let's look at the situations:

- Self-employed persons working full-time as an employee: for the first 18 months, you can apply for a reduction in the contribution base of 50%. And from months 19 to 36 this reduction becomes 25%.

- Self-employed person working part-time (more than half-time): for the first 18 months, the discount on the contribution base is 25%. From the 19th to the 36th month, the discount is 15%.

FLAT RATE FOR SELF-EMPLOYED WORKERS UNDER 35 AND SELF-EMPLOYED WORKERS UNDER 30:

Self-employed women under 35 and self-employed men under 30 can apply for their flat rate, enjoying an extension of 1 year with respect to the rest of the self-employed. Thus, your flat rate is now for a period of 3 years, as follows:

- First 12 months: flat rate of 80 euros.

- Months 13 to 36: flat rate of 80 euros, if they do not exceed the SMI.

FLAT RATE FOR THE SELF-EMPLOYED DISABLED, VICTIMS OF GENDER VIOLENCE OR VICTIMS OF TERRORISM:

Self-employed persons with a disability equal to or greater than 33%, victims of gender violence or victims of terrorism can apply for the flat rate of 80 euros for the first 24 months. At the end of this period, if their expected net yield is equal to or less than the minimum wage, they can request an extension for the following 36 months, for an amount of 160 euros.

CUOTA CERO PARA AUTÓNOMOS DE MADRID, ANDALUCÍA, MURCIA, BALEARES, LA RIOJA, GALICIA, CASTILLA LA MANCHA, EXTREMADURA, CASTILLA Y LEÓN, CANARIAS, ARAGÓN Y CANTABRIA:

A las comunidades autónomas de Madrid, Andalucía y Murcia que ya bonificaban la totalidad de las cuotas de la Seguridad Social de sus nuevos autónomos durante 2023, se han sumado las siguientes comunidades: Canarias, Castilla y León, Castilla La Mancha, Extremadura, Galicia, Aragón y Cantabria, teniendo esta última unos supuestos específicos para su aplicación, como ya pasaba con la comunidad autónoma de Baleares, la cual concede esta bonificación sólo a mujeres emprendedoras y autónomos menores de 35 años.

This zero quota for new self-employed consists of an aid with which 100% of the contribution of the new self-employed starting their activity in Madrid, Andalusia, Murcia and the Balearic Islands will be subsidised for 24 months.

PARA PODER ACCEDER A ESTA AYUDA, LOS NUEVOS AUTÓNOMOS TIENEN QUE CUMPLIR ESTOS REQUISITOS:

- Not to have been registered as self-employed in the last 2 years.

- Not being self-employed collaborator.

- Not to be in a situation of pluriactivity.

- No debts with the Tax Authorities and Social Security.

- Be registered in the state flat rate of 80 euros.

Present on the website of your Autonomous Community all the necessary documentation for registration in the RETA or in the Special System for Self-Employed Agrarian Workers. And, in the case of Madrid, self-employed workers entitled to the flat rate for termination due to the birth or adoption of a child can benefit from the zero quota as long as they resume their activity within 2 years of the effective date of termination.

The economic savings of the zero quota for new self-employed workers is one of the most important points, as the new flat rate of 80 euros will mean an annual saving of 960 euros. In addition, if they can also benefit from this aid in their second year of activity (if their net income is lower than the minimum wage), they can also benefit from this aid in their second year of activity (if their net income is lower than the minimum wage), the total saving will be 1,920 euros. For this reason, if you live in any of these autonomous communities and you are thinking of starting a business, do not forget to inform yourself about your options in order to benefit from the zero quota.

THE FLAT RATE FOR SELF-EMPLOYED CORPORATE (+) IN 2023

Until 2020, self-employed companies were not entitled to opt for the flat rate for the first 2 years. But the situation changed thanks to some Supreme Court rulings that established jurisprudence. Since then, the corporate self-employed also have the possibility to opt for the flat rate which considerably reduces their monthly self-employed contribution during the first phase of the entrepreneurship.

IN ORDER FOR THE SELF-EMPLOYED COMPANY TO BENEFIT FROM THE FLAT RATE, THEY MUST MEET 2 BASIC REQUIREMENTS:

- That you are registering with the RETA for the first time, or that 2 years have passed without being self-employed, or 3 if you benefited from the flat rate at the time.

- No debts with the Social Security or the Tax Agency. And if you are already self-employed as a company, you should know that you have the option of requesting the aid corresponding to your flat rate with retroactive effect.

In order to claim the bonus, you must meet the above-mentioned requirements and you must have been registered as a self-employed company after September 2016 (as the previous period is time-barred). However, if you plan to register as a new self-employed person, it is not necessary to go through this procedure, as you only need to register in the usual way and apply for the aid.

THE FLAT RATE FOR THE NEW SELF-EMPLOYED IN 2022 AND PREVIOUS YEARS:

As we have already mentioned, the new flat rate of 80 euros applies to all new self-employed workers who register from 1 January 2023. But those self-employed who registered in 2022 and previous years will keep the flat rate of 60 euros. So, if this is your case, here is a reminder of what it consists of.

AMOUNT OF THE FLAT RATE FOR THE NEW SELF-EMPLOYED IN 2022 AND PREVIOUS YEARS:

The amount of the flat rate that corresponds to these self-employed workers varies during the first months of activity, with the following rates being established 4 reduction brackets on the minimum contribution base and the minimum contribution rate:

- Tranche 1 (first 12 months): 60 euros (reduction of 80% on the base tax).

- Tranche 2 (months 13 to 18): reduction of 50%.

- Tranche 3 (months 19 to 24): reduction of 30%.

- Tranche 4 (months 25 to 36): reduction of 30% for new self-employed persons under 30 years of age and self-employed persons under 35 years of age.

These amounts correspond to the 294 euros per month in 2022 for self-employed workers paying the minimum contribution (960.60 euros).

AMOUNT OF THE FLAT RATE FOR NEW SELF-EMPLOYED WORKERS IN MUNICIPALITIES WITH LESS THAN 5,000 INHABITANTS IN 2022 AND PREVIOUS YEARS

THESE SELF-EMPLOYED WORKERS ARE ENTITLED TO THE FOLLOWING AMOUNTS IN THEIR FLAT RATE:

- Tranche 1 (first 24 months): 60 euros of contribution or a rebate of 80% if contributions are paid on bases higher than the established minimum.

- Tranche 2 (months 25 to 36): 30% rebate on the minimum contribution for common contingencies, only for self-employed persons under 30 years of age and self-employed persons under 35 years of age.

AMOUNT OF THE FLAT RATE FOR PEOPLE WITH DISABILITIES AND VICTIMS OF GENDER VIOLENCE OR VICTIMS OF TERRORISM IN 2022 AND PREVIOUS YEARS:

THESE SELF-EMPLOYED WORKERS ARE ENTITLED TO THE FOLLOWING AMOUNTS IN THEIR FLAT RATE:

- Tranche 1 (first 24 months): 60 euros of contribution or a rebate of 80% if contributions are paid on bases higher than the established minimum.

- Tranche 2 (months 25 to 36): 30% of rebate on the minimum contribution for common contingencies until 5 years have elapsed since the date of registration.

AMOUNT OF THE FLAT RATE FOR THE CORPORATE SELF-EMPLOYED IN 2022 AND PREVIOUS YEARS:

THESE SELF-EMPLOYED WORKERS ARE ENTITLED TO THE FOLLOWING AMOUNTS IN THEIR FLAT RATE:

- Tranche 1 (first 12 months): 80% reduction (about 85 euros).

- Tranche 2 (months 13 to 18): 50% reduction.

- Tranche 3 (months 19 to 24): 30% reduction.

- Tranche 4 (months 25 to 36): 30% reduction for self-employed persons under 30 years of age and self-employed persons under 35 years of age.

EVOLUTION OF THE FLAT RATE IN RECENT YEARS:

The flat rate is a measure that has undergone many changes over the years. The most recent and relevant have been:

- 2019: the amount of the flat rate was increased from 50 to 60 euros and the first tranche of this bonus for new self-employed workers was extended to one year.

- 2020: the Supreme Court rejected the Social Security's appeals and established case law so that self-employed companies could also benefit from the flat rate, even retroactively. Extension of the flat rate, from 1 to 2 years during the first period, for new self-employed workers registered in municipalities with less than 5,000 inhabitants.

- 2023: entry into force of the flat rate of 80 euros with the new contribution system for the self-employed based on their real income.

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP