TAX DEDUCTION FOR BUSINESS ANGELS IN SPAIN

Accelerate your business with these expert tips "Tax deduction for Business Angel in Spain". Take a look and discover this TIP!

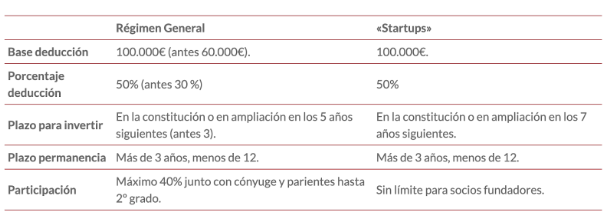

The Startups Act (+) increases the deduction for investment in new or recently created companies, increasing the deduction rate from 30 to 50 percent and increasing the maximum base from 60,000 to 100,000 euros. In addition, the period for subscribing to shares or units is generally increased from three to five years from the incorporation of the entity, and up to seven years for certain categories of emerging companies. In addition, for the founding partners of start-up companies, this deduction is allowed irrespective of their percentage shareholding in the entity's share capital.

The existing personal income tax deduction for "investment in new or recently created entities" is improved. And it is further extended in the case of "start-ups". This allows individuals (business angels and FFFs) who choose to participate in one of these entities to benefit from a personal income tax deduction. Investment in "start-ups" or "startups"will be treated more favourably than the rest.

A comparison is shown below

Startup requirements

IT IS NECESSARY FOR THE STARTUP TO HAVE OBTAINED ITS CERTIFICATE OF INNOVATIVE STARTUP ISSUED BY ENISA (+):

- It must have legal personality in the form of an S.A., S.L., S.A.L. or S.L.L., always unlisted.

- It may not be an asset-holding company.

- In the tax period of the investment, the amount of own funds may not exceed €400,000. In the case of a group, this limit applies to the whole group.

- The entity may not carry out the same activity that it previously carried out under different ownership.

Do I need to be a professional Business Angel?

The regulation does not add subjective requirements regarding the profile of taxpayers eligible for this benefit. In other words, it is not necessary to prove professional dedication to investment or mentoring of entrepreneurs. Mention is made of the possibility of the taxpayer contributing not only capital but also knowledge for the development of the company in which he or she is investing, but in any case this is voluntary. This opens the door to the possibility of the incentive being applied by family members or friends (or madmen) of the entrepreneur. (see+ TIP) to provide capital to your company. All requirements relate to the investment itself.

This is what the law on startups says (pending its development so that we can make the measures more concrete). With effect from 1 January 2023, the following amendments shall be made to Law 35/2006, of 28 November, on Personal Income Tax and partially amending the laws on Corporate Income Tax, Non-Resident Income Tax and Wealth Tax, which shall be worded as follows:

A POINT (M) SHALL BE ADDED TO ARTICLE 14(2), TO READ AS FOLLOWS:

"m). Income from work in kind derived from the delivery of shares or holdings in a start-up company as referred to in Law 28/2022, of 21 December, on the promotion of the start-up ecosystem, which, meeting the requirements established in Article 42(3)(f) of this law, are not exempt because they exceed the amount provided for in that article, shall be allocated in the tax period in which they are received, in accordance with the provisions of Article 42(3)(f) of this law. one of the following circumstances applies:

- The company's capital is admitted to trading on a stock exchange or any multilateral trading system, whether Spanish or foreign.

- The relevant share or interest is withdrawn from the taxpayer's assets.

However, once the period of ten years from the delivery of the shares or holdings has elapsed without any of the circumstances indicated above having arisen, the taxpayer must allocate the earned income referred to in this point corresponding to such shares or holdings in the tax period in which the aforementioned period of ten years has elapsed".

ARTICLE 42(3)(F) SHALL READ AS FOLLOWS:

"f). Under the terms established in the regulations, the delivery to active workers, free of charge or at a price lower than the normal market price, of shares or holdings in the company itself or in other companies in the group of companies, in the part that does not exceed, for the total of those delivered to each worker, 12,000 euros per year, provided that the offer is made under the same conditions for all workers in the company, group or sub-groups of companies. The exemption provided for in the previous paragraph shall be 50,000 euros per year in the case of the delivery of shares or holdings granted to employees of a start-up company as referred to in Law 28/2022 of 21 December on the promotion of the start-up ecosystem. In this case, it shall not be necessary for the offer to be made under the conditions indicated in the previous paragraph, and the offer must be made as part of the company's general remuneration policy and contribute to employee participation in the latter. In the event that the delivery of shares or holdings referred to in this paragraph derives from the exercise of purchase options on shares or holdings previously granted to the employees by the emerging company, the requirements for consideration as an emerging company must be met at the time the option is granted".

A NEW POINT (G) SHALL BE ADDED TO ARTICLE 43(1)(1)(G), TO READ AS FOLLOWS:

"g). In the case of delivery of shares or holdings granted to employees of an emerging company as referred to in the second paragraph of Article 42(3)(f) of this Act, at the value of the shares or holdings subscribed for by an independent third party in the last capital increase carried out in the year prior to that in which the shares or holdings are delivered. If no such increase has taken place, they shall be valued at the market value of the company shares or holdings at the time they were delivered to the worker".

ARTICLE 68(1) SHALL READ AS FOLLOWS:

- Deduction for investment in new or recently created companies:

- Taxpayers may deduct 50% of the amounts paid in the period in question for the subscription of shares or holdings in new or recently created companies, when the provisions of numbers 2 and 3 of this section are met, and may, in addition to the temporary contribution to the capital, contribute their business or professional knowledge appropriate for the development of the entity in which they invest, under the terms established in the investment agreement between the taxpayer and the entity.

- The maximum deduction base will be 100,000 euros per year and will be made up of the acquisition value of the shares or holdings subscribed.

- The amounts paid for the subscription of shares or holdings shall not form part of the deduction base when in respect of such amounts the taxpayer makes a deduction established by the Autonomous Community in the exercise of the powers provided for in Law 22/2009, of 18 December, which regulates the financing system of the common regime Autonomous Communities and Cities with a Statute of Autonomy and modifies certain tax rules.

- The entity whose shares or units are acquired must meet the following requirements:

- Be in the form of a Public Limited Company, Limited Liability Company, Workforce owned Limited Liability Company or Workforce owned Limited Liability Company, under the terms set out in the revised text of the Capital Companies Act, approved by Royal Legislative Decree 1/2010, of 2 July, and in Act 44/2015, of 14 October, on Workforce owned and Participated Companies, and not be admitted to trading on any organised market, whether regulated market or multilateral trading systems. This requirement must be met for all years of holding the share or unit.

- Exercise an economic activity that has the personal and material means to carry it out. In particular, it may not have as its activity the management of movable or immovable assets referred to in article 4.8.two.a) of Law 19/1991, of 6 June, on Wealth Tax, in any of the tax periods of the entity concluded prior to the transfer of the holding.

- The amount of the entity's equity may not exceed 400,000 euros at the beginning of the tax period in which the taxpayer acquires the shares or holdings. Where the entity forms part of a group of companies within the meaning of Article 42 of the Commercial Code, irrespective of residence and the obligation to prepare consolidated annual accounts, the amount of own funds shall refer to all the entities belonging to that group.

For the purposes of applying the provisions of paragraph 1 above, the following conditions must be met:

- The shares or units in the entity must be acquired by the taxpayer either at the time of incorporation or by capital increase (+) The company's assets and liabilities shall be transferred, as a general rule, within five years of such incorporation, or within seven years of such incorporation in the case of start-ups as referred to in Article 3(1) of Law 28/2022 of 21 December on the promotion of the start-up ecosystem, and shall remain in its assets for a period of more than three years and less than twelve years.

- The direct or indirect shareholding of the taxpayer, together with that held in the same entity by his spouse or any person related to the taxpayer by blood or marriage, up to and including the second degree, may not, during any day of the calendar years in which the shareholding is held, exceed 40 per cent of the share capital of the entity or of its voting rights. The provisions of this point shall not apply to the founding shareholders of a start-up company as referred to in Law 28/2022, of 21 December, on the promotion of the start-up ecosystem, understood as those who appear in the public deed of incorporation of the same.

- They must not be shares or holdings in an entity through which the same activity is carried on as was previously carried on under a different ownership.

When the taxpayer transfers shares or holdings and opts for the application of the exemption provided for in section 2 of article 38 of this Act, only that part of the reinvestment which exceeds the total amount obtained in the transfer of those shares or holdings shall form part of the basis of the deduction corresponding to the new shares or holdings subscribed. In no case may a deduction be made for the new shares or holdings as long as the amounts invested do not exceed the aforementioned amount.

In order to make the deduction, it shall be necessary to obtain a certificate issued by the entity whose shares or holdings have been acquired indicating compliance with the requirements indicated in number 2 above in the tax period in which the shares or holdings were acquired.

APPLY THIS TIP TO YOUR PROJECT

QUIZ

ARE YOU INTERESTED IN INVESTING AS A BUSINESS ANGEL? (see EBOOK)

Register for the Business Angels School mentorDay, where you will practice with all the tools and concepts to make money investing in startups.

ARE YOU A STARTUP LOOKING FOR PRIVATE FUNDING? (see+ EBOOK)

Sign up for the Acceleration Programme (+) mentorDay in order to gain access to a Business Angel by participating in the CoInvest.

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP