FORMULAS FOR INVESTING IN STARTUPS

Accelerate your business with these expert tips on "Formulas for investing in startups". Analyse and discover this TIP!

There are different formulas that business angels can use to invest in startups, each with its own pros and cons.

Here are some of the most common formulae

- Individual investment: business angels can invest in one or several start-ups individually, choosing the project and the amount they wish to invest.

- Venture capital funds: business angels can invest in a venture capital fund that invests in start-ups. This allows them to diversify your portfolio (+) and share the risk with other investors.

- Investment in a BA holding company or network: Some business angels may choose to invest in a holding company that in turn invests in start-ups. This structure allows them to have more direct control over their investments and can be easier to manage (see TIP).

- Investment Club: Another approach is to form an investment club with other business angels. Together, they can invest in start-ups and share risk and information.

Each formula has its own advantages and disadvantages and it is important that business angels carefully assess their situation before making a decision.

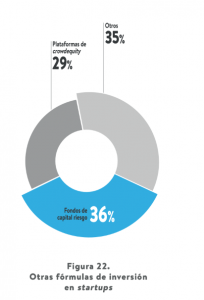

A considerable proportion of business angels in Spain resort to alternative instruments to direct investment in start-ups to diversify their investments. The most common are venture capital funds and crowdequity platforms. (see figure 22).

In addition to making direct investments, 36% have stakes in private equity funds (45% in 2019 and 35% in 2018), indicating that the interrelationship of both industries and activities remains, with a slight decrease compared to 2019 but in line with 2018. The use of crowdequity platforms by business angels decreased from 37% in 2019 to 29% in 2021. This could indicate the use of alternative formulas for indirect investment and diversification through vehicles such as venture capital funds, which are increasingly investing at more seed stage and therefore, are capturing a segment of investment previously occupied by platforms. The confluence of investors in the three scenarios, direct angel investment, through funds and through platforms, is already a palpable reality. The cross-cutting nature and the combination of different investment formulas is a reality that coexists naturally with angel investors.

INVESTING IN STARTUPS AS AN INDIVIDUAL BUSINESS ANGEL (VER+)

INVESTING IN STARTUPS THROUGH VENTURE CAPITAL FUNDS (SEE+)

INVESTING IN STARTUPS THROUGH AN INVESTMENT CLUB (VER+)

INVESTING IN STARTUPS THROUGH EQUITY CROWDFUNDING (VER+)

WHAT BUSINESS ANGELS INVEST IN:

WHERE DO THE STARTUPS IN WHICH A BUSINESS ANGEL INVESTS RESIDE? GEOGRAPHICAL SCOPE OF BUSINESS ANGEL INVESTMENTS (SEE+)

WHAT SECTORS DO BUSINESS ANGELS INVEST IN? (SEE+)

HOW TO START INVESTING?

RISKS

APPLY THIS TIP TO YOUR PROJECT

QUIZ

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

It is interesting to learn about the different ways of investing in startups, so it is clear that there is a variety of investment alternatives and this is good for both business angels and startups.