WHAT IS A BUSINESS ANGEL'S PERCENTAGE STAKE IN A STARTUP?

Accelerate your company "What is the percentage of participation of a Business Angel in a startup? Analyse and discover this TIP!

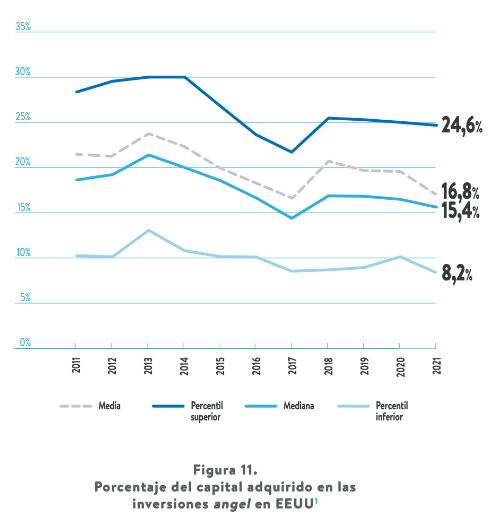

One fact that is of great interest to new investors is the stake that business angels acquire in the start-ups in which they invest. Please note that a very small turnout (below 5%) would not give you power over the startup and that with a very high % of participation in your startup (above 20%) You would be too involved and the startup's problems would also become yours, so you would have to get involved in the management, which is something we business angels do not do. Therefore, our comfort range is between 10% and 15%. This information is not usually publicly available in a structured form, so it is worthwhile to collect the US percentages here (see Figure 11).

The average share of business angels in the investments they make is 16.8%, very close to the median (15.4%), with one quarter exceeding 24.6% of the capital and one quarter below 8.2%. It is It is important to note that this presence has a general downward trend. These data also include It should be added that the mean and median percentage of participation in the seed stage, where more funds participate, is slightly above 29% in the US market, with a clear upward trend since 2015.

What is the % of venture capital participation in a startup compared to that of a business angel?

The percentage shareholding of a venture capital (+) in a startup can vary depending on the financing round (+) and the agreement established with the start-up. On average, venture capital can acquire between 10% and 50% of the startup's equity in a financing round. In comparison with business angels, venture capital tend to have a more significant stake in the company, as they invest large amounts of money in a single opportunity and seek active participation in the management and direction of the company. On the other hand, business angels tend to have a smaller stake in the company and are more likely to invest in one or several rounds of financing, with a more limited involvement in the management and governance of the company.

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Very good to know now what Venture Capital is and the intervention and investment they could inject into a startup.