TAX ADVANTAGES AND INCENTIVES FOR INVESTORS IN GRAN CANARIA

Accelerate your business with these expert tips on "Tax advantages and incentives for investors in Gran Canaria". Take a look and discover this TIP!

Gran Canaria is one of the islands forming part of the Canary Islands, an Autonomous Community belonging to the Spanish State and therefore also to the European Union. As it is a fully integrated territory, the applicable legal regime is Spanish and Community law.

It also has its own Economic and Fiscal Regime, fully compatible with European regulations, thanks to which it is possible to benefit from reduced taxation on business profits and consumption, as well as access to other incentives for business investment.

Political-administrative structure

Gran Canaria is one of the two so-called capital islands that make up the Autonomous Community of the Canary Islands. This autonomous community is itself part of the Kingdom of Spain. Thanks to its status as an insular and outermost territory.

The Canary Islands enjoy a specific status within the European Community, which, among other things, allows for a differentiated tax treatment for investors from abroad who set up companies in the Canary Islands.

The Canarian political bodies are as follows:

Government of the Autonomous Community of the Canary Islands:

- The Canary Archipelago is governed by the so-called statute of autonomy and its highest entity is the autonomous government of the Canary Islands.

- It consists of a President, a Vice-President and a number of councillors with responsibilities in different areas of governance.

- The capital of the Canary Islands is shared between the cities of Santa Cruz de Tenerife and Las Palmas de Gran Canaria.

The Parliament of the Canary Islands:

It is the Community's own legislative body and its seat is in Santa Cruz de Tenerife.

The Island Council:

Therefore, the Cabildo of Tenerife has its own powers of government over the island of Tenerife. It also holds powers delegated by the autonomous government. Its highest representative is the President, accompanied by a number of advisors.

Government Delegation:

- It is responsible for representing the Spanish government and coordinating activities between the Spanish government and Canary Islands organisations.

- The headquarters of the Government Delegation is in Las Palmas de Gran Canaria with a sub-delegation in each of the capital cities.

Consultative Council of the Canary Islands:

- In the city of San Cristóbal de la Laguna is located the headquarters of the Canarian Consultative Councils which, in accordance with our Statute of Autonomy, fulfils the generic function of ensuring that Bills and Bills are in line with the Constitution and the Statute of Autonomy.

- With the aim of ensuring that the public administration is fully subject to the purposes that justify it in the matters and terms set out in our constitutive law, Law 5/2002, of 3 June.

Business tax incentives

Canary Islands Special Zone (ZEC):

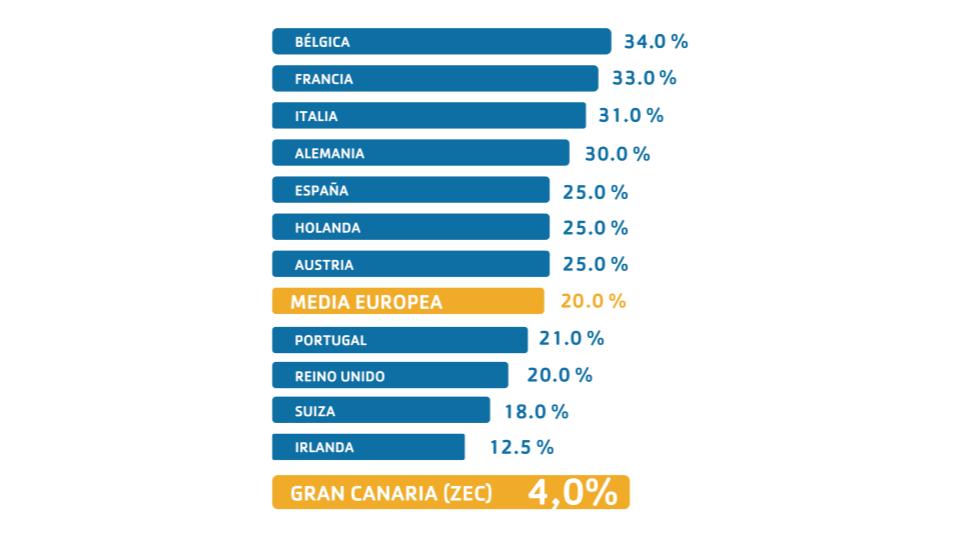

Companies established in the ZEC benefit from a reduced corporate income tax rate of 4%. This option is particularly attractive for investors from third countries as no witholding tax is applied on the repatriation of dividends or on the payment of interest to their parent companies.

Tax deduction for the production of tangible goods:

This incentive offers a 50% reduction in corporate income tax applicable to companies producing agricultural, livestock, fishing and industrial goods.

Canary Islands Investment Reserve (RIC):

With this incentive, the tax burden can be reduced, up to 90% of the business profit, provided that certain investments linked to the growth of the company are made.

Deduction for investments in fixed assets:

It involves a reduction in corporate income tax equivalent to 25% of the amount earmarked for the acquisition of fixed assets.

Deductions for investments in R&D&I and audiovisual productions:

- R&D and Technological Innovation, from 45% to 75%

- National and international audiovisual productions: 50 - 45%

Gran Canaria Free Trade Zone:

In this zone, goods can be stored, processed and handled for an unlimited period of time without having to pay any import duties or taxes.

Consumption taxation:

Canary Islands General Indirect Tax (IGIC):

Tax similar to VAT but specific to the Canary Islands, with notably lower tax burdens. Its general rate is 7%.

Excise duties:

Taxes on alcoholic beverages, tobacco, fuel and certain modes of transport are significantly lower than in the rest of the EU.

COMPARATIVE TAXATION, CORPORATE PROFITS 2017:

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK y this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇