CORPORATION TAX IN SPAIN

Speed up your business with these expert tips on "Corporate Tax in Spain". Analyse and discover this TIP!

What is corporation tax?

The main direct taxes in Spain that investors should be aware of are corporate tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax, corporate income tax and corporate income tax. natural persons (IRPF) (+) and non-resident income tax.

On the other hand, the main indirect taxes are the VAT (+) and Transfer Tax and Stamp Duty (ITP and AJD). This section provides detailed information on corporate income tax.

Corporate Income Tax (IS) is levied on the profits of companies and other entities that are tax resident in Spain and taxed on their worldwide income. A company is considered resident in Spain for tax purposes if it has been incorporated under Spanish law and has its registered office or effective centre of management in Spain.

With the entry into force of the General State Budget for 2022, some modifications were introduced in this tax. Among them, large companies with a turnover of more than 20 million euros will be obliged to pay a minimum tax rate of 15% from this year onwards, while banks and oil companies will be taxed at a minimum rate of 18%.

It is a measure that will be applied in all 137 OECD countries, and is intended to correct, among other things, inequality in corporate taxation in Spanish companies. It is a direct, state-imposed levy, which is regulated by the Law 27/2014 and which, together with personal income tax, contributes to the support of public expenditure.

It is structured around the result of the companies' accounts and, in general, its tax rate is 25%.

When is corporation tax paid?

As in the case of personal income tax, corporate income tax can be paid at different times throughout the year, through instalment payments in the first, second and third quarters, through form 202.

These are payments on account of the annual declarationThe tax return shall be submitted within 25 calendar days after the end of the six months following the end of the tax period. Form 200 is used to declare IS. There is also a specific declaration form for the tax consolidation regime: model 220.

Who is obliged to pay corporation tax?

Corporate income tax is levied on legal entities in general, with some exceptions:

- IS is not payable by civil law companies that do not have a commercial object.

- There are entities without legal personality that are considered to be taxpayers of IS.

- There are companies that are exempt and others, partially exempted.

LET'S START, THEN, WITH THOSE WHO ARE OBLIGED TO PAY IS:

TAXPAYERS WITH LEGAL PERSONALITY

These are public interest companies, such as corporations, associations and foundations, and private interest companies, such as commercial and civil companies (the latter provided they have a commercial purpose).

As specified in the Tax Agencyare also taxpayers:

- Agricultural processing companies.

- Worker-owned companies.

- Public business entities.

- State agencies.

- Mutual insurance companies and mutual benefit societies, accidents at work and occupational accidents.

- Consortia and fishermen's associations.

- Compensation boards, irrigation communities, water communities and inheritances in the Canary Islands.

- Banking foundations.

TAXPAYERS WITHOUT LEGAL PERSONALITY

The following estates are also considered to be taxpayers of IS, even if they do not have legal personality:

- Investment funds.

- Temporary joint ventures.

- Venture capital and closed-end mutual funds, pension funds, mortgage market regulation funds, securitisation funds, investment guarantee funds.

- Communities owning neighbouring forests in common ownership.

- Banking Asset Funds (FABs).

WHO IS EXEMPTED FROM PAYING IS?

Certain public sector entities, such as the State, autonomous communities or autonomous bodies and state agencies, are exempt from corporate income tax.

Nor will they have to submit tax returns, the Bank of Spain, the Deposit Guarantee Fund and the Investment Guarantee Fund, as well as the management entities and common services of the Social Security, the Institute of Spain, public bodies such as the State Tax Administration Agency, the Spanish Data Protection Agency, the National Markets and Competition Commission, the National Securities Market Commission, among others.

The income obtained by these entities will not be subject to IS tax, nor will they be subject to withholding tax, although they will have to withhold it from third parties.

PARTIALLY EXEMPTED:

There is a third category, made up of those companies that are partially exempt from paying this tax.

In the case of some non-profit entities and institutions, corporate income tax is optional and they may choose whether to pay it or not (entities that opt to apply the tax regime for non-profit entities regulated in Title II of Law 49/2002, provided that they meet a series of requirements).

Others, on the other hand, will have to pay tax, although their income will be partially exempt, as is the case for non-profit, charitable or public utility entities and institutions, professional associations, non-governmental organisations, business associations, official chambers, trade unions, political parties, among others.

CALCULATION OF THE TAX BASE AND CORPORATE INCOME TAX (IS)

- The IS is calculated taking into account the accounting results of the company, i.e. the difference between the income obtained and the expenses of the year.

- If necessary, off-balance-sheet adjustments are applied to these results in accordance with the tax criteria established by the tax authorities, which may be due to differences in classification, valuation or allocation, whether positive or negative, temporary or permanent.

- The amount obtained can be offset against tax losses from previous years and the result will give the taxable income for the year.

- To obtain the full tax liability, we apply the corresponding tax rate to that taxable base and, from the resulting amount, we can subtract any possible allowances or deductions. This will give us the positive net tax liability.

- In 2022 there will be a rebate of 40% (previously 85%) on the part of the tax liability corresponding to the income derived from the rental of dwellings that meet the requirements for the application of this regime.

- Finally, by applying the withholdings and fractioned payments made by our company in the tax period, we will obtain the differential tax liability.

- This amount, which may vary depending on whether we have lost tax benefits from previous years, late payment interest or payment of R&D&I deductions due to insufficient tax liability, will be the corporate income tax payment to be made to the tax authorities.

- In 2022, in the event that withholdings on account, payments on account and instalments exceed the amount of the net tax liability or, where applicable, the minimum tax liability, the tax authorities will automatically refund the excess.

General concepts:

TAXABLE BASE

- Accounting income - accounting expenses (company accounts) + adjustments, corrections and offsets of previous tax losses.

FULL QUOTA

- Tax base "x" tax rate.

POSITIVE NET QUOTA

- Full tax liability - allowances and deductions.

DIFFERENTIAL FEE

- Positive net amount - withholdings and instalments.

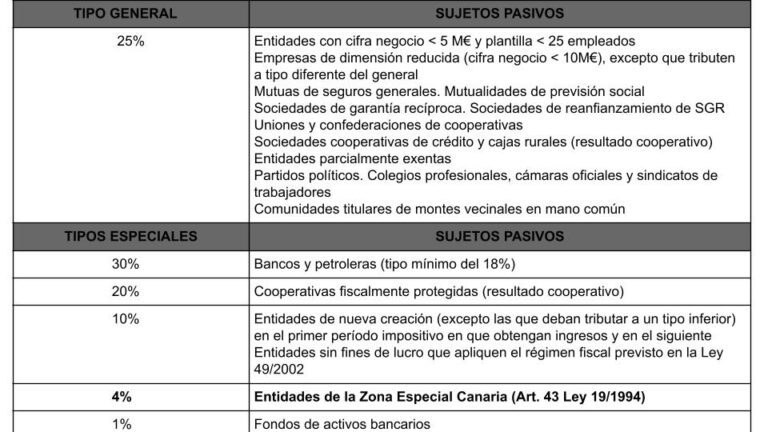

- Corporate tax rates in 2022.

WITH THESE CHANGES, THE TAX RATES FOR IS WOULD BE AS FOLLOWS FOR 2022:

How do I file corporate income tax?

SPLIT FORMS 202 AND 222

Corporate income tax can be brought forward on account of the annual tax return by means of instalments. To do so, companies will have to file form 202 three times a year.

- First instalment: from 1 to 20 April.

- Second instalment: from 1 to 20 October.

- Third instalment: from 1 to 20 December.

The rate or percentage that is applied in the fractioned payments is 18%, although there are higher tax rates for companies with a turnover of more than 10 million euros (24%). For groups of companies, the filing of form 222 will be obligatory. These forms can only be filed online, i.e. electronically.

ANNUAL MODELS 200 AND 220

MODEL 200

This is the one that is filed for the annual corporate income tax return or settlement. In order to know when to file it, six months must be counted from the end of the tax period. If the financial year coincides with the calendar year, it must be submitted by 25 July of the following year.

All companies and legal entities considered taxpayers are obliged to file this form even when they have not carried out any activity during the financial year or have not obtained any income subject to tax.

MODEL 220

This is the corporate income tax return for groups of companies, including cooperatives, taxed under the consolidated tax regime.

The group must file form 220, while all the companies that make up the group must file the corresponding form 200. These forms must also be filed online with an electronic certificate.

Frequently asked questions about corporate taxation:

DO THE SELF-EMPLOYED HAVE TO PAY IS?

In principle, no, because they are natural persons, not legal entities, who carry out economic activities. Self-employed persons pay personal income tax, which, after certain amounts of income, means that they pay a higher amount of tax than if they were a company.

It is therefore common for the self-employed to decide to set up a limited company or a public limited company when certain incomes are exceeded. Like everything else, this will have advantages and disadvantages or difficulties. (because, among other things, it will require you to keep commercial accounts).

What accounting books must be filed for IS?

Companies filing this tax must also keep a set of books of account:

- The journal, to record in chronological order the amount of all transactions.

- The inventory and annual accounts ledger.

- The corporate ledger.

These books shall be kept for at least 6 years from the last accounting entry.

APPLY THIS TIP TO YOUR PROJECT

TASK

Now that you have read this TIP, answer the following questions for your reflection:

- If you intend to start up your activities in Spain as a self-employed person, are you obliged to pay corporation tax?

- From a tax point of view; do you consider Spain to be a suitable country for your investment?

- Could you cite the two methods of filing corporate income tax?

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP