DIVERSIFY YOUR PORTFOLIO

Accelerate your business with these expert tips on "Diversify your portfolio". Take a look and discover this TIP!

Investing in many startups is important to diversify risk and reduce the impact of a failed investment. By investing in a single company, the investor assumes a high risk as his investment depends on the success of that particular company. On the other hand, by investing in several startups, an investor can minimise the impact of a failed investment and improve the likelihood of long-term success. Diversification also allows an investor to explore a wide variety of sectors and technologies, which can increase their return potential and enhance their knowledge of the market. Diversification is essential to mitigate risk and improve the probability of success in start-up investing. As the main financial theories explain, the key to reducing risk is to invest capital in different assets.

But in addition, within the investment in companies with high growth capacity, it is key to diversify our portfolio taking into account:

- Markets/sectors. Although investing in companies in the same sector enhances our knowledge of the sector, in the event of a problem in the market, our entire portfolio would be affected.

- Aggregates. A concept traditionally linked to wine. It is advisable to invest over a long period of time, at least 5 years. It is common to make the mistake of investing a large part of our wealth in the first year, when we have the least knowledge and where there is the greatest risk of making the wrong choice.

- Number. It is often said in the industry that only 1 or 2 out of 10 investments generate returns, so we must invest in enough companies (minimum 10) to balance the risk we take. They should all be companies that, over a period of 5 to 10 years, have the capacity to multiply their value; to cover failed investments and still generate returns.

This is one of the most important aspects to bear in mind when investing in this type of company: if you gamble everything on one card, your chances of losing everything are very high, so it is better not to invest in this case. If we invest everything in Bank X and suddenly the share price of Bank X starts to fall, our entire portfolio will lose value. Whereas if we hold shares in several companies, the fact that one company's share price falls does not necessarily mean that our entire portfolio loses value as other shares may rise in value.

How much money should I invest in each startup? How much of a business angel's equity should be invested in startups?

The amount of money you should invest in each startup depends on, for example, your investor profile, your risk aversion, your investment objectives and your diversification strategy. In general, it is recommended that no more than 10% of your total portfolio be invested in any one company or sector. Investing in this type of company falls into the category of high-risk investments, so it is advisable to allocate a small part of our assets depending on our risk profile, a maximum of 10-15 % of its investable assets, and always investing the money we can afford to lose. In addition, it should be noted that, of the If we have invested in such companies, we should set aside a significant portion of the capital to participate in future capital increases and avoid dilution, or even invest more in those companies in our portfolio that are performing well.

For example; Let's imagine that we have decided that we want to invest €100,000 in high-potential innovative companies, bearing in mind that the capital invested should be a small part of our wealth. Of this €100,000, we should invest €50,000 (50 %) in at least 10 deals over 5 years, and reserve another €50,000 (50 %) to make follow-on investments in the portfolio companies.

HOW QUICKLY CAN YOU RECOUP YOUR INVESTMENT IN STARTUPS?

It is important to understand the timing of returns on this type of investment. Since you are buying shares in the company when you invest, and the events at which the company may be sold are not predictable, it may take years to achieve a return, if any. The industry has standard terms of 5-7 years for seed stage investments, although these may be shorter or longer. This implies that, although there are many potentially profitable companies, When investing, we should look for companies with high growth potential and capable of generating high returns on investment within a few years.

REGARDING THE DIVERSIFICATION OF INVESTORS' PORTFOLIOS IN SPAIN, WE USE THE DATA FROM THE AEBAN-IESE SURVEY

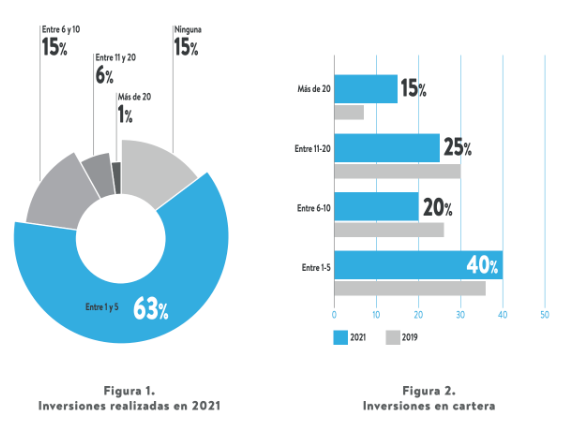

The entry of new investors into the ecosystem, the slowdown in activity of those who have entered more recently and the increase in those with more than 20 investments, mainly due to the scarcity of divestments, have marked the evolution of the live portfolio, giving rise to portfolios with a greater number of startups (see figure 2). Respondents with more than 20 investments in their portfolios increased by 8% and those with between one and five increased by 4%.

On the contrary, those with between six and 20 active investments decrease in 11%. These two elements would point to a growing diversification among investors and a good progression towards maturity and professionalisation of the sector. Importantly, the increase in the number of business angels with between one and five investments demonstrates the growing interest in investment activity by new players in the ecosystem despite a slowdown in the activity of more recent entrants.

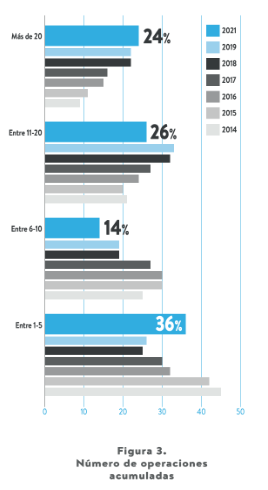

This trend also contributes to the growing accumulation of experience in the sector, which can be clearly seen in the evolution of the number of investments made by each investor since they started their activity. Business angels accumulating more than 20 startups in their portfolio have been gradually increasing since 2015, rising from 22% in 2019 to 24% in 2021 (see Figure 3). This represents a clear trend of investment consolidation by profiles that already have a track record and continue to bet on this sector, maintaining and increasing increasingly solid portfolios, while at the same time showing a slowdown in divestments.

APPLY THIS TIP TO YOUR PROJECT

QUIZ

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇