PERSONAL INCOME TAX IN THE CANARY ISLANDS

Speed up your business with these expert tips on "Personal Income Tax in the Canary Islands". Analyse and discover this TIP!

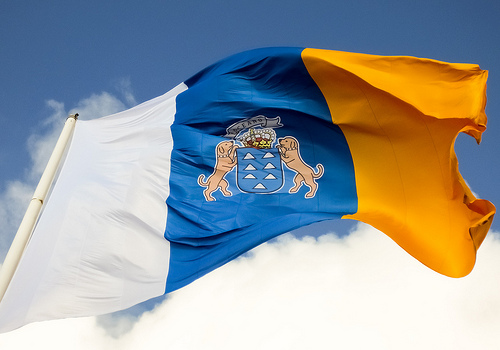

Personal income tax in the Canary Islands

Personal Income Tax is applicable throughout Spain, but in the Canary Islands, for the reasons explained above, it is treated differently.

In fact, taxpayers who are habitually resident in the Canary Islands can make use of a series of regional deductions established by law. These deductions are adjusted to the specific personal and family conditions of taxpayers on the date of accrual.

When persons in a family unit decide to contribute jointly under the terms established in the state personal income tax regulations, the deductions applied in the Canary Islands will be imputed to the family unit that would have corresponded to each taxpayer if they had opted for individual taxation, with the relevant limits established by the regulations.

If the taxpayers forming part of a family unit opt for joint taxation and one of them resides in an Autonomous Community other than the Autonomous Community of the Canary Islands, the provisions of the Legislative Decree 1/2009 of 21 April 2009. provided that the member of the same family habitually resident in the Autonomous Community of the Canary Islands has the highest taxable income, in accordance with the rules of individualisation of the tax.

How is taxation in the Canary Islands based on the taxable base?

In this personal income tax table in the Canary Islands contains the data necessary to find out the tax burden that resident taxpayers have to face. It identifies the total tax liability resulting from your taxable base and the application of the corresponding percentages of the regional scale and the personal and family minimum:

| Net base (up to euro) | Full amount (EUR) | Remaining basis applicable | Applicable rate (percentage) |

| 0,00 | 0,00 | 12.450,00 | 9,50% |

| 12.450,00 | 1.382,75 | 5.257,20 | 12,00% |

| 12.450,00 | 1.813,61 | 15.300,00 | 14,00% |

| 17.707,21 | 3.955,81 | 20.400,00 | 18,50% |

| 53.407,21 | 7.729,61 | 36.592,80 | 23,50% |

| 90.000,01 | 16.382,92 | From now on | 24,00% |

Personal income tax deductions in the Canary Islands:

The regional government of the Canary Islands has launched various initiatives to reduce the tax burden on taxpayers. In fact, citizens of the islands are some of the most tax-advantaged in Spain.

These are the personal income tax deductions in the Canary Islands:

- For donations for ecological purposes.

- For donations for the rehabilitation and conservation of the historical heritage of the Canary Islands.

- For amounts earmarked by their owners for the restoration, rehabilitation or repair of property declared to be of cultural interest.

- For study expenses.

- For moving the habitual residence to another island of the archipelago to carry out an activity as an employee or an economic activity.

- For donations in cash to descendants or adopted children under 35 years of age for the purchase or renovation of their first main residence.

- For the birth or adoption of children.

- For disabled taxpayers and taxpayers over 65 years of age.

- For childcare expenses.

- For large families.

- For investment in primary residence.

- For works to adapt the usual dwelling due to disability.

- For renting a permanent residence.

- For unemployed taxpayers.

- For donations and contributions.

- For donations to non-profit organisations.

- For study expenses in education.

- For foster care.

- For single-parent families.

- For energy rehabilitation and housing reform works.

- For sickness expenses.

- For disabled dependants.

- For the rental of the usual dwelling linked to certain.

- For leases at socially sustainable prices, lessor.

- Expenditure on credit insurance premiums to cover defaults.

For more information on personal income tax in the Canary Islands, click on this link to the Tax Agency.

APPLY THIS TIP TO YOUR PROJECT

TASK

Now that you have read this TIP, you may want to answer the following questions for your reflection:

- Which aspects of the above do you think would favour your establishment in the Canary Islands?

- If you live in the Canary Islands, would you opt for a joint or individual declaration? Why?

- Which of the deductions offered by the Canarian tax system do you consider most appropriate for you?

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇