WHAT ALTERNATIVE INVESTMENTS ARE THERE FOR YOUR SAVINGS?

Accelerate your business with these expert tips "What alternative investments are there for your savings?" Analyse and discover this TIP!

Investment alternatives

What do I do with my savings? Which ones can offer the best returns? Stock market, fund, real estate, bond and private equity investments have different characteristics and levels of risk and return.

- Stock market investment: Stock market investment involves buying shares in listed companies. Returns can be high over the long term, but are also volatile and depend on the performance of the companies invested in.

- Investment funds: mutual funds are a way of investing in a wide range of assets, such as shares, bonds and other financial instruments. The expected return can be moderate over the long term, but also depends on the performance of the underlying assets.

- Real estate: investment in real estate can provide a long-term return through property value appreciation or rental income. However, real estate investment can also be costly and requires a large amount of initial capital.

- Bonds: Bonds are a way of investing in debt issued by companies or governments. The expected return is usually lower than that of equities, but it is also more stable and depends on the credit quality of the bond issuer.

- Cryptocurrencies: Cryptocurrencies are a way to invest in digital currencies such as Bitcoin. The expected return can be high, but it is also highly volatile and depends on the performance of the cryptocurrency market.

Risk capital:

It is a way to invest in startups and early stage companies with high growth potential. The return can be very high if the company is successful, but it is also a high-risk form of investment and there is a possibility of losing all the capital invested. In general, the return and risk of each investment option depends on many factors, including the economic situation and the performance of the underlying assets. It is therefore important, carefully consider each option and consult a financial advisor or investment expert before making an investment decision.

Comparative performance of alternative investments. Comparative performance stock market, funds, real estate, crypto...startups

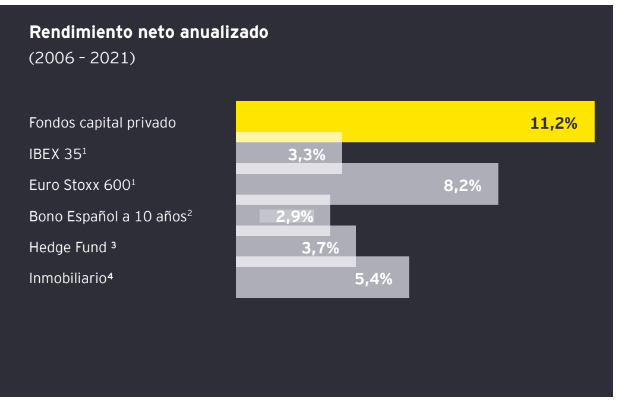

In order for you to see the profitability of each alternative, we are going to take advantage of the study carried out by the spain cap venture capital employers' association. (see+). In order to put the returns achieved by private equity in context, a comparison with other possible investment alternatives, both at national and European level, is provided.

With a net IRR of 11.2% as of December 2021, Spanish private equity consistently outperforms other investment assets considered as alternative investments to private equity and represented by their respective indices. The IBEX 35 and Euro Stoxx 600 indices represent a liquid equity investment alternative, while the Hedge Fund index gives an idea of the performance of a hedge fund with fewer legal constraints. The Spanish 10-year bond and the real estate index serve as benchmarks for the performance of investment alternatives for a more conservative risk profile. Thus, Spanish private equity outperformed the Ibex 35 index* by more than three times during the period under review and outperformed the Euro Stoxx 600* by more than 35%, in both cases considering reinvested dividends and net of fees.

Similarly, the spread of private equity over the Spanish 10-year bond exceeds 8%, representing a robust premium to equity alternatives. Compared to the return on real estate, private equity can more than double its return. Put in a 10-year time frame, this means multiplying the investment by 2.9 times in the case of private equity compared to 1.7 times for real estate. However, remember that past performance does not guarantee future performance and therefore the best option is to diversify (+) and have your savings spread over all the alternatives "don't put all your eggs in one basket" ...sound familiar?

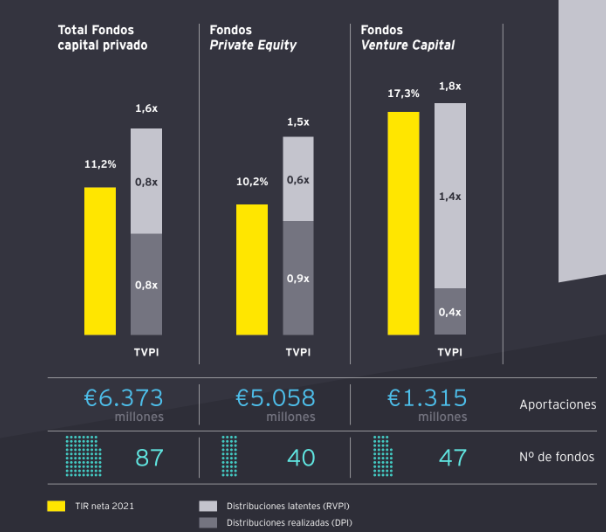

Comparative performance of venture capital and private equity funds, venture

When analysing the data by fund type, Venture Capital funds show, on an aggregate basis, higher returns (17.31 PTP3T vs. the industry average of 11.21 PTP3T). However, these returns are underpinned by a higher proportion of unrealised dormant distributions, which is consistent with the greater youthfulness of the Venture Capital (+). Private Equity funds had double-digit returns (10.21 bps3T), but with a weight of 601 bps3T of realised distributions. This shows less dependence on the future materialisation of latent distributions.compared to Venture Capital funds. An analysis is also made of the dispersion of private equity fund returns by dividing them into quartiles, a very standardised methodology in the industry. As with any type of investment asset, behaviour is not homogeneous across the entire sample, which is why its analysis provides us with relevant information.

Focusing on the funds of Private Equity, it can be observed that more than 50% of the contributions were made in quartiles 1 and 2, with very high average returns in terms of net IRR of 30.8% and 16.4% respectively, within the reach of very few asset classes. If we add the third quartile, which outperforms most of the investment alternatives shown on the previous page, we can conclude that 90% of the contributions have obtained average returns of 7.5% or higher. These three quartiles group together more than 4.5 billion euros of capital calls. In terms of Venture Capital funds, there is a greater dispersion between quartiles. However, 36.51TTP3T of the funds contributed (€480m) are in the first quartile with an average return in terms of net IRR above 50% and, additionally, more than 80% of the contributions have a positive average IRR (€1,060m).

QUIZ

ARE YOU INTERESTED IN INVESTING AS A BUSINESS ANGEL? (see EBOOK)

Register for the Business Angels School mentorDay, where you will practice with all the tools and concepts to make money investing in startups.

ARE YOU A STARTUP LOOKING FOR PRIVATE FUNDING? (see+ EBOOK)

Sign up for the Acceleration Programme (+) mentorDay in order to gain access to a Business Angel by participating in the CoInvest.