WORKING CAPITAL

Accelerate your business with these expert tips on Working Capital. Take a look and discover this TIP!

A new company's working capital is a financial indicator that measures its ability to meet its short-term obligations. In other words, it is the amount of financial resources that the company has available to cover its short-term expenses and commitments, such as payment of suppliers and employees. To calculate the working capital, current liabilities are subtracted. (short-term liabilities) of current assets (resources available in the short term). If the result is positive, means that the company has sufficient financial resources to cover its short-term obligations. If the result is negative, it means that the company may have problems meeting its short-term obligations and may need additional financing.

It is important that a new company, has adequate working capital to ensure its liquidity and ability to meet its short-term financial obligations. Positive working capital can also be a sign that the company is well managed and has good cash flow management. We would also point out that the calculation of working capital, is only a financial analysis tool and should not be used in isolation. It is recommended that companies use multiple financial tools and analyses to assess their financial health and make informed decisions.

Cases of companies that failed due to negative working capital

There are several cases of companies that failed due to negative working capital, resulting in liquidity problems and difficulties in meeting their short-term financial obligations.

Examples include:

- Blockbuster: In 2010, the popular movie and video game rental chain filed for bankruptcy due in part to negative working capital. The company had accumulated a large amount of debt and was unable to meet its short-term obligations.

- Toys "R" Us: In 2017, it filed for bankruptcy due to a series of financial problems, including negative working capital. The company had accumulated a large amount of debt and was unable to meet its short-term financial obligations.

- Kodak: In 2012, the famous photography company filed for bankruptcy due to a series of financial problems, including negative working capital. The company had accumulated a large amount of debt and was unable to meet its short-term financial obligations.

These cases highlight the importance of having adequate working capital to ensure a company's liquidity and ability to meet its short-term financial obligations. It is important that companies regularly monitor their working capital and take measures to improve their financial health if necessary.

Ideas for maintaining positive working capital

Here are some ideas that a company can implement to maintain positive working capital:

- Reduce costs: One way to maintain a positive working capital is to reduce costs in the business. This may include reducing staff costs, supply costs and overheads.

- Increase sales: Another way to maintain positive working capital is to increase the company's sales. This can be achieved by expanding sales channels, improving marketing and promoting new products or services.

- Improve inventory management: Efficient inventory management can help reduce costs and maintain a positive working capital. The company should make sure to maintain adequate inventory levels and avoid excess inventory, which can be costly.

- Control capital expenditure: Capital expenditures can have a significant impact on a company's working capital. It is important to monitor these expenditures and ensure that they are necessary and justified.

- Getting paid on time: It is important for the company to collect from its customers on time to maintain a positive cash flow and a healthy working capital. The company can establish clear payment policies and remind customers about due dates.

These are just a few ideas that a company can implement to maintain positive working capital. It is important that the company regularly monitors its financial situation and takes appropriate measures if necessary. Working Capital is a metric that shows the short-term liquidity of a company. Represents the portion of current assets that is financed by non-current liabilities. It can vary depending on the time of year and due to the seasonality of business it is very important to have it under control to ensure short-term liquidity.

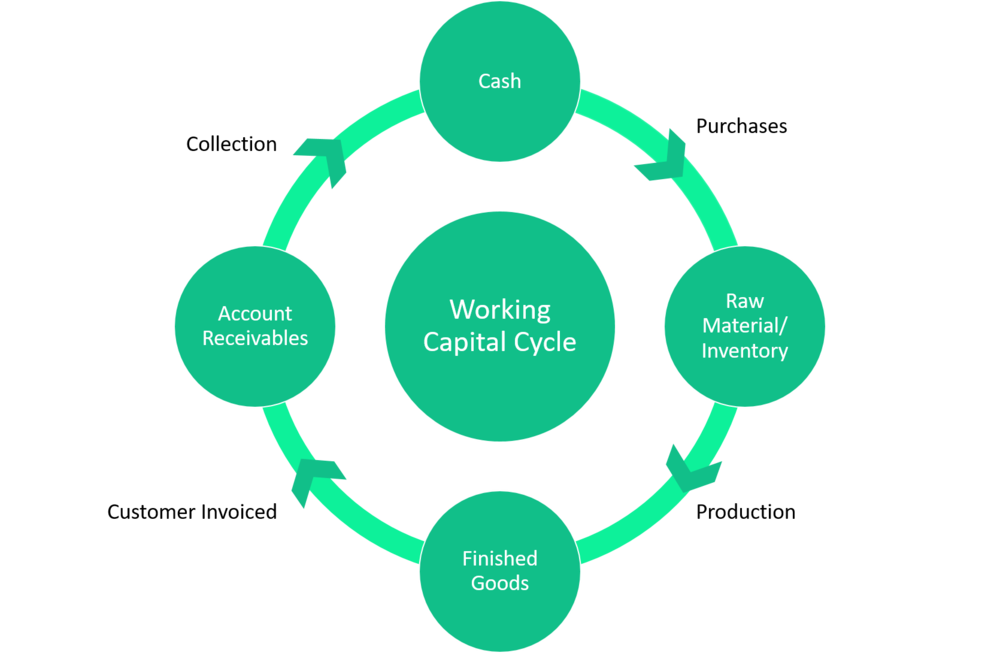

How is this working capital calculated?

It is calculated as the difference between current assets and current liabilities, including all accounts:

- (+) Cash.

- (+) Accounts Receivable.

- (+) Inventory.

- (-) Accounts Payable.

Well, although it may be a very simple concept to calculate, a series of factors must be taken into account in order to know how to interpret it and its influence on the development of the business. For the working capital to be adequate for the correct continuity of the business, as you can imagine, the current assets or the most liquid assets of the companies must be greater than the debts that we have to face in the short term or the current liabilities. If the result of this difference were zero or negative, it is very likely that the company would not be able to meet its debts in the very near future and that sooner or later it would have to file for bankruptcy.

How to interpret Working Capital?

Once calculated we can find 3 different situations:

- WC > 0: the company is able to meet its short-term obligations.

- WC = 0: the company could face problems in the event that a customer's payment is delayed.

- WC < 0: could lead to a suspension of payments, as the company is not able to meet its short-term obligations.

Knowing the 3 situations that we can find ourselves in, we can see that the best option is to have a positive Working Capital, but we must ensure that it is not excessive, as this would represent an opportunity cost because the company would have uninvested resources that it could make profitable by financing other investments.

THERE IS A GOLDEN RULE IN THE ISSUE OF WORKING CAPITAL DISTILLATION:

- Charge quickly.

- Delay payments as long as possible (without defaulting, of course!).

- If you have stock, keep it as low as possible.

APPLY THIS TIP TO YOUR PROJECT

QUIZZES

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇