FINANCING ACCORDING TO THE STAGES IN THE CREATION OF A COMPANY

Accelerate your business with these tips "Financing according to the stages in the creation of a business". Analyse and discover this TIP!

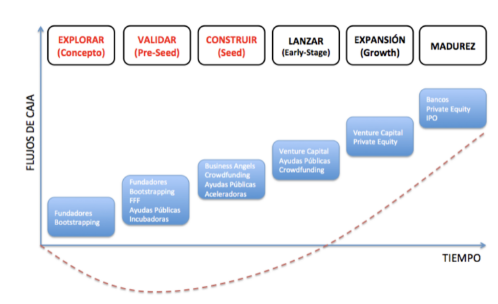

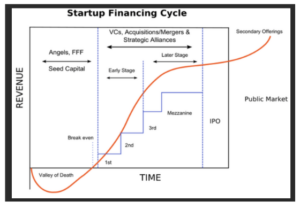

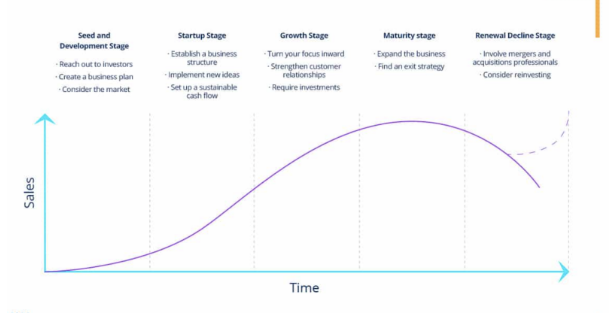

In this TIP, we propose a review of the phases or stages that startups usually go through from the moment the entrepreneur identifies a business opportunity until, once in the market, they begin to grow. This will give you a clear vision of what you need to do in each of them in order to achieve success with your business. As we shall see, funding and growth capacity are two constant variables that condition the development of start-ups. It is very important that you know what phase or stage you are in to be clear about what the next step is so that you can move forward faster. At each stage you have different needs, so it is essential that when you plan your pitch with an expert, investor... you make it clear at what stage you are, what steps you have taken and what are the next steps you want to take.

Stages of a startup looking for an investor (business angel, venture capital....)

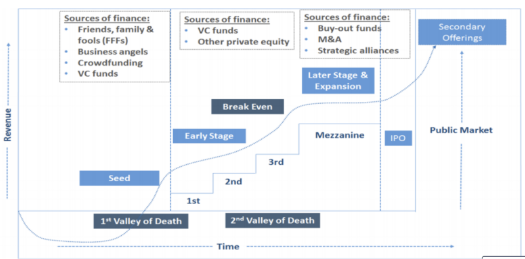

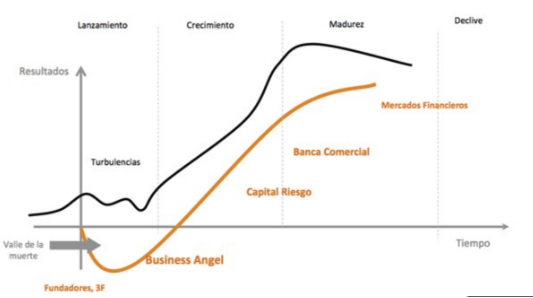

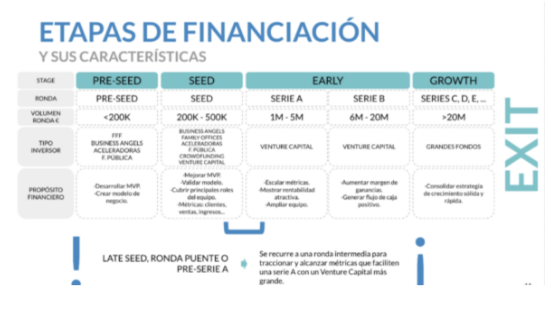

Pre-Seed or pre-seed

This stage starts from the moment a business idea emerges, but it is not the first stage. the product is not yet fully validated and certainly there is no or only very token turnover. In this phase, it is the founders themselves who make the first capital injection with their own funds and the well-known 3Fs are also often used: "...", "...", "...", "...", "..." and "...".Family, Friends and fools."Generally the investment made in this phase is less than €50,000 (in Spain, €100,000 in the US).

- What are its characteristics?

- There is already a founding team (of two or three people), may still be incomplete.

- The entrepreneur has a fairly clear idea of the problem it addresses and how to solve it. I might even have a MVP (minimum viable product) of the product.

- It wants to raise a relatively small round (no more than €100,000) in order to develop and test the product.

- No or non-recurrent income.

Seed

At this stage the startup already has a finished product and a defined and functioning business model. It has a full team and has started to bill on a more stable and recurring basis. They are usually looking for rounds of less than €300,000.

What are its characteristics?

- The recruitment of more people to the team is normally considered in order to develop and scale up the product.

- The product is already on the marketis known to a growing number of customer users. It is time to demonstrate traction (see TIP), that is to revalidate the business model in contact with the market.

- The focus in this phase is NOT necessarily on increasing revenues.The focus is on continuing to develop the product and iterate, to grow in users, retention and loyalty.

Growth

Once the market launch is over and with recurring sales, the startup is now entering its growth phase, focusing on optimising operations and scaling sales, which requires an injection of capital to undertake new investments.

In this phase, startups are categorised by "series":

Serie A (rounds not exceeding €1M):

- Staff of more than 25 people.

- Own sales team with the prospect of expanding it in order to increase sales, building loyalty among current customers while adding new customers to the portfolio.

- Revenue (under one million euros) and enough traction to double or triple that revenue quickly.

Series B (rounds not exceeding €3m):

- Revenues have doubled or tripled since the A series. Customer retention is at its strongest.

- It is clear to them that they can defend their product against competitors.

- It is very likely that they will be acquired by others and make an EXIT and future investment decisions will be more financial in nature than anything else.

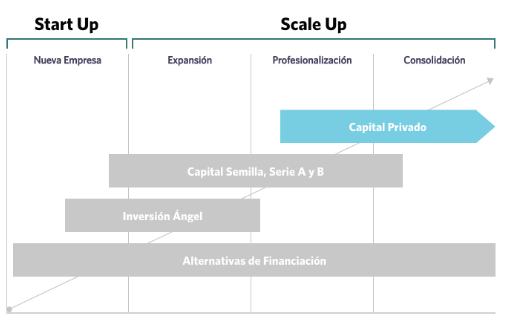

Stage according to private financing:

TYPE OF PRIVATE INVESTOR DEPENDING ON THE STAGE OF THE START-UP

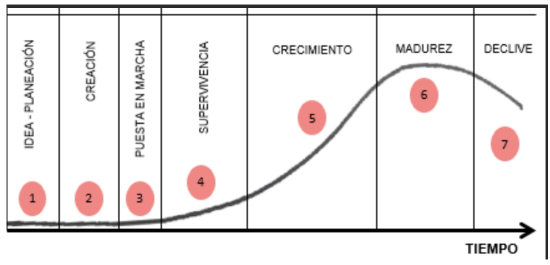

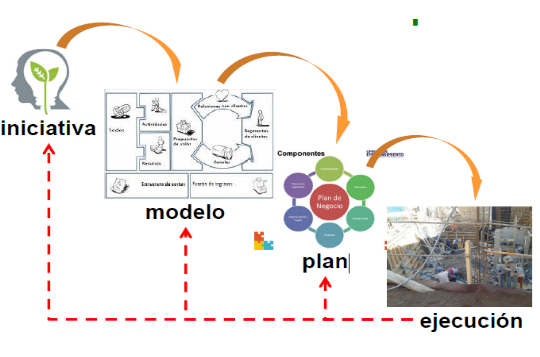

Stages that an entrepreneur must go through, from having an idea to turning it into a company:

- INITIATIVE, opportunity: idea, seed, seed (I design a solution for the need/problem of a customer segment), you create the project,

- MODEL: startup, create model, validate model, reduce uncertainty by testing, have a startup.

- BUSINESS PLAN.

- IMPLEMENTATION: expansion, growth, internationalisation.

- COMPANY stable with recurring customers.

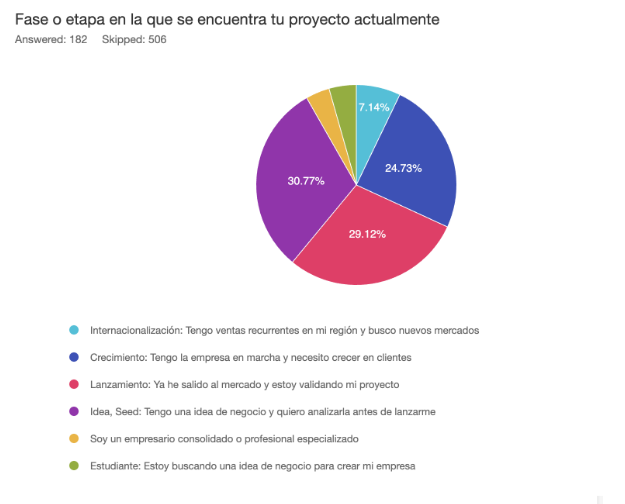

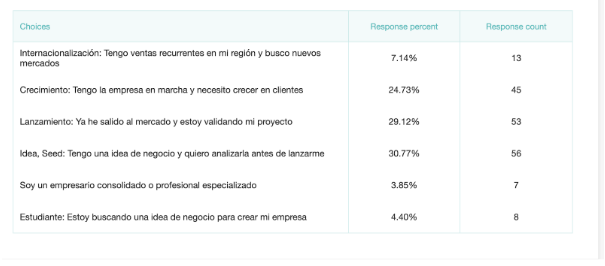

The projects that participate in the acceleration programme organised every month by mentorDay, are in the next stages:

Phase of a company according to the relationship with your customer, according to sales:

If we look only at your relationship with your customers, we can set several stages or milestones that you have to overcome in the creation of your company:

- Business idea: The customer knows nothing about my value proposition.

- I have identified a great many customer segments that I BELIEVE (hypothesis) that they will go crazy with my solution...

- Several customers who have already expressed interest in your proposal. Testing, validating.

- I have selected that segment (ONLY ONE) that is willing to pay for my solution.

- I have a validated solution: testing, testing. I have identified a segment that is willing to pay for my solution, and I know this because I have validated it by testing and ...

- First sales: I have my first paying customers (they are not "paying customers").early adopters").

- I have discovered a good opportunity (+) y comi Sales J-curve (+).

- Loyalty (+). Customers renew, repeat, buy again. I have traction.

- Hook-up. I have repeat customers who choose me over the competition.

- Internationalisation. I identify new markets where I can replicate results with very little adaptation of the model.

You may also be interested in the types of relationship with your customer (see+).

APPLY THIS TIP TO YOUR PROJECT

TASK

Now that you've learned all about this Tip, you should knowr answer these questions:

- What stage are you at?

- What steps have you already taken?

We encourage you to do the exercise of answering them!

QUIZ

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK y this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "34" - Average " - Average4.5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP

[...] Depending on the stage I'm in, I have sources that offer me more funding, analyse this TIP http://15.188.33.98/wikitips/fases-de-la-startup/ […]

startup improves if there is a planning and strategy control of finances this helps to grow, 3 years to be stable with project

initiative opportunity model start-up model implementation expansion stable company

This tip is extremely important to determine the stage our startup is at in real time.