STARTUP VALUATION METHOD

HOW MUCH IS A COMPANY WORTH?

Accelerate your company with these tips "Startup valuation method: How much is a company worth? Analyse and discover this TIP!

The business valuation method is a The process used to determine the current or future economic value of a company. There are several valuation methods, each with its own assumptions and limitations. It is important to bear in mind that the valuation of a company is an estimate and not an exact figure.

In the case of companies with metrics, mature in operation the most common methods are

- Discounted cash flow method: calculates the present value of the expected future cash flows of the company, discounted at a discount rate.

- Market multiple method: uses the market price of the share of a similar company to determine its value.

- Book value method: is based on the book value of the company, including tangible and intangible assets.

- Price/benefit ratio method: compares the growth rate of revenues and profits with the growth rate of the industry.

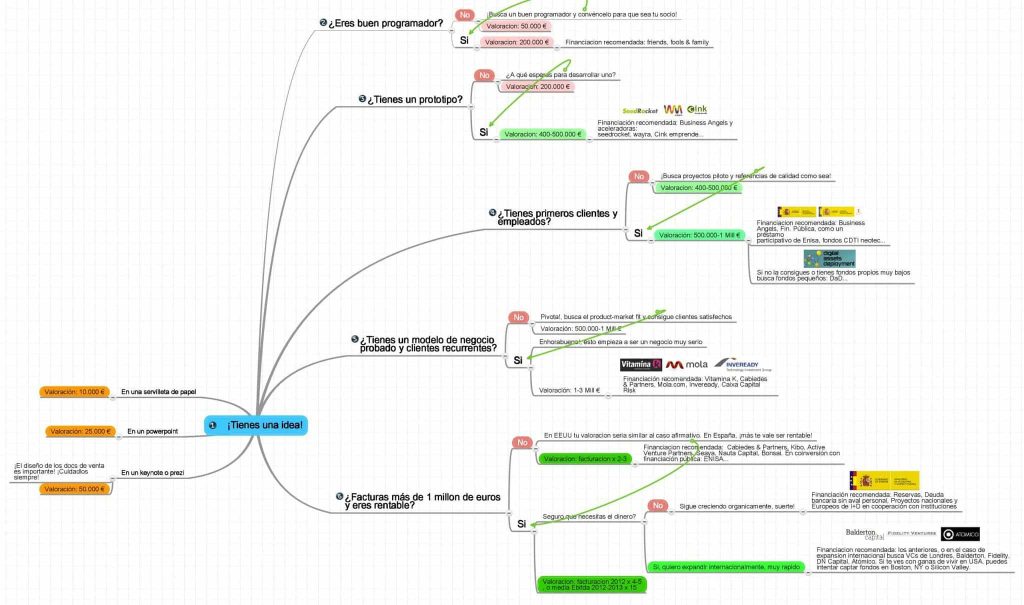

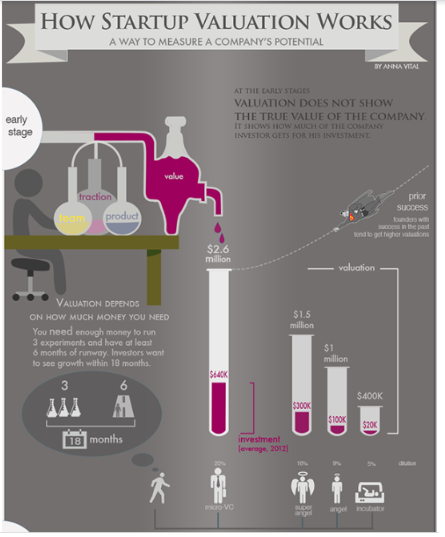

The valuation method to be used depends on the information available, the industry and the purpose of the valuation. It is much easier and there are many references to value startups in later stages when they are already growing, invoicing... etc. But; What about seed stage? How do you value a company through a financial analysis that does not invoice or if it does, does not do so with big numbers, that does not have a mature product and is starting on the path to growth but does not yet have consolidated metrics? Many believe that a startup in its seed stage is worth 0 because it has not yet proven its value in the market... while others believe that it is worth a lot given its potential. And, actually, both views are correct... but with nuances!!! An idea is worth zero (see+). The reality in the end is that startups are usually undervalued (not very common) or overvalued (more common)... but that any approximation is qualified by one thing: the absolute uncertainty of the business.

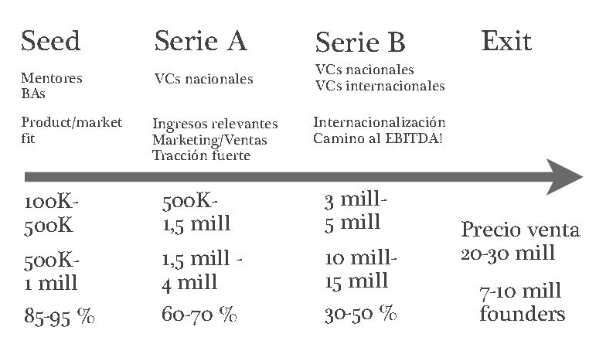

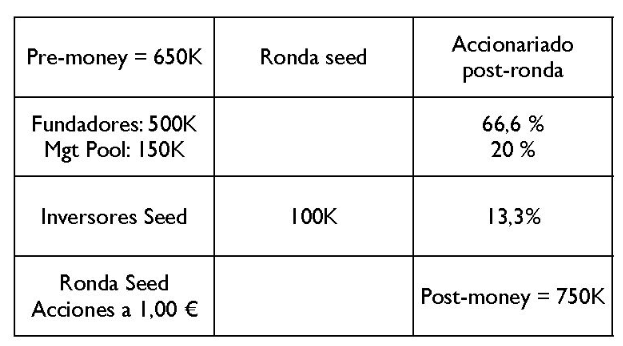

Dilution method of valuing startups

Dilution valuation is the method we recommend to establish an approximate value of a seed stage startup. It's about analysing how much money I need to take my company to the "next phase", and comparing this figure with the dilution (+) maximum I am willing to assume (it is usually recommended that per round it should never be more than 10-20%). In the end, it is a matter of understanding what value my project holds in the 4 main axes that an investor uses to value a project. investable startups (see+) and try to find the figure that best represents it within that range.

HOW MUCH IS MY SEED STAGE TARTUP WORTH?

Basically, I suggest that the valuation of the project should start backwards, from the roof, and then the question is not how much my project is worth, but how much it is worth; How much money do I need to take my project to its next significant stage of development?

AND WHAT DOES THE NEXT PHASE MEAN?

Well, it depends on each project, it may be to go from having no income to finding an initial business model that produces the first recurring customers, it may be to give the next push to the prototype to be able to launch a decent beta... But be careful, I add, in a significant way, because it is not enough to make a little progress, you have to notice a strong evolution in the following 6 months. So that value has been created in the project and a new valuation can be justified to raise enough money to reach the next milestone, without excessive dilution of the founders. It is a leap that is repeated round after round, until the final exit (+), and that it must be managed with care and head from the outset. Unfortunately, many founders do not think about these things and either dilute themselves excessively in the early stages, or else do a round at such a high valuation that it will not be possible for them to make the value increase sufficiently in the next round. Balancing act...

So, going back to the beginning, once we have defined what we want to achieve and calculated the money we need for it, voila, we have the pre-money valuation. Because the dilution at this stage should be within a reasonable range, approximately 10-20 % for the founders. That is, considering this range of dilutions, if we need 100K (an amount that seems consistent for this pre-seed phase) the post-money valuation will be in the range of 500K to 1 million. And the pre-money in the range (400K-900K).

If the range is too wide, well, at least we know what we are talking about. Within that range, the entrepreneur should consider what the real foundations of his project are today, not in the future.

ON THE FOLLOWING KEY POINTS:

- Equipment: How well established it is, what previous experience it has. What is the risk of it breaking down or not being able to cope with the changes and challenges to come.

- Business model: is still totally up in the air, or it already has customers and a development, commercial and marketing plan that fits.

- Technology: the prototype is either watertight or robust and already has a large prior investment in time and effort or it is a spaghetti code to get out of the way.

Market opportunity: how obvious and sustainable the competitive advantage is and how hot the market is.

If everything looks good, you will be in the upper part of the range, 1 million (or even more, why not, you can already see pre-moneys seed of 1.5 to 2 million in Spain, but not many get investment), if instead you have gaps to resolve in all sections you will be in the lower part (or even less) and, God forbid, you might not even be investable. So your discussions with investors at this stage are not going to focus on comparable multiples or Excel models with 5-year estimates, etc. But rather on setting the concrete financing need and then convincing them that you can move into the higher end of the reasonable range because your perceived risk is lower. Nobody expects you to have it all figured out, but at least you have common sense, a plan, initiative and expertise in your sector.

That is why it is so important to have a mentor or initial investor to help you detect your shortcomings before presenting them to the world and to eliminate some of the risk inherent in being the first to bet on you. If all this has not helped you, and you want a more engineering approach, in decision tree format, here you have the infographic of how much your seed startup is worth in Spain, updated:

P.s.- This system works mostly for seed stage, from A rounds onwards, there is more information about the startup's performance and metrics to be able to predict future cash flows, and comparable multiples can also come into play. But in general, the exercise of starting the valuation by looking at the actual financial needs first should never be neglected.

Business angel reflections on valuation

There are many theories on the subject of startup valuation, but regardless of all of them, valuation doesn't really matter much, because, after all, what difference does it make to enter at 1 million than at 1.3 million? If you are going to put in, for example, 10 percent as a business angel, your investment will be between 100,000 and 130,000. That range is not what is going to define profitability. What really matters to an investor is to see that in that project he can multiply by a factor of ten or more. On the other hand, entrepreneurs do attach a lot of importance, too much importance, to the valuation of their start-up, because they consider it to be a kind of mark they have given it in the exam that they can boast about in bars and blogs. Finally someone has endorsed that their idea is valuable and they can finally tell others about it.

It is as if success has already been achieved. The entrepreneur thinks so, and quite possibly his brother-in-law and in-laws as well, and this, when you have been selling smoke for a long time, matters a lot, even if it is only to recover your self-esteem. But for an investor, valuation is almost irrelevant. At least it is not the determining factor when it comes to whether or not to enter into an investment. A business angel usually invests between 100,000 and 200,000 euros, which represents a 10 to 20 percent stake, so, relatively speaking, whether the valuation goes up or down a little is almost irrelevant to the final amount invested and, above all, to what an investor is really interested in, which is the final return on his investment.

If a company is sold for 80 million, like Trovit; What difference does it make whether you got in at one million or two million? Your 10 per cent is now worth eight million. Who can remember whether it cost you 100 or 130? The real objective of a valuation, in the eyes of the investor, is therefore to visualise in some way what the company is expected to look like in five years' time, the usual horizon for a business angel investment. What turnover can we be talking about in five years' time? This does make it possible to estimate what kind of profitability and what kind of exit transaction to expect. In practice, this The valuation process is usually done in reverse. The investor usually asks the entrepreneur: to achieve that target of, say, 20 million in five years, what investment do you need now? Let's say the entrepreneur says 300,000 euros. Well, as the investor needs to be able to multiply by ten what he is going to give now, he will want to receive at the time of the exit, in five years, about 3 million, and as it is assumed that the company will then be worth 20, in order to get the three he is aiming for, he must have 6 percent of the company. So the valuation is there. The investor will give 300,000 in exchange for 15 percent of the company.

This simple calculation becomes more complicated if between now and the time of departure new capital increases (+) and there will be dilutions (+), but the concept is always the same:

- What company will we have in five years' time?

- How much money do you need from the investor for this?

- What returns do investors demand for their money?

All in all, you get a percentage share in the company, which you will have to give him now. And that is the valuation. This is the essence of what investors call the venture capital method, a method of valuing companies that is mostly used by business angels and venture capitalists. But let's take the drama out of it, if in this calculation of the valuation y, therefore, in this discussion of investor participation, no agreement is reached with the entrepreneurs, nothing really happens for the investor.

"It is better to have a friend who is not a partner than a partner who is not a friend.

Moreover, this is going to be a long-term relationship and it should be one of total mutual agreement, with each party looking after its own interests.

HOW MUCH INVOLVEMENT DOES A BUSINESS ANGEL WANT?

Business angels, whatever the amount to be contributed, always take minority stakes. It is a big mistake for investors who want to run the company, who want to be entrepreneurs and control the investee companies. It is better for the founding team to keep control of more or less 60 percent of the shares and the other 40 percent to be divided equally between two investors, because the real business angel does not like to invest alone, mainly to avoid that uncomfortable situation in which entrepreneurs seem to be on one side, on one side, and on the other, opposite, on the opposing side, the investor.

As we all know, tables are much more stable with three legs than with two.

Many investors move around a 10 to 20 per cent stake for an investment of between 100,000 and 200,000 euros which, together with an identical investment from the co-investor, totals the 300,000 to 400,000 euros which, on average, I believe is enough today to start up a digital business. So I tend to keep no less than a 10 per cent stake, to get them to listen to me on the boards, but never more than 20 per cent, so that if things don't go well, it's the entrepreneur who doesn't sleep. The problem is theirs and the company is theirs. I think it's a fair deal.

"In my own business plan, I set myself the objective that in each year of the four years into which I divide the life span of each fund, I should make ten investments of 200,000 euros, i.e. 40 investments. Of these, I know that 80 percent will disappear or I will forget about them, and that the remaining 20 percent - that is, eight companies - I will invest an average of another million euros. That is my investment strategy. Clear and simple, with few exceptions...".

It is also common to do follow-up rounds in companies that work very well; I invest approximately up to two or three million euros. In terms of investment and my criteria as a business angel.

SOME TIPS FOR VALUING START-UPS:

It is important to give you some thoughts on the subject of valuation, because we often not only make the wrong judgement, but do so for the wrong reasons.

- Separate valuation from your ego: Unfortunately, more often than we dare to say, we take the term valuation as a measure of our success. As a question of size... when it is an instrument of our company, nothing more and nothing less. And so we spend months looking for a valuation that we think reflects us and not our company (which is different). So remember that your job is not to find investors, but clients.

- Round sizes: at the beginning it is a bad idea to do huge pharaonic rounds that require many months to close, why not split the round into "phases"? Although it depends a lot on the sector, in my opinion you should look for enough money to last 6-8 months and make the jump to the next level... and with those metrics look for the next round and my advice is to always ask for something more than you think you will need, given that normally the expenses are always higher than expected, and the income lower. How much? Well, maybe 20-30% more, but that's more of a personal assessment based on my experience than a scientifically derived figure.

- The investor profile also determines valuation - and value: usually, the more experienced the investor you are going to talk to, the more the valuation will be adjusted... which means you will be more diluted. This is a negative, no doubt, but it has to be weighed against another factor: the value that an experienced investor can give you is several orders of magnitude greater than that provided by a financial partner alone. So weigh both approaches with all the facts in hand.

- The more tangible the better: My advice is to try to delay that first round as much as possible to give yourself space to generate enough traction to support your valuation, and to provide the necessary confidence to investors. Nobody invests in powerpoints anymore, but in the right metrics, and in this order: revenue -> users -> social (contests, media...).

- Courage and valuation, first cousins: the key is to understand that the valuation of your startup has to be "matched" to the value that is created in the project... and between rounds, clear and quantitative leaps in value must be justified. Look at it from the investor's point of view: if he invests in your startup it is because he expects to multiply his investment (among other things)... and the first requirement for this is that you are able to multiply the value of the company. If there is no major qualitative leap between rounds, new investors are likely to doubt your ability to create that value.

- The impact of a high valuation: a high valuation can compromise the future of your project, even if you are now very happy because you have managed to convince 10 investors to contribute 200K at a valuation of 2M being in seed stage, most likely, you have just put the first nail in your coffin, as discussed in the previous point, you will have to make a major qualitative leap to get the next round ... and do you really think you will be able to justify that your company is worth 4 or 5M in 6 months a year? The road is littered with startups that have died because of this. How many rounds? It is often said that the ideal number of rounds is equal to or less than zero... because joining is a way to gradually lose control of your company, and to have to deal with more people, which increases the complexity of management. But it is also true that having experienced people on board in your company is absolutely key to go faster and better. Also, if you are exit-oriented, having experienced investors is usually the difference between "almost" and making it (but of course, it depends a lot on what success is for you).

AND REMEMBER, IT IS KEY TO UNDERSTAND THAT:

"In the early stages, valuation is not a function of the actual value of the company but of its potential and, above all, of the percentage that is given to investors".

DIFFERENT TECHNIQUES FOR VALUING STARTUPS

One of the things that most people in the traditional world get uptight about is that they think startup valuations are crazy (and sometimes they are...) but the problem with their approach is that you can't value a company with years of history and stable growth (more or less) in the same way as a company that is growing exponentially. In this sense, you can imagine that the traditional techniques of the M&A (mergers and acquisitions) world make no sense: How are you going to apply discounted cash flow or EBITDA multiples to a company that barely turns over and is growing at 20% per month... Is it going to keep growing like this? How much is it going to turn over? What is its potential?

I WILL THEREFORE TELL YOU ABOUT SOME OF THE MOST COMMONLY USED TECHNIQUES FOR VALUING A START-UP:

There are different methods of valuing a startup, depending on its stage of development, the industry in which it operates, among other factors. Some of the most common methods are:

COMPARABLE OR SIMILARITY METHOD:

The startup is compared with other similar companies that have been acquired or have made a successful exit. It is a matter of looking for companies with a similar profile to yours (by sector and speed, for example), and after doing this analysis, arrive at a valuation range based on the price paid in previous operations for similar startups... and, based on these numbers, decide where we stand, using the aforementioned (team -> business model -> product/technology -> market). However, let's be sensible and compare pears with pears: it makes no sense to compare your company with the first round made in Tel Aviv or Silicon Valley by the leader of the sector.

My advice is to go to Startupxplore and look for startups in your sector and work with their valuations as a starting point. It can also be a good idea to talk to people around you who have experience in the sector (startup accelerators can help a lot here), and ask them what they think is the right valuation for your startup... but make sure they know the project.

DISCOUNTED CASH FLOW METHOD:

The startup's future cash flows are projected and discounted at an interest rate to determine its present value.

ON BUSINESS PLAN

In my opinion a very bad approximation... because normally business plans are not fulfilled. It is about discounting as true your sales and expenses forecasts on the business plan, and believing that in 2 years you will be invoicing those €4M... something I am VERY sceptical about. Although it is certainly something that is done in other entrepreneurship hubs, it is not really that common and only happens with companies that have demonstrated tremendous performance (such as Slack and er Vico!, Valley).

MARKET MULTIPLIER METHOD:

A market multiplier specific to the industry in which the startup operates is used to estimate its value.

FOR A RATE

When we are already invoicing, everything is much easier, because we can make a more financial approach to the valuation, although I sincerely believe that this approach is complex because if there is something certain in the life cycle of the startup is uncertainty, and the fact that this month you have invoiced €10,000 does not mean that you are going to invoice next month. In any case, the idea is to identify the run rate, which is the expected financial performance of your company over a period of time (e.g. 1 year) and multiply that by a factor that qualifies the opportunity (usually 8>). As in this example, if we have a return (not turnover) of €15,000 per month (unusual for seed startups), we could extrapolate a 1-year return of €180,000 (=€15,000 x 12). Applying a multiplier of 8 to this figure, we would have a valuation of €1.440M.

METHOD OF THE FINANCING ROUND:

The value of the startup is based on the amount of capital it receives in a financing round.

BY OWN INVESTMENT

A valuation technique that was fashionable a few years ago for startups in VERY early stages, but is no longer used much, basically because in the end it is a form of reverse engineering until you get to the valuation you want. The idea is to calculate the amount invested in the project, at market price, and then add a correction factor that qualifies the opportunity.

For example, if you have invested a year in your startup (1,800 hours, at a market price of €40/hr), spent €10,000 on various suppliers and bought €3,000 worth of equipment... one could argue that what you have spent (€13,000) + your opportunity cost (1,800 hours x €40/hr=€72,000, or what you would have earned if you were not doing this) would be €85,000. If we use a correction factor of 1.5 indicating that the opportunity is interesting, we could start from a valuation of €127,500.

MARKET:

Probably the most sensible one is based on a popular saying: "Things are worth what people are willing to pay for them". If there are 3 investors willing to invest €200K between them at a valuation of €1.5M, it is probably because your startup is worth €1.5M to them.

FOR MILESTONES PASSED

Which one should you use? Well, in my experience, the reality is that all of the above are a way of justifying or arriving at a market valuation, but when in doubt, the one I like the most is the dilution technique, the first one we have shared. Chat the investor's relationship with the investee company should look like and what it usually looks like.

APPLY THIS TIP TO YOUR PROJECT

QUIZZES

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "7" - Average " - Average4.9"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP

Very interesting, I had already used some of these methods, but it is good to refresh the ones that are still in use.