WHAT DO INVESTMENT PARTNERS LOOK FOR WHEN ANALYSING A START-UP?

RESUMEN

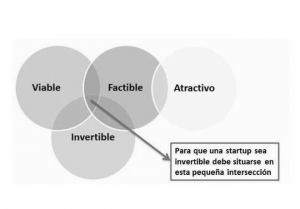

Para captar la atención de socios inversores, una startup debe demostrar ser viable, factible e invertible, destacando una oportunidad clara, un mercado en crecimiento, una ventaja competitiva sólida, y un equipo completo con experiencia relevante. La escalabilidad y un posible exit claro son esenciales para ser considerada invertible. Inversores buscan startups con potencial de crecimiento rápido, preferiblemente en sectores donde ya existen operaciones significativas de M&A o IPOs. Es crucial entender que más allá de la financiación, socios inversores como los business angels aportan «smart money», ofreciendo no solo capital, sino también su red de contactos y asesoría estratégica, sin involucrarse directamente en la gestión diaria.

Las startups deben prepararse para presentar un pitch convincente que refleje la viabilidad, factibilidad e invertibilidad del proyecto. Es recomendable elegir el momento adecuado para buscar inversión, cuando la empresa puede demostrar tracción real. Preparar entregables coherentes y recibir feedback de inversores para adaptar la presentación es crucial. Utilizar conexiones para llegar a los inversores y construir un funnel de inversores ayuda a organizar y seguir las interacciones eficientemente. Centrarse en conseguir un lead investor puede acelerar el proceso de inversión.

Tabla de contenidos

For a startup to be investable, it must be located at the small intersection in the middle of these 3 keys

- Viable.

- Feasible.

- Invertible.

VIABLE

- Demonstrating that you have found a good opportunity (+), i.e. a customer segment (+) clear, large and growing market, and that you have validated your solution. (right side of the CANVAS (+)).

- That you can build a competitive advantage (+) that will defend you in the long run from the competition. "If I can't be different, I'll have to be the cheapest. Demonstrate that you have done copycat (+), I copy and then improve to create competitive advantage.

FACTIBLE

- Complete equipment to take advantage of the opportunity, several people covering: 1. commercial, 2.technicians 3 .management..., with exclusive dedication, with experience and knowledge in the sector.

- Adequate timing (+), not too late, not too soon: in business it is not so clear that he who gives first gives twice, ...the pioneer has to use much more resources...

INVERTIBLE

- Scalable (+) I have a large potential market that I know how to grow in collections, without needing many more expenses and investments. I can double my income without doubling my expenses.

- With Exit (+) clear approach to being sold your startup, including your participation.

Being viable and feasible is necessary for you to set up your business but it is not enough for an investor to come in, you also need to be investable. In your first pitch (mentor COINVIERTE (+)) you have to get the seduction to be granted a second meeting where you can go deeper into all these points.

WHAT DO INVESTMENT PARTNERS BRING TO THE TABLE? ALSO, SERVICES FOR EQUITY

The Business Angel (+) brings smart money, i.e. money plus contacts or advice... but never your dedication, working hours and worries!!!

TECH FOR EQUITY

The partner comes in as a technology partner who does the development/coding of your startup and is not paid for it, but receives shares (or only takes a share of your budget and capitalises the rest...). To work well, you have to choose the right partner, because not all relationships end well. If you are a startup really, normally, your technology is your core business (+) and you should not outsource it because you have the risk of being sold to your supplier, which you cannot change. On the other hand, in many cases, a startup is a bad client for development companies, paying little (or in equity) that is received late or never and asking for odd developments that take longer than making a standard SME website. For this reason, developers end up prioritising jobs that get paid quickly and involve less work (SMEs and large accounts), and its last priority is the start-up, for which it is a top priority and on its development time depends its life.

"...The graveyard is full of startups that outsourced...." is the opinion of some experts.

Highly recommended for startups B2B (+) who have a long sales cycle with other companies, as Sales for equity allows you to have a senior, high-level sales team, well connected with corporate CIOs and SMEs, to convert them into customers. This formula allows you to increase the value of your equity as you win those customers, and instead of burdening your startup with costs, you burden it with revenues!!!!

IT FOR EQUITY

When your startup needs big technology developments to jump to the next valuation milestone to raise a new round, it may be advisable to have a large group of developers covering many different disciplines. This funding formula makes sense when looking for technologically strong innovative and complex solutions. IT for equity really adds value when the problem to be solved is not trivial and the ideal solution is hidden somewhere that is not easy to reach.

Some B2C startups (+), They can only grow by carrying out large advertising campaigns in the mass media (TV, radio, press...), and this requires too large an investment, sometimes impossible to finance... The media for equity allows you to manage large advertising campaigns in mass media in exchange for handing over a stake in your startup. Keep in mind that the valuation of your startup has to be high for the media group to be interested in entering.

LOGISTIC FOR EQUITY

In the ecommerce (+) You need good logistics and at a very competitive cost, having a good supplier in the capital can in some cases make innovations in distribution, warehousing, transport, etc. more accessible.

Having good online marketing professionals can in some cases give you a better chance of success. competitive advantage to justify the payment for their services with shares in your company

Actually, we can use this formula with any service, in fact, the accelerators (+) capitalise on the services provided to the startup by a 10% (mentorDay is an exception, it does not keep anything). Changing supplier is much easier than changing partner, in fact you can't even fire a partner unless there's something very serious...Business Angel. The hours not worked in professional services are lost, so it is possible to find providers with idle time of their professionals who "do not lose anything" if they capitalise their services... the problem comes when they are saturated with work, and it takes a long time to give the first results... they can get tired soon.

FOR A SERVICE FOR EQUITY PROVIDER TO CONTRIBUTE ITS GLOBAL KNOWLEDGE IN EXCHANGE FOR PARTICIPATION IN THE PROJECT, THEY USUALLY HAVE THE FOLLOWING STEPS:

- Rate (always within the market) the effort to be made and part of this effort. This assessment is made by a team of product development experts with years of experience and who are currently in the market developing technologies.

- The business team values the Business Plan (+).

- On the basis of the above points we decided on the amount to be invested in hours. This amount can be between 30% and 70% of the total project, never 100% of the investment.

What advice would an investor give you when you are looking for investors for your project? This is what this TIP is all about: how and where to get investment, what do investors want to hear when making a decision?

THE MOMENT

Choose strategically the moment to open the round, don't wait until you really need it because the investor will know and you will be at a disadvantage in the negotiation. The best time is when you can demonstrate traction, so you can try to play with large contracts, seasonality, etc. When you have completed the sprint 1, 2 and 3 of the mentorDay acceleration programme (+).

TIME

Dedicate the necessary time to prepare the round and deliverables. Do not contact any investor beforehand, because they will ask you for documentation that you do not yet have and you will be generating delays, a bad image and closing doors for yourself.

COHERENCE

Prepare the deliverables in a serious and coherent way. If you do not have a designer in your team, it is highly recommended to have the help of a freelancer to prepare the deck, who will give your document packaging, a careful image and coherence.

The deck is dynamic, with feedback from investors you have to adapt it. For example, if in conversations with investors you notice that they have doubts about the market, try to modify the presentation/speech to try to mitigate this weakness. Therefore, it is advisable to contact investors in batches and not all at once. Remember the importance of the active listening (+) with investors and ask them to give you feedback.

SEGMENTATION

If you have segmented the investors you need to target well, try to reach them through someone to generate more trust and to make the investor "look at you with more affection". In the mentorDay acceleration programme (+) investors know that we only present the most investable projects after a thorough screening process.

THE FUNNEL

Build an investor funnel to better track and trace all conversations. It is the same concept of funnel we use in marketing (+).

Focus on getting a Lead Investor and create a sense of "FOMO" to the other investors to close the round early. In each accelerator programme we nominate the most investable startups in the programme and this is a good door opener for other investors.

FINAL TIPS!

Raising an investment round is not easy, nor is it an end in itself. It is a means to take the company to the next level. The best financing is from your customers when they buy your product. Bootstrapping (+). And remember: The most important thing that an entrepreneur has and that keeps them motivated is equity. Therefore, in order to preserve it, it is very interesting to complement rounds with bank or public debt. A bad investment strategy will make the cap table(+) for future rounds (+).

To be investable in your PITCH you need to clearly demonstrate that you meet these 6 characteristics that we worked on during the Acceleration Programme (+): be Viable, Feasible and Investable.

VIABLE

- Demonstrating that you have found a good opportunity (+), i.e. a customer segment (+) clear, large and growing market, and that you have validated your solution (right-hand side of the CANVAS)

- That you can build a competitive advantage (+) that will defend you in the long run from the competition. "If I can't be different, I'll have to be the cheapest. Demonstrate that you have done copycat (+), I copy and then improve to create competitive advantage.

FACTIBLE

- Team (+) full to take advantage of the opportunity, several people covering: 1. commercial, 2.technicians 3 .management, ...with exclusive dedication, with experience and knowledge in the sector.

- Adequate timing (+), not too late, not too early: in business it is not so clear that he who gives first gives twice, ...the pioneer has to use a lot more resources...

INVERTIBLE

- Scalable (+), I have a large potential market that I know how to grow in collections, without needing many more expenses and investments. I can double my income without doubling my expenses.

With Exit (+) clear approach to being sold your startup, including your participation. Being viable and feasible is necessary for you to set up your company, but it is not enough for an investor to come in, you also need to be investable. In your first pitch (+) (COINVIERTE mentor) you have to get the seduction to be granted a second meeting where you can go deeper into all these points.

INVESTABLE STARTUP. WHAT PRIVATE INVESTORS LOOK AT

The key to any good business angel investment lies in how he chooses investable startups, in how he evaluates their supposed business opportunities. Investors try to make an absolutely rational analysis, albeit with the caveat that, at least initially, it is not numerical, because the rational does not have to be based on figures and arithmetic operations. Decision-making can be perfectly rational and rigorous without necessarily being numerical in nature.

La Metodología de Evaluación: Más Allá de las Cifras

It does not make much sense to analyse a project on the basis of its numerical projections, because I am well aware that the figures contained in a project are not always the same. business plan (+) or in any other forward-looking document, even if they are completely honest, are not at all real, but speculative. A good picture of the treasury (+) demuestra que el emprendedor tiene buena capacidad de planificación y de anticiparse a las necesidades financieras.

Sin embargo, antes del excel lo que utilizan los inversores son las evaluaciones de oportunidades de negocio, es decir que, antes de ponerme a ver proyecciones y otros factores, lo primero que tengo que evaluar es si lo que se me propone es una auténtica opportunity (+) for the investor. Many investors apply a very rigorous and well-tested methodology based on the so-called "Six Criteria for Evaluating Startups" by Rob Johnson, an expert professor at IESE, who bases his theories on his triple consecutive status as entrepreneur, investor and professor.

FEASIBILITY

Lo primero que tiene que demostrar el emprendedor de su proyecto es si es o no viable. A project is viable if it has 1) a clear, defined and accessible market, and 2) a competitive advantage.

- What does a clear and defined market mean? A market is not a need, not a demand, not a segment, not a niche; a market is most like a phone book: first name, last name, phone number or, better yet, account number.

Definiendo el Mercado: De la Abstracción a la Concreción

A market is a sufficiently large set of names and surnames of specific people willing to open their wallet and pay for a product or service. Such a market needs to be clear and defined, but it also needs to be accessible; can it be easily communicated with? Are there already channels (+) I cannot address, for example, something as abstract as "that independent woman who works but longs for other incentives because she is not fully satisfied with her life". Where do you get this archetypal woman? How do you transform such entelechies into concrete clients? On the other hand, I can address "women between thirty and thirty-five years old who live in Sabadell", or in Dos Hermanas, or in Ponferrada. I can locate them and, therefore, turn them into clients, because they are not an entelechy: they are women with names and surnames.

La Importancia de un Mercado Accesible y Concreto

Therefore, the first thing I ask an entrepreneur is what his market is, the first name and surname of his first customers. To check that he already has a clear and defined market, I ask him for proof of the first ten invoices. The entrepreneur may have planned to sell "to all secondary schools in Spain", but at which counter are the invoices presented to all secondary schools in Spain? No.

A market is made up of specific people, who know where they live, who need something specific and who are willing to buy it, to pay a price for it, and even to repeat their purchase a certain number of times. A market should be reminiscent of a telephone directory. If the start-up does not yet have a market or if it does not exist, it has to create one, and this is not only very expensive, but also extremely risky. It is very difficult to create a market out of nothing.

If you want to expand on this point, I recommend you to this TIP (see+)

COMPETITIVE ADVANTAGE (+)

The second evaluation criterion is that it has a competitive advantage, because it is going to be completely decisive. There is nothing more dangerous and suspicious than an entrepreneur who tells you with absolute conviction that his project has no competition. Either it does, and he hasn't heard about it, or it really doesn't, and that's worse, because it means that it's something that no one else in the world has thought of before, which must be for a reason. In fact, when I am told about a good project based on an idea that no one has told me about before, I usually take the precaution of putting it in a drawer until someone else tells me about something similar.

La Ventaja Competitiva: Clave para Diferenciarse en el Mercado

There must always be competition, and if there isn't, there will be, and soon. In any case, the opportunities that investors look for are those that everyone sees, but in which the project presented to you demonstrates a clear competitive advantage, which is also sustainable when the competition that "does not exist" appears or manifests itself. Defining and applying that competitive advantage is, in fact, the main task of a good entrepreneur: to see what everyone else sees, but to deal with it in a different and advantageous way. For its part, the investor's obligation is to recognise this competitive advantage. Whatever it is, even if it is the one that the former head of Apple's Mac brand and now investor Guy Kawasaki referred to: "In the end, you're either different... or you're cheap".

There must always be competition, and if there isn't, there will be, and soon.

FEASIBILITY

By bringing together these two factors, clear market and competitive advantage, you demonstrate that you have a business opportunity. The question now is whether this opportunity is not only viable but also feasible. For this, two other key factors need to be assessed: Can this opportunity become a feasible business opportunity in the hands of this team at this particular time?

PROMOTER TEAM (+)

APPROPRIATE TIMING (+):

INVERTIBLE

The positive evaluation of these four factors (market, competitive advantage, team and timing) makes it possible to classify an opportunity as viable and feasible, and that is the end of the entrepreneur's responsibility. But, of course, it is now necessary to establish whether it is also investable, and this is something that is only up to the investor, as it depends on his criteria, which do not always have to coincide with those of the entrepreneur. Any investable business has to meet two new characteristics: scalability and clear exit.

SCALABILITY (+)

For an investor to decide to put his money into a company, it has to be one that can become very large in a short period of time, otherwise there is a risk of creating small companies. ZOMBIES (+), that pay the entrepreneur's salary, but will never give the investor the returns he demands and needs to sustain his own business. In other words, they have to be highly scalable businesses. Pof course, Saying that a business is not scalable does not mean that it is a bad business. It is simply not a business that can be invested in by professional investors.

An investor looks for scalability in a startup to ensure that the company has the potential to grow and multiply its profits over the long term. Scalability means that the company can expand efficiently without the need to increase its costs and investment proportionally. This can be achieved through automation, the use of technology, the creation of distribution networks, product diversification, among others. A scalable business is attractive to investors as it is more likely to generate a return on investment.

THE SIXTH AND FINAL CRITERION TO BE ASSESSED BY THE INVERTER IS THE OUTPUT (+):

Planificando la Salida: La Visión a Largo Plazo del Inversor en Startups

The investor is willing to stay in the company for a certain period of time, but sooner or later - sooner rather than later - he will want to get out of the company and, ideally, reap the benefit. Therefore, before entering, he needs to know from the outset how he will be able to exit the company. The exit of an investor in a start-up is the process by which an investor recovers its investment through the sale of its shares in the company.

This exit can take the form of an initial public offering (IPO), an acquisition by another company or a share sale agreement. An investor's objective when investing in a start-up is to achieve a sufficiently high return to compensate for the risks associated with the investment. Exit is a key moment in the life cycle of a startup, as it allows investors to recoup their investment and generate profits, while also opening up new opportunities for the company and its employees.

Planificando la Salida: La Visión a Largo Plazo del Inversor en Startups

Here, the usual asymmetry of interests between an entrepreneur and an investor becomes fully apparent. The entrepreneur is a person who has spent every night for some time now half-awake with his dreams and worries, who has spent hours with his family thinking about his idea, his project and with a valid, viable and feasible business model, and with a solid, competent, enthusiastic and committed team. Most of the time, the startup is a life project in which you are almost literally working your fingers to the bone. But for the business angel it is like a bond, a treasury bill or a piece of land: a strict investment whose only possible success is a tenfold return on investment within a relatively short time horizon.

These are the famous six criteria for investor evaluation of opportunities. However, almost as important as what is included is what is not included. For example, the product. Where is the product in these circles? Probably nowhere. The investor is not looking to buy your product, that's what your customers are for!!! Of course, another component is missing from this overall scheme, fundamental for the entrepreneurThe project should be attractive to you, and fit with your personal aspirations and motivations as an entrepreneur and as a person.

El Valor de Mantener el Control: Equilibrio entre Propiedad y Crecimiento

Académicamente está demostrado que, además de más satisfactorio, también es más rentable a la larga mantener un total control, aunque sea a costa de mantener un tamaño más pequeño. En términos humanos, es siempre mejor tener el ciento por ciento de un negocio de 100, que el 10 por ciento de un negocio de 1.000. Por tanto, nunca hay que olvidar que la gran decisión personal acerca del tamaño, modelo y rumbo de tu empresa está siempre en tus manos. Mientras sean éticas y legales, todas las aspiraciones y motivaciones personales son legítimas.

Evita una dilution (+) excessive.

Because if you're going to spend so much time and effort on your project, if you're going to obsess over the design of your product, if you're going to spend so many hours with those clients and those collaborators, you'd better be comfortable with it all, or you won't be able to stand it. This is true for internet projects, but even more so for investments with a greater social impact, such as health or projects that bring more than just movement and economic return, and where personal criteria weigh even more heavily.

Atractivo Personal vs. Criterios de Inversión: Encontrando el Equilibrio Ideal

That the project is "attractive" from a personal point of view is, therefore, extremely important for the entrepreneur; however, in most cases it is almost irrelevant for the investor, who is not going to spend so many hours with those clients, or with those collaborators, or working on that product. In reality, personal criteria always weigh heavily in decisions, including of course those of investors. In short, any project that passes through a business angel's office that meets these six evaluation criteria automatically becomes a good candidate for investment. However, the process does not end there.

Del Análisis a la Acción: Aprendiendo el Arte de Invertir con Éxito

After this general assessment phase, the investor moves on to a full analysis of all the details of the project, in which he/she will already have to make calculations and handle figures. As can be seen, this is a very rigorous and rational decision-making process, on which there is a large body of literature and which has been extensively studied. Therefore, it can be learned, as it does not involve any secrets or require extreme skills. Just as one learns to formulate in chemistry or to calculate the multiplication table, one can learn to apply the six criteria for project evaluation and thus learn to invest successfully. All that remains is for the investor, assess and quantify the investment and make a concrete offer. How do you do this? (see+)

Some more tips on how to seduce a BA:

- Make yourself loved, use a celestina, avoid the cold pitch... you have to come recommended. Being selected in an acceleration programme and getting funding at their invest day (accelerator demo day) opens doors... and this is what we do at the COINVIERTE mentor (see+).

- Do not arrive too early, it is better to arrive with some positive metrics already achieved. "The good cook doesn't bring out the roast half done.

- The Business Angel wants to know your company, he doesn't want to hear your pitch or buy your product. They want to hear: "I sell travel solutions, not shoes".

- The Business Angel is not there to buy your product, don't insist on the advantages of your service.

- Tell the Business Angel something they don't already know, something new.

- Tell us who you are, where you are... what you need to know

- Explain how the euro moves through the balance sheet: customer, price, collection, payments, profit, cash.

- Entrepreneur = entrepreneur with an L.

- Know something about the investor: their profile Angel, financial, industrial, smart money... (send invitation by LinkedIn (+), Twitter (+), Facebook (+), look for his email (rocketreach).

- Herd effect... co-invest... find a lead investor first.

AND MORE ADVICE FROM OTHER AUTHORS:

If you are looking to attract a business angel to your company, here are some tips that can help you seduce them:

Do thorough research:

Investiga a fondo a los business angels que puedan estar interesados en tu empresa. Conoce sus antecedentes, intereses y preferencias de inversión.

Create a solid pitch:

Prepara un pitch bien estructurado y convincente que explique de manera clara y concisa quiénes son tú y tu equipo, qué es tu empresa, cuáles son tus objetivos y cómo te diferencias de la competencia.

It shows a long-term vision:

Demuestra a los business angels que tienes una visión a largo plazo para tu empresa y que has pensado in how seize opportunities for growth and expansion.

It offers an attractive ownership structure:

Crea una estructura de propiedad atractiva que permita a los business angels participar en el éxito de tu empresa y que les brinde un retorno adecuado en su inversión.

Make a good financial presentation:

Prepara una presentación financiera completa y detallada que incluya información sobre tus ingresos, gastos, flujos de efectivo y proyecciones a largo plazo.

Show your dedication and passion:

Demuestra a los business angels que estás dedicado y apasionado por tu empresa y que estás dispuesto a hacer lo necesario para alcanzar el éxito.

Prepare an exit strategy:

Demuestra a los business angels que tienes una estrategia sólida para salir de su inversión y brindarles un retorno adecuado en su inversión.

By following these tips, you can increase your chances of attracting a business angel to your company and getting the financial and mentoring support you need to succeed.

APPLY THIS TIP TO YOUR PROJECT

NOW THAT YOU HAVE READ THIS TIP, ANSWER THE QUESTIONS:

- Is it clear to you that your business model is investable by a Business Angel?

- What are they looking for? Explain each of the 6 areas the investor looks at.

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "74" - Average " - Average4.7"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP

[...] the 99%. Innovative startup-type projects fail 90%. Startups funded by private investors fail 80%. New companies in traditional businesses fail 70%. Of the companies that [...]

I would like to have more information about funding for my startup. A possible communication with you would be good to present our business plan.

Alexis sign up for mentorday to access all funding.

The Business Angel wants to know your company, not to hear your pitch or buy your product.

how could i get a contact of an angel investor for my extremely good profit margin project. 0989679979 only serious people.

John you can access investors by completing an accelerator programme. https://mentorday.es/modelo-mentor-day/

There are many questions that are of interest to an investor, but perhaps the most charismatic question of all may be: WHAT MAKES YOU SO SPECIAL? AND THE COMPETITION?

scalable so that the investor can and will want to put his money in my company he has to be sure that it will be scalable he does not want a ZOMBI company.

Without the application of these tips in a startup the chances of success are nil. Each and every one of these tips are the guarantee of success when it comes to entrepreneurship and finding the right funding.