DOUBLE TAXATION AGREEMENTS: TAXATION FOR COMPANIES OPERATING IN A COUNTRY OTHER THAN SPAIN AND ITS EXCEPTIONS IN THE CANARIES

Accelerate your business with these tips on "Double taxation agreements: taxation for companies operating in another country besides Spain and its exceptions in the Canary Islands". Analyse and discover this TIP!

What is a double taxation agreement?

A double taxation agreement (DTA) is an international treaty signed between two States that establishes a series of tax rules to prevent companies present in both States, normally with headquarters in one and business in the other, from having to pay twice for the same taxable event.

Among other things, the convention establishes the country to which the tax is levied when several countries are initially entitled to levy the tax. International double taxation is a situation that arises when the same taxable event affecting the same person is taxed in two different countries in the same tax year.

In other words. There may be a situation where there is an act, an earning of income, which may be taxable by the same person, natural or legal, in two different countries in the same tax year.

- For example:

- Without such an agreement, it could be the case that a foreign subsidiary of a Spanish company would have to pay a withholding tax for paying a dividend in the country from which it operates and another one in Spain when the parent company repatriates the dividend.

To avoid paying twice for the same event, countries sign international agreements that explain in which of the two countries the event is to be taxed. They also usually include guidelines for taxation, communication channels between tax administrations and some allowances.

These agreements operate in a bidirectional manner for both signatory countries, i.e. they apply equally to a Spanish company doing business in the other country as they do to a company from the other country doing business in Spain.

The existence of Double Taxation Avoidance Agreements (DTAs) is essential to promote foreign investment, whether foreign investment in Spain or Spanish capital abroad, as they provide legal certainty for investors and reduce the taxation of such investments.

Types of agreements

- The most common type of international DTAA is the bilateral convention covering direct taxation of income and wealth in general.

- Multilateral agreements are less frequent, although there are examples such as those signed by the Nordic countries (Denmark, Finland, Iceland, Norway and Sweden) and the Andean Pact countries (Bolivia, Colombia, Chile, Ecuador and Peru).

- At present, 103 double taxation treaties have been initialled and 99 are in force.

- The other 5 are at different stages of processing (Bahrain, Montenegro, Namibia, Peru and Syria). In addition, the agreements with Austria, Belgium, Canada, China, Finland, India, Japan, Mexico, Romania, the United Kingdom and the United States have been renegotiated.

What are the advantages of such agreements for companies?

- Experts point to the advantages of legal certainty, because in this way the investor knows the return he will get and the taxes he will have to face.

- It represents a significant saving in taxes, as it avoids duplication in the tax bill.

- They are useful tools in the fight against tax fraud and tax evasion, as they often provide for mechanisms of information exchange and anti-fraud collaboration between the signatory states.

How do double taxation treaties work?

These agreements operate in a bidirectional manner for both signatory countries, avoid duplication of tax bills for the same benefits and seek to boost investment and economic relations with other countries.

- Method of exemption. The State of residence of the taxpayer waives taxation of income obtained by the taxpayer in a foreign country. This is usually done by delimiting the taxable events. In other words, it defines which of the income obtained abroad is taxable and which is not.

- Imputation method. The income received in the source State (the country in which the income was generated) is included in the taxable income of the recipient for the purpose of taxation by the State of residence and the amount thus obtained is deducted from the tax liability of the State of residence. tax tax paid in the State of source (full imputation) or the tax that would be payable in the State of residence if the income had been obtained there (partial imputation). The total income generated by the taxpayer is taxed, but allows a deduction equivalent to the tax liability in the foreign country.

For an example, see this link you can read the double taxation agreement between Spain and France, signed in 1995.

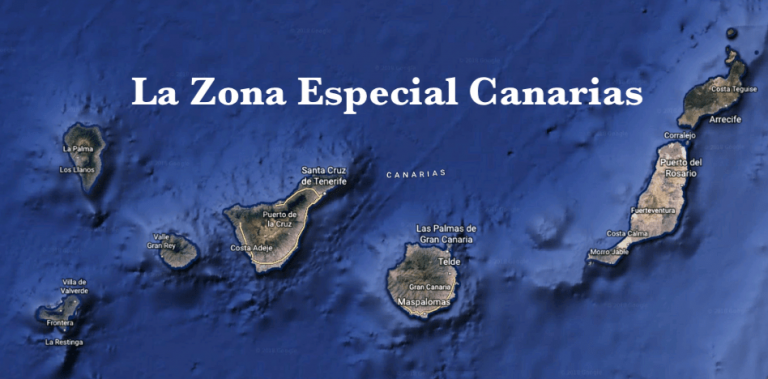

Double taxation agreements in the Canary Islands ZEC zone

Among the tax advantages for subsidiary companies established in the Canary Islands Special Zone ZEC is the fact that dividends distributed to their parent companies in another country are exempt from withholding tax, thanks to the Parent-Subsidiary Directive and with the other countries with which Spain has signed an agreement to avoid double taxation.

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP