CONFIRMING

Accelerate your business with these expert tips on "Confirming" - take a look and discover this TIP!

Confirming is a financial service in which a company (the client) instructs a financial institution (the confirmer) to manage the payment of its invoices to its suppliers. The confirmer is responsible for checking the authenticity and veracity of invoices submitted by suppliers and, once verified, proceeds to payment. The main objective of this confirming service is to facilitate the management of payments and the commercial relationship between the client and its suppliers, as it provides the latter with a fast and secure means of payment, without having to wait for the client to pay them directly.

Among the advantages of confirming for the customer are the reduction of payment periods to suppliers, the increase in the customer's negotiating capacity with suppliers by having a fast and secure means of payment, and the improvement in cash management by having greater control over payment flows. On the other hand, for suppliers, confirming allows them to have a fast and secure way of collecting their invoices, without having to worry about collection management and without having to assume the risks of non-payment, since the confirming party assumes responsibility for payment.

In short, confirming is a a useful financial tool for the management of payments and the commercial relationship between companies and suppliers, as it allows greater agility and security in the management of collections and payments, and facilitates the optimisation of the cash flow of both parties.

Confirming for entrepreneurs

Confirming is a financing tool that can be useful for entrepreneurs, especially if they have to make payments to suppliers in a short period of time. See below, we explain to you what confirming for entrepreneurs consists of and what its advantages are. Confirming is a a service offered by some financial institutions consisting of the confirmation of payments to suppliers. In other words, the entrepreneur agrees with his supplier that payments will be managed through a financial institution, which is responsible for confirming the payments and making them effective on the agreed date. In this way, the supplier obtains a guarantee of payment and the entrepreneur can extend the payment period.

The main advantages of confirming for entrepreneurs are as follows:

- Extension of the payment deadline: The entrepreneur can negotiate with the supplier a longer payment period than usual, which can be very useful if he needs time to obtain liquidity to meet the payment.

- Management of payments: Confirming allows the entrepreneur to delegate the management of payments to the financial entity, allowing him to focus on managing his business.

- Payment guarantee: The supplier obtains a payment guarantee from the financial institution, which can be very useful if the supplier is not in a good financial situation or if the entrepreneur is a new and unknown company.

- Improving supplier relations: Confirming can help to improve the relationship with the supplier by providing a guarantee of payment and facilitating the management of collections.

In short, confirming can be very useful for entrepreneurs who need to extend the payment period to their suppliers and improve their payment management. It is important to bear in mind that, Although confirming may involve a cost for the entrepreneur, this can be compensated by the advantages it offers in terms of liquidity and payment management.

Confirming for internationalising companies

Confirming is a financial tool that can also be useful for companies seeking to expand internationally and need to secure payment from their suppliers abroad. Imagine that a Spanish company wants to import raw materials from a company in China. To ensure that the Chinese suppliers receive payment for the products delivered, the Spanish company can use a confirming service.

In this case, the Spanish company would contract a financial institution to confirm the invoice issued by the Chinese company. Once the invoice has been confirmed, the financial entity undertakes to pay the Chinese supplier within an agreed period of time. In this way, the Spanish company can be sure that the payment to its foreign suppliers will be made and, at the same time, it can extend the payment period to the financial institution compared to the period agreed with the suppliers. In a nutshell, Factoring can help internationalising companies to secure payment to their foreign suppliers and to obtain more advantageous payment terms.

Advantages and disadvantages of confirming

Confirming is a financial tool that has advantages and disadvantages for companies.

Some of the main ones are:

ADVANTAGES:

- Improved liquidity: Confirming enables companies to obtain short-term financing by paying outstanding invoices in advance, thus improving their liquidity.

- Reduction of the risk of non-payment: By delegating the management of invoice payment to a financial institution, the company reduces the risk of non-payment and ensures that it receives payment of its invoices in a shorter period of time.

- Improving supplier relations: Confirming can improve the relationship with suppliers by ensuring that they receive their invoices in a shorter period of time, which allows them to improve their own liquidity.

- Reduction of administrative costs: By outsourcing the management of invoice payment, the company can reduce the administrative costs associated with this activity.

DISADVANTAGES:

- Financial cost: Confirming has a financial cost associated with it, which may be higher than other financing alternatives.

- Dependence on the financial institution: The company is dependent on the financial institution to manage the payment of its invoices, which may limit its bargaining power with suppliers.

- Impact on the company's image: The fact that the management of invoice payment is delegated to a financial institution can have a negative impact on the company's image, as it can be perceived as a sign of financial weakness.

- Possible delays in payments: In some cases, there may be delays in payments by the financial institution, which can lead to tensions in the relationship with suppliers.

It is important for companies to carefully assess the advantages and disadvantages of confirming before deciding to use this financial tool.

Practical examples of how confirming works in different situations

A supplier in need of immediate funding:

- A supplier of goods or services agrees with its customer to pay by confirming. When the supplier sends the invoice to the customer, the customer forwards it to his financial institution for payment to the supplier. The supplier receives payment immediately, without having to wait for the customer to make payment in due time.

A company that wants to improve its relationship with its suppliers:

- A company decides to offer its suppliers the possibility of collecting their invoices by confirming. In this way, it improves its relationship with suppliers, as they receive payment quickly and efficiently.

A company that wants to optimise its cash flow:

- A company with a large number of suppliers decides to use reverse factoring as a tool to optimise its cash flow. By using reverse factoring, suppliers collect their invoices before the due date, allowing the company to better manage its cash flows and avoid liquidity problems.

A company that wants to outsource payment management:

- A company decides to outsource the management of payments to its suppliers by means of reverse factoring. In this way, it does not have to worry about the management of payments, which are left in the hands of the financial institution in charge of the reverse factoring.

I hope you find these examples useful to better understand how confirming works in different situations. Confirming is a type of financing in which you as an entrepreneur can hand over the complete administration of outstanding payments to suppliers, delegating the management of these disbursements to a financial institution. In a confirming transactionThe bank or credit institution is responsible for managing payments to your suppliers. and, generally, offers financing to both parties. In other words, both the debtor (your company) and the beneficiary (supplier) can access credit from the bank to advance or cover a payment.

This system is related to the figure of the factoring (see TIP) but in reverse. In the latter, it is the supplier who seeks the entity to provide financing and, in confirming, it is the customer who requests the management of its payments to suppliers.

ARE YOU INTERESTED IN THE IDEA OF REDUCING YOUR ADMINISTRATIVE COSTS AND AT THE SAME TIME DECENTRALISING YOUR SUPPLIER PAYMENT SYSTEM?

Having the possibility of having a good supplier system that can serve as a basis for financing, while at the same time freeing you from certain administrative costs, can be very useful as an entrepreneur. In this sense confirming is the best option, in addition, it is very easy to access such services at low cost and in a safe and secure manner.

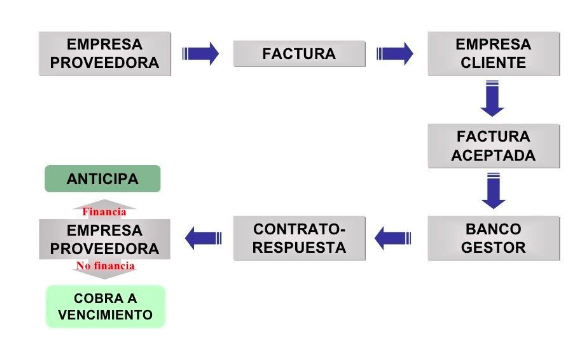

A confirming transaction involves three agents:

- The issuer (your company).

- The credit institution.

- The supplier.

The transmitter is looking for a credit institution to optimise the management of its debts to suppliers (beneficiaries). The latter, can wait, until the due date of your invoice or request an advance from the credit institution.

THE FOLLOWING DIAGRAM SHOWS THE MECHANISM:

The supplier issues an invoice for its services, the customer accepts it and sends it to its credit institution. The credit institution then offers the supplier an advance payment of its invoice (charging a fee) or that the supplier waits for payment on the due date. The lender charges the customer a fee for the debt management service. In addition, it may offer you financing so that you can pay your invoices after the due date. In return, the lender will charge you a fee or interest.

ADVANTAGES AND DISADVANTAGES OF CONFIRMING

THE ADVANTAGES AND DISADVANTAGES OF CONFIRMING INCLUDE THE FOLLOWING:

FROM THE POINT OF VIEW OF THE ISSUER (DEBTOR)

The advantages refer to the fact that they are facilitates the management of your suppliers, The bargaining power with the bank is improved and financing can be accessed. Among the disadvantages, are the administration service costs and not being able to access means of payment not considered by the credit institution.

FROM THE POINT OF VIEW OF THE SUPPLIER (BENEFICIARY)

Among the advantages to the supplier are a greater security of payment and the possibility of accessing finance quickly. Meanwhile, the disadvantageThe main one is the cost of financing (which can be high).

FROM THE CREDIT INSTITUTION'S POINT OF VIEW

The advantages for the bank include increased access to customers, customer loyalty and higher business volume. However, the disadvantages are administration costs and the possibility of non-compliance by the customer.

ADVANTAGES OF CONFIRMING

Confirming contributes to the improvement of business relations between customer and supplier, which is possible, because the The financial institution is the guarantor of the outstanding payments. It greatly reduces administrative management and increases the possibility of obtaining discounts on your suppliers' invoices, even higher than the cost of financing.

APPLY THIS TIP TO YOUR PROJECT

TASK

CASE STUDY

Clara is an entrepreneur who has recently launched her online shop selling organic products. Due to high demand, she has needed to buy products in large quantities in order to be able to offer competitive prices to her customers and improve her profit margins. However, bulk purchases require more cash flow and payment terms that, in some cases, are not feasible for Clara. This is where confirming can be a solution.

Clara contacts a financial institution that offers confirming services and explains her situation to them. The financial institution verifies the invoices issued by her suppliers and, once verified, undertakes to pay them within the agreed period, allowing Clara to receive payment before the payment deadline. In return, the financial institution charges a fee for the service and Clara's suppliers are paid in advance, improving their cash flows and reducing their risk of non-payment.

In this way, Clara can better manage her cash flow and ensure that she can continue to buy wholesale products for her online shop, keeping her prices competitive and improving her profits.

QUIZZES

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "2" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP