DRAG ALONG, DRAG ALONG RIGHTS IN STARTUPS

Accelerate your business with these expert tips "Drag along, drag along right in startups". Analyse and discover this TIP!

It is a financial law that it is always easier to sell and that a better valuation is achieved by selling 100 percent of a company than 10 or 20 percent. Therefore, the investor usually makes sure from the outset, through the shareholders' agreement, that the moment he decides to exit the business, his decision will equally affect all the others. Therefore, the investor usually procures from its entry, through the partners' agreement (+), The time when he decides to leave the business, his decision will drag all the other partners along with him. That when he decides to leave by accepting an offer of sale, the rest of the partners will have to follow.

Ultimately, this means that when a professional investor comes in, you have sold your company, although you will find out in five years' time. Admittedly, this is qualified by your right of first refusal, but in practice it means that you have sold your company, unless you have or are able to raise the necessary money at the price set by the market. The drag along is a agreement between the shareholders of a company as a clause in the shareholders' agreement allowing business angels to force entrepreneurs to sell their shares in the event of a sale or merger of the company (see+ TIP).

This clause is a way to ensure that all shareholders are aligned on a transaction and to avoid obstacles that could delay or prevent a transaction. From the entrepreneur's point of view, having a drag-along right in the investment agreement may be a disadvantage in terms of control and flexibility. The entrepreneur may lose control over the fate of the company and may not have the ability to make important decisions about the transaction. In addition, the drag-along right may also limit the company's ability to negotiate more favourable terms in a transaction. Therefore, it is important for the entrepreneur to carefully evaluate the terms of the investment agreement before signing a drag-along right.

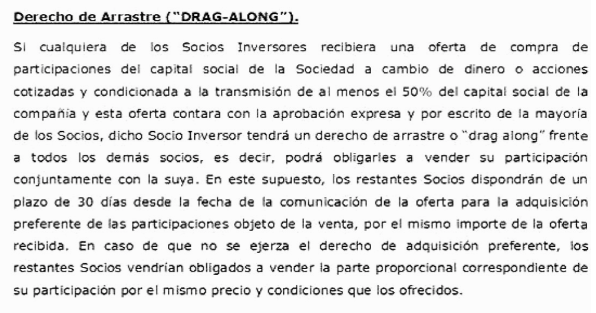

Typical example of a clause

"If any of the investment partners receives an offer to purchase shares in the company's share capital in exchange for cash or listed shares and conditional upon the transfer of at least 50 percent of the company's share capital and this offer is expressly approved in writing by the majority of the partners, this investment partner shall have a drag along right against _____________ the remaining partners _____________".

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇