SPAIN, A COUNTRY TO INVEST IN AND TO LIVE IN

Spain enjoys great prestige not only as a tourist destination but also as one of the preferred places to live and work and also, of course, to invest. This tip aims to give you a clear idea of the benefits that this country offers to foreigners who decide to live here.

Spain, also known as the Kingdom of Spain, is a sovereign member of the European Union. Its constitutional form is a parliamentary monarchy and its constitution defines it as a social and democratic state governed by the rule of law. It covers an area of 505,370 square kilometres. Its capital is Madrid and administratively it is divided into 17 autonomous communities, 50 provinces and two autonomous cities.

Spain is located in the south of Western Europe and North Africa. In Europe, it occupies most of the Iberian Peninsula, Peninsular Spain, two archipelagos, the Balearic Islands in the Mediterranean and the Canary Islands in the Atlantic, and the autonomous cities of Ceuta and Melilla, located in North Africa. It is the third largest country on the European continent after Russia, Ukraine and France.

It is the most mountainous country in Europe and has a population of over 47 million. Its official language is Spanish, which is the fourth most widely spoken language on the planet. Catalan, Basque and Galician are also spoken and are official languages.

Spain has one of the most important cultural and historical collections in the world. Over the centuries it has been influenced by many different peoples who have left a great cultural wealth in the country. Greco-Roman culture is undoubtedly the most important and the one that characterises Spanish culture to the greatest extent.

The trace of these influences is enormous, as evidenced by the fact that the country has the fourth largest collection of UNESCO World Heritage Sites in the world.

In terms of economic indicators, Spain is a developed country, with the second highest life expectancy in the world after Japan, according to the OECD, thanks to its Mediterranean diet and mild climate.

The country's GDP ranks 14th in the world (2021). For many different reasons, Spain is a major tourist power as it is the second most visited country in the world (83 million tourists in 2019) and also the second most visited country in the world in terms of tourist income.

It has a human development index The ratio is very high, reaching 0.904 in 2020 (UN indicator composed of life expectancy, education and per capita income).

The country enjoys a high international profile thanks largely to its membership of the most important supranational organisations: United Nationsthe Council of Europethe World Trade Organisationthe Organisation of Ibero-American Statesthe OECDthe NATO and the European Union -including the Schengen area and the Eurozone-as well as being a member of de facto from G20.

Spain is a great place to live and work:

Health system:

- The World Economic Forum's Global Competitiveness Index ranks the Spanish healthcare system first in the world. Spain provides universal access to healthcare, guaranteeing relocated workers and foreigners virtually the same healthcare services as Spanish citizens.

- Spain ranks second in the world and first in Europe in life expectancy according to the OECD. Contributing factors include the Mediterranean diet and temperate climate.

Education and talent:

- There are 287 international schools throughout the country, and public schools offer special programmes including bilingual education.

- It has an important pool of highly qualified and trained human capital in its network of universities distributed throughout the country. The University of Navarra is one of the most prestigious in Europe, along with Cambridge University, and the autonomous universities of Madrid and Barcelona are among the 20 best in Europe.

- Moreover, four Spanish business schools are among the top 20 in Europe (IESE, ESADE, IE and ESIC).

- It ranks sixth in the world and third in Europe in percentage of population with higher education (GTCI 2020 Report, INSEAD). It ranks fourth in the number of scientists and engineers according to the Institute of Economic Studies.

A competitive labour market:

- The Spanish regulatory framework is modern, flexible and transparent and is based on OECD standards and best practices. Foreign companies based in Spain directly employ 1.4 million workers, ranking fifth in Europe in terms of volume (Eurostat, Foreign Affiliates Statistics).

- Wage costs are also more competitive than in other major European economies.

- Productivity in Spain has been on an upward trend over the last ten years and continues to grow faster than in other European countries.

Spain is a country open to foreigners:

- Spain is an open and inclusive society. More than 6 million foreigners live in Spain (13% of the population) and are well integrated into society. Spain is particularly attractive for Spanish-speaking talent.

- It is the preferred destination for university students in the Erasmus exchange programme according to the European Commission: mainly because of the language, the quality of its universities and its open and inclusive culture towards foreigners.

- In Spain there are specific formulas designed to facilitate the relocation of workers, investors and entrepreneurs.

- Spain has excellent diplomatic relations with nations around the world. The Spanish passport ranks second out of 168 countries as the most valued by the countries to which it offers access (Arton Capital Passport Index).

- EU citizens and their family members can live and work in Spain without a work permit. Non-EU foreigners must obtain prior official authorisation to live and work in Spain; this can be any of several authorisations under the Ley de Extranjería and the Ley de Emprendedores 14/2013, which grant visas and residence permits for investors, entrepreneurs, highly qualified professionals, training, research, development and innovation activities, and intra-company transfers.

Investing in Spain

- Spain ranks high in the world in terms of the importance of its economy: 15th largest economy in the world in terms of GDP size, 11th most attractive country for foreign direct investment (FDI), 13th largest FDI issuer among sovereign countries and 11th largest exporter of commercial services.

- Spain is also a modern knowledge-based economy, where services account for more than 741 Tp3T of business activity, being an international centre of innovation favoured by the existence of a young, highly qualified and proactive population, and offering competitive costs in Western Europe, especially in the case of higher education graduates.

- Specifically, our country has made a great effort to equip itself with the most advanced infrastructures, capable of facilitating the future growth of the Spanish economy. Moreover, this has been accompanied by a major commitment to R&D.

- For foreign investors, Spain offers interesting business opportunities in strategic sectors with high added value, such as ICT, renewable energies, biotechnology, environment, aerospace and automotive, due to its attractive competitive environment.

- Moreover, companies setting up in Spain can not only access the domestic market, a very attractive market due to its size (over 47 million consumers) and its high purchasing power, but also the markets of the EMEA region (Europe, Middle East and North Africa) and Latin America, given its privileged geostrategic position, its prestige and the strong presence of Spanish companies in these regions.

This chapter describes the main features of our country: demography, political and territorial structure, its economy and foreign sector.

Spain is a member of the European Community:

Spain became a full member of the then European Economic Community in 1986. Since then, according to data published by the European Commission, Spain has met the targets set by the European Council.

Joining the European Union brought Spain, as well as the other Member States, a transcendental change since the mid-1990s with the creation of the Single European Market and the European Economic Area, the architects of a borderless commercial space.

Since then, the European Union has made significant progress in the process of unification by strengthening political and social ties between its citizens; Spain, throughout this process, has been one of the leading countries in the implementation of liberalisation measures.

On 1 July 2013, with the accession of Croatia, the number of EU countries increased to 28 Member States. However, on 23 June 2016, the referendum on the United Kingdom and Gibraltar remaining in the European Union was held, in which they voted to leave.

Thus, as of 31 January 2020, the United Kingdom has left the European Union with the entry into force of the Withdrawal Agreement, bringing the number of Member States to 27.

With the aim of increasing the EU's democracy, efficiency and transparency, and thus its ability to address global challenges such as climate change, security and sustainable development, the then 27 EU Member States signed the Treaty of Lisbon on 13 December 2007, which entered into force - subject to ratification by each of the 27 Member States - on 1 December 2009. Prior to this, elections to the European Parliament were held between 4 and 7 June.

Spain has acquired an important responsibility in the European Union, as evidenced by the fact that, together with Poland, it is the fifth country in terms of voting power in the Council of Ministers. In 2010, Spain assumed the Presidency of the Council for the fourth time and for the period from January to June of that year.

The introduction of the euro (1 January 2002) marked the beginning of the third Spanish Presidency of the European Council, representing the culmination of a long process and the birth of a whole series of growth opportunities for the Spanish and European markets.

Since 1 January 2015, with the accession of Lithuania, nineteen Member States have participated in the Eurozone.

With the euro, a single currency area has been established in the European Union, forming the largest trading area in the world, bringing about the integration of the financial markets and economic policies of the Member States belonging to the euro area, enhancing the coordination of Member States' fiscal systems and increasing the stability of the European Union.

The adoption of a single European currency has also produced clear results at the international level, promoting the Eurozone both in international and financial fora (the G7 meetings) and in multilateral organisations.

The economic and trade stability provided by the euro has been reinforcing Spain's economic growth, along with its international political projection.

In addition, measures are being put in place to strengthen the European economy, e.g. to strengthen economic policy coordination in the Economic and Monetary Union, the Euro Plus Pact is being created.

In May 2020, the European Commission presented a proposal for a revision of the Multiannual Financial Framework with the objective of undertaking increased investments in 2020 to address the COVID-19 crisis.

Subsequently, on 17 December 2020, the Council of the European Union adopted the Regulation establishing the multiannual financial framework of the European Union for the period 2021-2027, which will be a financing instrument aimed at strengthening all areas of European Union action.

In particular, it will focus on the ecological and digital transitions and will also help EU Member States to address the consequences of the COVID-19 crisis by stimulating their modernisation and resilience.

In this way, Spain has maintained its commitment to structural reforms in line with the Europe 2020 Strategy and the Pact for Growth and Employment, which are making it possible to relaunch economic growth, investment and employment, on the basis of a more competitive European Union.

Spain has traditionally benefited from Community resources from the Structural Funds and the Cohesion Fund. In this respect, Spain is the third country that receives the most aid from these Funds.

In the period 2020-2027, European funding, through the Multiannual Financial Framework together with the extraordinary Recovery Facility "Next Generation EU", is estimated to provide a positive contribution of more than EUR 1.8 trillion over the coming years to underpin the recovery from the COVID-19 pandemic and the long-term priorities of the European Union in different policy areas.

Stimulating and supporting research and technological development are functions attributed to the European institutions. On 11 December 2020, the Council of the European Union reached a provisional political agreement with the European Parliament negotiators on the proposal for a Regulation establishing Horizon Europe for the period 2021-2027.

Horizon Europe will be organised around three pillars:

- Excellent science.

- Global challenges and European industrial competitiveness.

- Innovative Europe.

In this way, it will help create industrial leadership in Europe and strengthen the excellence of the science base, essential for Europe's long-term sustainability, prosperity and well-being.

In this respect, the 2011 Science Act contributed measures to the current existing framework (autonomous development, growing European dimension, quantitative and qualitative leap in public resources, consolidation of a professionalised scientific and technical community, competitive and open to the world, and transition towards a knowledge and innovation-based economy).

Likewise, the promotion and encouragement of excellence and the strengthening of scientific research institutions is one of the central axes of the actions and definition of the scientific policy of the Ministry of Science and Innovation.

At the end of 2015, the Government approved the creation of the State Research Agency with the aim of providing the Spanish Science, Technology and Innovation system with a more flexible, agile and autonomous management.

This body, which is responsible for the financing, evaluation and allocation of R&D funds, acts in coordination with the Centre for the Development of Industrial Technology (CDTI), the other major R&D&I financing agent, in this case aimed especially at the business world. Both organisations are major promoters of transnational and bilateral cooperation and research projects.

Throughout the 2020 financial year, the Ministry of Science and Innovation has established extraordinary measures in the labour field to support research on COVID-19, as well as measures in the budgetary field, launching various lines of subsidies and extraordinary credits in the budget earmarked for R&D projects on COVID-19.

Likewise, at the end of the 2020 financial year, the Ministry of Science and Innovation presented the general lines of the General State Budget for 2021, which includes a large direct investment in R&D and innovation.

Specifically, the budget increases by 59.4% compared to 2020, to EUR 3,232 million.

Infrastructure

Road, motorway and motorway network

The government intends to continue its programme of intensive investment in this area in the future. In this regard, the Infrastructure, Transport and Housing Plan (PITVI) was approved which, based on a review of the situation and a rigorous assessment of society's needs, establishes priorities and action programmes for the period up to 2024.

The objectives of the plan include the following:

- Improving the efficiency and competitiveness of the overall transport system by optimising the use of existing capacities;

- Contribution to balanced economic development;

- The promotion of sustainable mobility, making its economic and social effects compatible with respect for the environment;

- Reinforcing territorial cohesion and the accessibility of all the territories of the State through the transport system and

- Improving the functional integration of the transport system as a whole through an intermodal approach.

The 17,228 kilometre network of motorways and dual carriageways has undergone continuous renovation to increase its efficiency, and is now the leading European network of motorways and dual carriageways in Europe.

One of the objectives of the Plan is to improve this road network and expand the number of high-capacity roads by investing 36,439 million euros.

Railway network:

In terms of rail transport (where Spain has a network of 16,000 kilometres), high-speed rail lines have become a priority. Madrid is currently connected by high-speed train to 31 cities in Spain, following the inauguration in 2015 of the sections that have brought the high-speed train to Zamora, Palencia and León.

Likewise, in 2015 the last section of the "Atlantic Axis" was inaugurated, which has allowed Galicia to be connected from north to south.

On the other hand, the Barcelona-Paris connection has enabled the high-speed rail link between the capitals of Spain and France, and in the near future the connection with the French border via Vitoria and Irun (Basque Country) will be added.

The network is in permanent expansion, with the new Madrid-Granada section having been added in June 2019 and the inauguration of the Burgos and Murcia sections scheduled for 2022. In fact, in recent years Spain has become a world leader in high-speed rail.

In this time, our country has multiplied by more than 6 the number of high-speed kilometres in service, from just over 550 kilometres to more than 3,400 kilometres.

Since its implementation, the High Speed has had an investment of approximately 51.775 million euros, with a commitment that 9 out of 10 citizens will be less than 30 kilometres away from a high-speed station.

As a result, Spain has become the leading country in Europe and second in the world, after China, in terms of the number of high-performance kilometres in operation, ahead of countries such as France and Japan.

With a view to 2021, the General State Budget envisages an increase in expenditure on high-speed rail compared to previous years, partly financed with European funds.

On the other hand, it is worth highlighting the important network of relations with railway infrastructure managers in other countries that has been established through the signing of collaboration protocols. Within the scope of these agreements, representatives from various countries such as the USA and Brazil have come to Spain to learn about our high-speed model.

By way of example, in the 2020 financial year, licences and administrative concessions were granted to Spanish companies for their participation in the construction of railway infrastructure and equipment in countries such as Australia, the United Kingdom, the United States (Dallas and Houston) and Mexico, among others, as well as in the construction of the high-speed line that will link the cities of Medina and Mecca in Saudi Arabia, which came into operation on 11 October 2018.

In relation to the liberalisation of passenger transport by rail, Royal Decree-Law 23/2018 of 21 December was approved, by virtue of which the Directive that develops the single European rail space was transposed, allowing access to the rail infrastructures of all Member States and reinforcing the independence and impartiality of the administrators of the aforementioned infrastructures.

As a consequence of this liberalisation, during the 2020 financial year, it was announced that the "low cost" high speed train called "Avlo" would be put into operation, although its launch was postponed until 2021 due to the health crisis caused by the COVID-19 pandemic.

Finally, it is worth mentioning the liberalisation of the freight transport sector since 2005, which is giving way to private companies providing rail freight transport services.

In this sense, the government plans to approve a series of measures in order to promote this type of transport and remove administrative and technical obstacles, thus making railways a competitive mode of transport.

Air transport

Air transport, on the other hand, links the main Spanish cities through the 46 airports in Spain, which connect our country with the main cities in the world. Spain is an important hub for the routes linking America and Africa from Europe.

In this sense, the most important planned investments are aimed at the two main international airports, located in Madrid and Barcelona. AENA plans to invest 1,571 million euros in Madrid's Adolfo Suárez-Barajas International Airport until 2026 with the main objective of increasing its capacity to 80 million passengers.

During 2020, as a consequence of the global crisis caused by COVID-19, Spanish airports, like those of the rest of the world, have exceptionally decreased the number of passengers compared to the positive evolution registered in previous years.

In this context of global paralysis of the sector, Spain has become one of the top parking locations for the airlines' aircraft fleets, given the excellent existing infrastructures.

Access to the high-speed train from Madrid's Adolfo Suárez-Barajas International Airport in just 25 minutes allows both means of transport to be used together, placing Spain at the forefront of passenger transport.

The 2021 Operational Plan for air navigation, approved in the 2020 financial year, has planned an investment of more than 127 million euros with the aim of adapting to the technological transformation and boosting the recovery of the aeronautical sector.

Furthermore, a new strategic flight plan 2025 is currently being drawn up, which will take over from the Flight Plan 2020.

Maritime communications

On the other hand, Spain enjoys excellent maritime communications with more than 46 international ports on the Atlantic and Mediterranean coasts, making it a port power behind only the Asian giants, the United States, Germany and the Netherlands.

The promotion of short sea shipping, both at national and European level, and the development of the motorways of the sea are another of the basic axes. The Motorway of the Sea between Spain and France, which links Vigo with the French port of Saint-Nazaire, is also in operation.

In parallel, work is being carried out to recover the connection between Gijón and Nantes-Saint Nazaire, which would bring back what was one of the first Spanish motorways of the sea and which operated until its closure in 2014.

On the other hand, it is planned to promote this type of line in the Mediterranean, through agreements with Italy and other countries, with the aim of increasing the offer of those already in existence and which are operating with good results between the Spanish ports of Barcelona and Valencia, and the Italian ports of Porto Torres, Civitavecchia, Livorno, Savona, Cagliari and Salerno.

This will allow for a more sustainable modal alternative in some of the main flows with the EU. On the other hand, in order to improve the competitiveness of ports, the Ports Act was amended in 2010, with the aim of reducing restrictions on inter- and intra-port competition and, in short, to encourage the competitiveness of our ports in the global economy.

Along the same lines, the Port Accessibility Investment Plan was approved to improve the land accessibility of the port system with an investment of more than 1,418 million euros.

At the end of 2020, the budgets for the port system in Spain for 2021 were presented, with an investment of more than 1 billion euros, earmarked for port terminals, improvements in land connectivity, environmental sustainability and digitisation.

As part of its internationalisation plans, Puertos del Estado is promoting alliances with major Chinese operators. Thus, the Port of Barcelona's BEST terminal (Barcelona Europe South Terminal) is operated by the Chinese group Hutchison Port Holdings (HPH), the world's leading port terminal operator.

Three major Spanish ports (Bahía de Algeciras, Valencia and Barcelona) appear in the TOP 100 in the world in terms of container traffic10 , and confirm the strategic position that Spain holds in the context of world maritime transport.

Spain is well equipped in terms of technological and industrial infrastructure, with a proliferation in recent years of technology parks in the main industrial areas, as well as around Universities and Research and Development Centres.

There are currently 61 technology parks in which 8,130 companies are established, mainly in the telecommunications and IT sectors, with a large proportion of the workforce dedicated to R&D activities.

Telecommunications

Spain also has a good telecommunications network. In addition to the extensive conventional fibre optic cable network that covers practically the entire territory, Spain has one of the largest submarine cable networks and satellite connections with the five continents.

In particular, it is worth mentioning the important liberalisation process that has already been underway for years in most industries, including the telecommunications sector, and which has been successfully meeting the deadlines set for this purpose by the European Union.

Among other benefits, this liberalisation entails an offer of

The cost-reflective competitiveness of these products is essential for economic development.

Water resources

Finally, it should be noted that the Government is promoting integrated water resources management based on environmental recovery and management, greater efficiency in water use, and planned management of risks such as droughts and floods.

Within the framework of the development of these actions, by Royal Decree 1/2016 of 8 January, the Government approved the revision of the Hydrological Plans of the Western Cantabrian, Guadalquivir, Ceuta, Melilla, Segura and Júcar river basin districts and of the Spanish part of the Eastern Cantabrian, Miño-Sil, Duero, Tagus, Guadiana and Ebro river basin districts.

Finally, Spain's infrastructure sector is expected to be particularly favoured by the "Next Generation" aid package agreed by the European Union in support of the countries most affected by the pandemic.

Economic structure:

It is that of a developed country, with the services sector, followed by industry, being the largest contributor to Gross Domestic Product. These two sectors will account for almost 91% of GDP in 2020.

The contribution of agriculture fell significantly as a result of economic growth and now accounts for 3.44% of total GDP. Over 2020, the effects of the COVID-19 health crisis have been felt in the Spanish economy mainly due to the implementation of pandemic containment measures.

Esto ha supuesto un cambio respecto de la senda de crecimiento iniciada en los dos últimos trimestres del año 2013. Sin embargo, durante el cuarto trimestre del 2020 el PIB ha mejorado sus previsiones de recuperación, registrando una variación de la tasa inter trimestral del 0,4%12respecto del trimestre anterior en términos de volumen.

En este sentido, si bien el crecimiento interanual del PIB se situó en el -9,1%13, las proyecciones efectuadas por el Fondo Monetario Internacional (FMI) reflejan una recuperación de la economía española respecto de la caída producida en el ejercicio 2020 para los ejercicios 2021 y 2022, impulsada por la aprobación de las vacunas y el respaldo de las medidas políticas de recuperación.

Inflation in Spain has been falling slowly since the late 1980s. The average inflation rate between 1987 and 1992 was 5.81 PPP3T; it fell below 51 PPP3T for the first time in 1993 and has been progressively declining.

The year-on-year rate of inflation as at December 2020 was -0.51 Q3YoQ, three tenths of a percentage point higher than in the previous month, mainly due to lower prices for package holidays and food and non-alcoholic beverages.

On the other hand, the positive influence on this evolution of the annual rate corresponds to the increase in the prices of electricity, heating oil and fuels, which has had a positive impact on the housing and transport groups.

The internal market:

The growth of the Spanish economy in recent times has been the result of strong growth in demand as well as a strong expansion of production, all of this in the current context of economic globalisation.

Today, the Spanish domestic market is made up of more than 47 million people with a per capita income according to INE data of 26,426 € for 2019, with a significant additional demand coming from the 648,669 tourists who visited the country in 2014, which represents an exceptional reduction compared to the positive evolution of previous years, due to the health crisis caused by Covid-19.

In this regard, international movement restrictions have had a serious impact on tourism in 2020, drastically reducing tourist arrivals by 82% in the Asia-Pacific region and by 68% in Europe and the Americas.

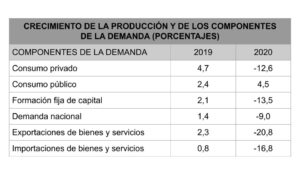

The table shows the evolution of output and demand components over the last year. The pace of growth of the Spanish economy has strengthened, mainly due to the contribution of domestic demand, as well as external demand, as exports have increased.

Foreign Trade and Investment:

The strong growth in international trade and foreign investment in recent years has made Spain one of the most internationalised countries in the world.

In terms of trade in goods, in 2019, Spain is the 16th largest exporter and 15th largest importer in the world, while in trade in services, it is the 11th largest exporter and 18th largest importer in the world.

The shares of Spanish exports and imports of goods in the world figure are 1.81 Tbp3T and 1.91 Tbp3T respectively. The shares of Spanish exports and imports of services in the world figure are 2.6% and 1.5%.

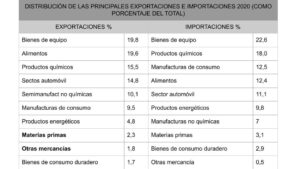

The sectoral distribution of foreign trade is relatively diversified, as the following table shows:

5 WTO World Trade Statiscal Review 2020.

Foreign investment regulations and exchange controls:

Liberalisation is the dominant feature in matters of exchange control and foreign investment. As a general rule, a foreign investor can invest freely in Spain without the need for any type of prior authorisation or notification.

Only once the investment has been made, the investor must notify it, within a maximum period of one month, to the Directorate General for International Trade and Investment of the Secretariat of State for Trade for purely administrative, statistical or economic purposes.

Exchange control and capital movements are fully liberalised in Spain, with complete freedom of action in all areas.

FOREIGN INVESTMENT LEGISLATION:

Royal Decree 664/1999 liberalised practically all this type of transactions (with the peculiarities and exceptions discussed below), adapting Spanish domestic legislation to the rules on free movement of capital contained in Articles 56 et seq. of the Treaty on European Union.

The most important aspects of the regulation applicable to foreign investments are the following:

As a general rule, and for purely administrative, statistical or economic purposes, foreign investments are subject to a regime of ex-post declaration to the Directorate General for International Trade and Investment, once the investment has materialised18.

The only exceptions are those relating to:

- Investments from tax havens, which, in general, are also subject to prior administrative declaration.

- Foreign investments in activities directly related to national defence and investments in real estate by non-EU Member States for their diplomatic headquarters, which are subject to prior authorisation by the Council of Ministers. Unless expressly provided otherwise, foreign investments do not have to be formalised before a Spanish notary public.

As regards the reporting regime, in relation to investment or divestment transactions in marketable securities, the reporting obligation does not generally fall on the investor but on those investment services companies, credit institutions or other resident entities which, where appropriate, carry out any of their activities and which act on behalf of and at the risk of the investor as interposed holder of the securities in question.

Investors must declare the investment only when the securities account or securities deposit is held with an entity domiciled abroad, or the securities are in the custody of the holder of the investment; or when acquiring a holding from 3% onwards in listed companies (in the latter case it is necessary to notify the Comisión Nacional del Mercado de Valores).

Foreign investments in the sectors of air transport, radio, raw materials, minerals of strategic interest and mining rights, television, gambling, telecommunications, private security, manufacture, marketing or distribution of arms and explosives, and activities related to national defence (the latter also subject to an authorisation regime) shall comply with the requirements of the competent bodies established in the specific sectoral legislation, without prejudice to the application of the general rules once these requirements have been met.

EXCHANGE CONTROL REGULATIONS:

Exchange control and capital movements are also fully liberalised matters where the principle of freedom of action applies.

The basic regulation on exchange control is contained in Law 19/2003 on the legal regime of capital movements and foreign economic transactions and in Royal Decree 1816/1991 on Foreign Economic Transactions, which maintain the principle of liberalisation of capital movements.

DECLARATION OF FOREIGN TRANSACTIONS WITH THE BANK OF SPAIN:

For purely statistical and informative purposes, Banco de España Circular 4/2012 establishes that natural and legal persons (public or private) resident in Spain, other than payment service providers registered in the official registers of the Banco de España, that carry out transactions with non-residents or hold assets or liabilities abroad must declare them to the Banco de España.

The periodicity of the communications shall depend on the volume of transactions carried out by the regulated entities during the immediately preceding year, as well as on the balances of assets and liabilities of the said regulated entities on 31 December of the preceding year, as follows:

- If the amounts of transactions during the immediately preceding year, or the stocks of assets and liabilities on 31 December of the preceding year, are equal to or greater than EUR 300 million, the information shall be reported on a monthly basis, within 20 days after the end of each calendar month.

- If the amounts of transactions during the immediately preceding year, or the stocks of assets and liabilities on 31 December of the preceding year, are equal to or greater than EUR 100 million and less than EUR 300 million, the information shall be reported on a quarterly basis, within 20 days after the end of each calendar quarter.

- If the amounts of transactions during the immediately preceding year, or the stocks of assets and liabilities on 31 December of the preceding year, are less than EUR 100 million, the information shall be reported on an annual basis, no later than 20 January of the following year.

- When the amounts referred to above do not exceed EUR 1 million, the declaration shall only be sent to the Banco de España at the express request of the latter and within a maximum period of two months from the date of the request.

However, those residents who, having not reached the aforementioned declaration thresholds, exceed them during the current year, will be obliged to file declarations at the corresponding intervals, starting from the moment in which these limits are exceeded.

Without prejudice to the foregoing, when neither the amount of the balances nor the amount of the transactions exceeds EUR 50 million, the declarations may be made in summary form, containing only the opening and closing balances of external assets and liabilities, the sum total of the collection operations and the sum total of the payment operations for the period declared.

IMPORT AND EXPORT OF CERTAIN MEANS OF PAYMENT AND MOVEMENTS THROUGH NATIONAL TERRITORY:

The exit or entry into national territory of means of payment for an amount equal to or greater than €10,000 or their equivalent in foreign currency is subject to prior administrative declaration. If such a declaration is not made, Spanish customs officials may seize these means of payment.

Likewise, movements through national territory of means of payment of €100,000 or more or their equivalent in foreign currency must also be subject to prior declaration.

For the above purposes, "movement" means any change of place or position outside the domicile of the holder of the means of payment.

Means of payment" shall mean paper money and coins (domestic or foreign); bearer bank cheques denominated in any currency as well as any other physical means, including electronic means, designed to be used as a means of bearer payment.

For the sole purpose of exit from or entry into the national territory, "means of payment" shall also mean negotiable bearer negotiable instruments, including monetary instruments such as travellers' cheques, negotiable instruments, including cheques, promissory notes and money orders, whether made out to bearer, endorsed without restriction, made out to the order of a nominee payee or otherwise by virtue of which title thereto is transferred on delivery, and incomplete instruments, including cheques, promissory notes and money orders, endorsed without restriction, made out to the order of a fictitious payee or otherwise by virtue of which title thereto is transferred on delivery, and incomplete instruments, including cheques, promissory notes and money orders, signed but with the name of the payee omitted.

EXCEPTIONAL MEASURES IN RESPONSE TO COVID-19:

As a result of the international outbreak of the coronavirus (COVID-19) and the extraordinary effects it has had in all aspects, the Spanish government has approved a series of measures aimed at responding to the pandemic.

Among the various measures adopted, the measures to control foreign investment established in Royal Decree-Law 8/2020 of 17 March on extraordinary urgent measures to address the economic and social impact of COVID-19 stand out in this area.

In this sense, the deregulation regime for foreign direct investment in Spain (i.e. investments made by residents of non-EU and EFTA countries in which the investor holds a stake equal to or greater than 10% of the share capital of the Spanish company, or when, as a result of the corporate act, legal act or transaction, they effectively participate in the management or control of said company) is suspended if:

- Investment is made in certain sectors affecting public order, public security and public health.

- If the foreign investor is directly or indirectly controlled by the government, including public bodies or the armed forces, of a third country; if the foreign investor has made investments or engaged in activities in sectors affecting security, public order and public health in another Member State; or if administrative or judicial proceedings have been initiated against the foreign investor in another Member State or in the home State or in a third State because of criminal or illegal activities.

In order to carry out these investments, authorisation must be obtained in accordance with the terms of the applicable legislation (Law 19/2003 of 4 July 2003).

On the other hand, Royal Decree-Law 11/2020 of 31 March, which adopts urgent complementary measures in the social and economic sphere to tackle COVID-19, modified the aforementioned regime established by Royal Decree-Law 8/2020 in two ways:

- On the one hand, it is clarified that the suspension of the FDI liberalisation regime applies to investments made by non-EU and EFTA residents or residents of EU and EFTA countries whose beneficial owners are residents of non-EU and EFTA countries.

Such a beneficial owner shall be deemed to exist where the latter ultimately owns or controls, directly or indirectly, more than 25% of the investor's capital or voting rights, or otherwise exercises direct or indirect control over the investor.

- On the other hand, a simplified authorisation process is allowed for foreign investments for which a simplified authorisation process is allowed:

- There is evidence of an agreement between the parties or a binding offer in which the price, fixed or determinable, is established before 18 March 2020.

- The amount is equal to or greater than EUR 1 million and less than EUR 5 million.

Provisionally, and until the minimum amount is established by regulation, investment transactions of less than EUR 1 million shall be considered exempt from the obligation of prior authorisation.

Obligations relating to the prevention of money laundering and the financing of terrorism

The execution of certain transactions in Spain will require those who intend to take part in them, prior to their execution, to provide certain documents relating to their identity and their business or professional activity, all within the framework of the applicable regulations on the prevention of money laundering and the financing of terrorism ("AML/CFT").

For more information this link.

Setting up in Spain

We analyse the main alternatives available in Spain for foreign investors to set up in Spain, as well as the main steps, costs and legal obligations involved.

WAYS OF OPERATING IN SPAIN:

Incorporation of a Spanish company with its own legal personality

Foreign investors have at their disposal various types of commercial entities for investing in Spain, as provided for by Spanish law. The most commonly used corporate forms are the public limited company (S.A.) and, mainly, the limited liability company (S.L.).

Limited liability entrepreneur

Development of the activity directly by a natural person if certain requirements are met.

Branch or permanent establishment

Both of these entities have no legal personality of their own, so that their activity and legal liability will always be directly linked to the parent company of the foreign investor.

Business cooperation

Partnerships with other entrepreneurs already established in Spain. They make it possible to share risks and combine resources and experience.

In Spanish law, different forms of joint ventures can be distinguished, which are developed in this Chapter:

- Temporary Joint Venture (U.T.E.).

- Economic Interest Grouping (EIG) and European Economic Interest Grouping (EEIG).

- Conclusion with one or more Spanish entrepreneurs of a form of collaboration specific to the Spanish legal system: "la cuenta en participación".

- Participatory lending.

- Joint ventures, through public limited companies or limited liability companies. Without incorporating an entity or associating with other existing entities or without physically establishing a centre of operations in Spain.

The various alternatives in this regard are as follows:

- Conclusion of a distribution agreement.

- Conducting transactions through an agent.

- Carrying out transactions through a commission agent.

- Establishment of a franchise.

- Procurement:

- Acquisition of shares or holdings in companies.

- Acquisition of real estate located in Spain.

- Business acquisition.

- Venture capital:

- Investment in venture capital companies.

Tax identification number:

The Spanish implementing legislation currently stipulates that all natural or legal persons with economic or professional interests in Spain or with a relevant involvement for tax purposes must have an N.I.F. (in the case of legal persons) or N.I.E. (natural persons).

Specifically, and among other cases, the N.I.F./N.I.E. must be requested whenever a foreign investor makes a direct investment in Spain or when he/she is a partner or administrator of an entity resident in Spain or of a branch or permanent establishment located in Spain of a foreign entity.

In the following link you will find more information on the formalities to be carried out depending on the N.I.F., for those legal persons who are going to be partners or administrators of companies resident in Spain or owners of a branch in Spain or permanent establishments, and the provisional and definitive N.I.F. of the company resident in Spain that is going to be incorporated.

The second option is the N.I.E., for those individuals who are going to be partners or administrators of companies resident in Spain, legal and tax representatives of branches located in Spain, permanent establishments or limited liability entrepreneurs.

Incorporation of a company in Spain

The most common corporate forms under Spanish commercial law are the public limited company (S.A.) and the limited liability company (S.L.).

The steps to incorporate a company in Spain are as follows:

Registration of the name and bank account:

The first step is to apply for a negative certificate of company name, a document certifying that the chosen name does not coincide with any other existing name.

Next, we must open a bank account in the name of the company by depositing the minimum capital corresponding to the legal form your business will take. The bank will provide us with a certificate that will be useful later on.

Articles of Association and Memorandum and Articles of Association

The Articles of Association are the set of rules governing the company. Among the minimum elements that must be included in the articles of association are the corporate purpose or activity to which the company will be dedicated, the system of administration, the shares, if any, to be divided and the share capital.

As for the public deed, it must be executed before a notary public and the following documentation must be provided:

- Identification documents of the founding partners.

- Articles of Association.

- Negative certification of the company name and bank certification.

- In the case of foreign partners, a declaration of foreign investments.

Formalities at the Tax Agency:

- Provisional Tax Identification Number (NIF):

- For this purpose, the signatory's identification document, form 036 and a copy of the deed of incorporation are required.

- Registration with the Economic Activities Tax (Impuesto de Actividades Económicas):

- This is a local tax levied on the activity of businesses, professionals and artists.

- Census declaration Value Added Tax (VAT):

- The commencement, modification or cessation of the activity is detailed here.

Registration in the Commercial Register.

Within a period not exceeding 2 months, the company must be registered in the Commercial Register.

This registration must be made in the Register of the same province in which the registered office is located and the following documentation acquired previously must be provided:

- Negative certification of the name.

- A certified true copy of the company's articles of association.

- Proof that the Transfer Tax and Stamp Duty has been paid.

- Copy of the Provisional N.I.F. (Fiscal Identification Number).

Post-registration formalities.

Obtaining the definitive N.I.F. number:

Once we have completed all the requirements detailed above, and once we go back to the tax office, we will get the Permanent N.I.F. (Fiscal Identification Number).

Social Security formalities:

Apply for registration in the Special Regime for Self-Employed Workers by presenting the TA0521 form at the Social Security administration offices, providing:

- Identification document

- When necessary for the registration of foreign workers, work permit or certification of the exception to the permit.

- Any document proving the origin of the discharge.

Employer number where necessary.

Opening licence:

This licence is an essential requirement for any commercial, industrial or service activity to be carried out in a given space, be it premises, warehouse or office. This document accredits that the conditions of use and habitability are met in order to carry out the activity.

Finally, once these requirements have been met, you will be able to start your activity.