TAX ADVANTAGES AND INCENTIVES FOR INVESTORS IN TENERIFE

Accelerate your business with these tips on "Tax advantages and incentives for investors in Tenerife". Analyse and discover this TIP!

Since its incorporation into the Kingdom of Castile, the Canary Islands have enjoyed a different economic and fiscal treatment from the rest of Spain. The remoteness from Europe, its insular fragmentation and the scarcity of natural resources constitute an evident differential fact that justifies certain rights which, under different modalities, are maintained to this day.

Since the decades of the free ports, the Canary Islands evolved towards new formulas embodied in the so-called Economic and Fiscal Regime of the Canary Islands in force since 1972. With the arrival of democracy, the new Constitution recognises the special regime for the islands.

With the incorporation of Spain into the European Community, the Canary Islands Parliament requested greater integration while maintaining a lower tax burden than in the rest of Spain, but adopting Community customs legislation and indirect taxation in accordance with European requirements that would allow the financing of local finances.

Tenerife offers a unique enclave in which to work and live. A place where it is worth investing and doing business that benefits those who decide to settle on the island. Those who want to start up their ideas, projects and businesses in Tenerife will find not only a place where they can achieve professional success, but also an ideal place to live and improve their quality of life.

Setting up a company in Tenerife is simple, and there is a wide range of possibilities capable of responding to the particular needs of the different types of investors wishing to operate on and from the island.

Institutions in the Canary Islands:

Tenerife is one of the two so-called capital islands that make up the Autonomous Community of the Canary Islands. This autonomous community is in turn part of the Kingdom of Spain. Thanks to its status as an insular and outermost territory.

The Canary Islands enjoy a specific status within the European Community, which, among other things, allows for a differentiated tax treatment for investors from abroad who set up companies in the Canary Islands.

The Canarian political bodies are as follows:

Government of the Autonomous Community of the Canary Islands:

The Canary Archipelago is governed by the so-called statute of autonomy, and its highest entity is the autonomous government of the Canary Islands.

It consists of a President, a Vice-President and a number of councillors with responsibilities in different areas of governance. The capital of the Canary Islands is shared between the cities of Santa Cruz de Tenerife and Las Palmas de Gran Canaria.

The Parliament of the Canary Islands:

It is the Community's own legislative body and its seat is in Santa Cruz de Tenerife.

The Island Council

The Cabildo is an administrative entity specific to the Canary Islands. Each of the islands has its own Cabildo and its task is to take over the government of each of the islands.

Therefore, the Cabildo of Tenerife has its own powers of government over the island of Tenerife. It also holds powers delegated by the autonomous government.

Its highest representative is the President, accompanied by a number of advisors.

Government Delegation:

It is responsible for representing the Spanish government and coordinating activities between the Spanish government and Canary Islands organisations.

The headquarters of the Government Delegation is in Las Palmas de Gran Canaria with a sub-delegation in each of the capital cities.

Consultative Council of the Canary Islands

In the city of San Cristóbal de la Laguna is located the headquarters of the Canarian Consultative Councils which, in accordance with our Statute of Autonomy, fulfils the generic function of overseeing the adaptation of Bills and Proposed Laws to the Constitution and the Statute of Autonomy, and with the aim of ensuring that the public administration is fully subject to the purposes that justify it, in the matters and terms set out in our constitutive Law, Law 5/2002, of 3 June.

Taxation:

Tenerife offers important tax advantages within the Spanish and European economic context. Its differentiated economic and fiscal system, permanently included in the legal framework of the European Union, guarantees exceptional conditions for investment and trade.

The Economic and Fiscal Regime of the Canary Islands (REF), renewed for the period 2014-2020, includes among other advantages:

Canary Islands Special Zone (ZEC):

The Canary Islands Special Zone (ZEC) is a low tax zone which is set up in the framework of the REconomic and Fiscal Regime (REF) of the Canary Islands, with the aim of promoting the economic and social development of the archipelago and diversifying its productive structure.

The ZEC was authorised by the European Commission (EC) It is regulated by Law 19/94 of 6 July 1994 and is open to all entities and branches that intend to carry out industrial, commercial or service activities, which are included in a list of permitted activities.

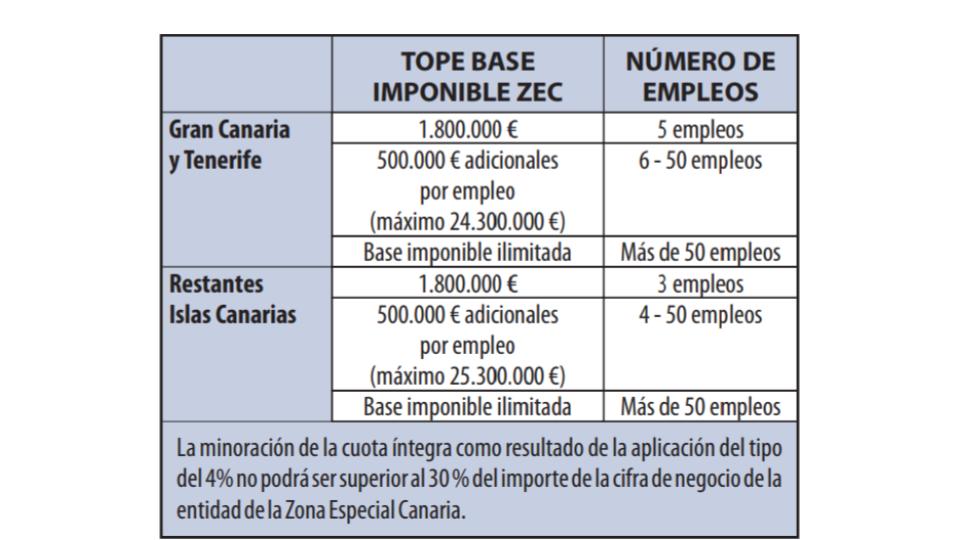

The reduced tax rate applied in the ZEC zone is 4% with respect to corporation tax, compared to 25% nationally or 20.94% on average in the European Union.

Non-resident income tax exemption:

- Dividends paid by ZEC subsidiaries to their parent companies resident in another country as well as interest and other income obtained from the transfer of own capital to third parties and capital gains derived from movable property obtained without the intermediation of a permanent establishment will be exempt from withholding tax.

- This exemption applies to income derived by residents of any state where such income is received by a ZEC entity and is derived from transactions materially and effectively carried out within the geographical scope of the ZEC.

- However, these exemptions do not apply where the income is derived through countries or territories with which there is no effective exchange of tax information or where the parent company is resident for tax purposes in one of those countries or territories.

Transfer Tax and Stamp Duty (Impuesto sobre Transmisiones Patrimoniales y Actos Jurídicos Documentados):

ZEC entities shall be exempt from ZEC tax in the following cases:

- The acquisition of assets and rights intended for the development of the activity in the ZEC entity in the geographical area of the ZEC.

- Corporate transactions carried out by ZEC entities, except for their dissolution.

- Documented legal acts related to transactions carried out by these entities in the geographical area of the ZEC.

Under the ZEC regime, supplies of goods and services carried out by the ZEC Entities between themselves, as well as imports of goods carried out by them, shall be exempt from IGIC taxation.

Compatibility with other REF tax incentives

Within the limits of the Community regulations on the cumulation of aid and under certain conditions, the tax advantages of the ZEC are compatible with other tax incentives of the REF, such as the Investment Reserve, the Investment Deduction and the Free Trade Zones.

How to obtain authorisation to set up in the ZEC area

Investors wishing to set up in the ZEC must obtain prior authorisation from the Consortium Board of the ZEC Consortium to become a ZEC Entity.

The procedure is simple and begins with the submission of an application for authorisation prior to registration in the Official Register of ZEC Entities (ROEZEC), a report describing the economic activities to be carried out and a number of documents to be provided.

Once the prior authorisation has been obtained, which must be granted within a maximum period of two months, the entity may register in the ROEZEC by presenting the Tax Identification Code (CIF), a simple copy of the document accrediting its incorporation filed with the Commercial Registry, and the application for registration in the ROEZEC.

The requirements necessary to set up in the ZEC zone are as follows:

- Be a newly created entity or branch with its registered office and effective place of management in the geographical area of the ZEC.

- At least one of the administrators must reside in the Canary Islands.

- Make a minimum investment of €100,000 (for the islands of Tenerife and Gran Canaria) or €50,000 (in the case of La Gomera, El Hierro, La Palma, Fuerteventura or Lanzarote) in fixed assets related to the activity, within the first 2 years from the moment of registration.

- Create at least 5 or 3 jobs, depending on whether or not the islands are capital islands, within 6 months of registration and maintain this average during the years that it is attached to the ZEC.

- Its corporate purpose is within the activities permitted within the framework of the ZEC.

General Indirect Tax of the Canary Islands:

It is a tax largely based on VAT, with a general rate of 7%.

Reserves for Investments in the Canary Islands (RIC):

Bonus of up to 90% of undistributed profit.

Tenerife Free Trade Zone:

An enclosed space for the storage, handling or processing of goods, regardless of origin, destination, quantity or nature.

It offers advantages in terms of administrative procedures, tariffs and taxes, fully compatible with other incentives such as those of the Canary Islands Special Zone (ZEC) or the Reserve for Investments in the Canary Islands (RIC).

Incentives for investment in Tenerife:

Investment in Tenerife is attractive not only because of the quality of life, climate and dynamic economic environment. It is also attractive because it is a destination that provides facilities for the creation and development of companies with aid and subsidies structured in different areas, among which the following stand out:

Regional incentives:

The Society for the Economic Development of the Canary Islands (SODECAN)is actively involved in financing viable and innovative business projects in Tenerife.

On 3 December 2018, the Government of the Canary Islands approved the creation of the FONDO CANARIAS FINANCIA, as a means to provide resources to the different financial instruments foreseen in the Canary Islands ERDF Operational Programme 2014-2020. In the same Agreement, SODECAN was designated as the Fund Manager.

The Financing Agreement between the Government of the Canary Islands and SODECAN was signed on 26 December 2018.

The financial instruments in place until 2023 aim to address the problems existing in the Canary Islands Autonomous Community in terms of access to financing for entrepreneurship; for innovation, research and development projects promoted by companies; and for projects related to energy saving and efficiency, as well as the introduction of renewable energies in SMEs.

Deduction of 45% for R&D&I:

It promotes the development of new R&D activities by foreign capital companies already established or planning to set up in Spain.

In the audiovisual sector:

The Canarian REF increases by 20 percentage points the deductions of the Corporate Tax Law (2, 3, 5 and 6) for audiovisual productions and by 80% the limits.

Therefore, in the Canary Islands, the incentive for foreign and Spanish productions goes from 30-25% of deduction to 50%-45% of deduction and in some cases increases to the 54% deduction on the first million euros. Both incentives have a refund limit of €18 million.

In addition, audiovisual works, with the exception of advertising, which are made by means of service production facilities, are eligible for the 0% of IGIC and VAT excluded.

- Royal Decree-Law 15/2014, of 19 December, amending the Economic and Fiscal Regime of the Canary Islands

- Law 27/2014 of 27 November 2014 on corporate income tax

- Law 3/2017 of 27 June 2017 on the General State Budget for the year 2017

- Law 8/2018, of 5 November, on the modification of the Economic and Fiscal Regime of the Canary Islands.

- Royal Decree-Law 26/2018, of 28 December, approving emergency measures on artistic and cinematographic creation.

- Royal Decree-Law 17/2020, of 5 May, approving measures to support the cultural sector and tax measures to address the economic and social impact of COVID-2019.

Subsidies for job creation:

In particular, the recruitment of unemployed people and those groups with greater difficulties in finding employment.

Tangible assets:

Allowance of up to 50% of the gross tax liability corresponding to income derived from the sale of tangible goods produced in the Canary Islands.

Patent box:

Spain was one of the first countries to put in place a mechanism to promote the sale or commercial exploitation of patents and any form of intangible.

ICEX Invest in Spain Technology Fund.

It promotes the development of new R&D activities by foreign capital companies already established or planning to set up in Spain.

Internationalisation:

In addition to the aid and services provided by ICEX and Proexca, there are special deductions for entities domiciled in the Canary Islands that make investments in West African territories and that spend on promotion and advertising, product launches, opening and prospecting markets abroad, and attending trade fairs or events of a similar nature.

Chamber of Commerce:

The Chamber of Commerce, Industry, Services and Navigation of Santa Cruz de Tenerife is a differential instrument when approaching markets in Latin America and, especially, in Africa from Tenerife..

APPLY THIS TIP TO YOUR PROJECT

.

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇