WHAT IS AN INVESTOR DECK AND WHAT IS ITS STRUCTURE AND CONTENT?

RESUMEN

Optimiza tu estrategia de financiación con la guía definitiva sobre el «Investor Deck»: descubre su estructura esencial y contenido clave para atraer a inversores privados como Business Angels y venture capital. Este documento es tu oportunidad inicial para capturar el interés del inversor, siendo esencial presentar una visión convincente de tu negocio. Desde definir claramente el problema que resuelve tu empresa, hasta detallar tu propuesta única de valor, el tamaño del mercado, y la estrategia de entrada al mercado; cada sección del Investor Deck es crítica para demostrar el potencial de tu proyecto. Aprende a destacar la fortaleza de tu equipo, la tracción actual de la empresa, la economía de las unidades y el uso previsto de los fondos para asegurar el crecimiento y éxito a largo plazo de tu startup. Con ejemplos prácticos y consejos expertos, este resumen te equipa con todo lo necesario para crear un Investor Deck que no solo atraiga la atención, sino que también abra puertas a reuniones clave con inversores. Descubre más sobre cómo elaborar este documento crucial y prepara tu empresa para el éxito en el ámbito del financiamiento.

Tabla de contenidos

Introducción al Investor Deck

Investor Deck is an English term for a presentation prepared with the aim of providing a brief but persuasive overview of a company's business plan to various sources of private financing: Business Angels (+), venture capital (+), etc. It is therefore the first source of knowledge that the investor will have of your project and the entrepreneur and also the first filter that you must overcome in order to possibly sit down with him.

The objectives of the investor deck are different from the point of view of the entrepreneur and the investor. Obviously, for the entrepreneur, it is essential to arouse the investor's interest so that he sits down with him and discusses the opportunity. For its part the investor's objective is to determine whether the project interests him/her enough to want to go further and meet with the entrepreneur. From an operational point of view, it is an initial document that the investor analyses in order to prepare a subsequent questionnaire that some call Killer Desck.

La Estrategia y Estructura del Investor Deck

The Killer Desck is like a turn of the screw that the investor prepares for his formal meeting with the entrepreneur, provided that he has detected reasons for interest in the project. The aim is to go as deeply as possible into the project, to provide further information and to clarify doubts. Taking into account both points of view, as an entrepreneur you should make a good empathy exercise and understand the role of business angels in entrepreneurship and what their financial objectives are. It is not about selling them your product. It is about getting them to fall in love with your project. We have already made some considerations about this in this TIP (+). We recommend you to read this other TIP on how to get to a first meeting with investors (+).

The Investor Deck is the first contact that an investor has with an entrepreneurial project. It is therefore essential to make a good first impression, knowing that the investor will dedicate very little time to this first analysis. A rejection at this stage is definitive. It is therefore necessary to think very carefully about what message you want to convey and what structure it will have. Normally, the Investor Deck is a Power Point presentation that should not exceed 15-20 slides and should be well designed.

Below is an analysis of the parts that make up the Investor Desck and the contents of each part.

1.-Cover page

CLEAR AND ATTRACTIVE. EXPLAINS WHAT THE PROJECT IS ABOUT:

- Startup name and logo.

- Short statement of the company's mission.

- Date of document.

2.-Problem

WHAT IS THE REAL RELEVANCE OF THE PROBLEM?

In the investor deck you have to describe the problem that your target customer has and that your company intends to answer. It is a "nice to have" or a "must have". Detail the segment(s) or niche(s) you are targeting as concretely as possible. BtoB or BtoC or both. Quantify the segment as much as possible. Bear in mind that the investor may not be an expert in the sector in which you intend to act, so you can use some kind of reference to corroborate your point of view regarding the problem you are raising: readings, potential clients, etc.

3.-Unique Selling Proposition (USP)

WHY DOES YOUR SOLUTION SOLVE THE PROBLEM AND DOES IT DO SO IN BETTER CONDITIONS THAN OTHERS?

It is essential that the unique selling proposition is explained very well. Talk about the technology, UX, roadmap, etc. You can introduce features and benefits of the product or service in very understandable terms: savings for the customer, time savings, increase in sales, loyalty effect, etc. It may be interesting to draw up a simple table in which you can correlate problems and solutions in your unique selling proposition.

4.-Momentum

Is it the right time to launch the product? What will happen in the medium to long term? Will it be sustainable? Is it a fad or a real trend in the sector? Any quotes from sources that corroborate your thesis are welcome.

5.-Market Size

WHAT IS THE SIZE OF THE MARKET?

It is big enough. Start by quantifying your primary market and how you are going to grow in it. Then explain your plans for the other markets. Don't give the impression that you are going to divide your efforts by going beyond your resources.. Quantify as much as possible the annual Total Addressable Market (TAM) of the market you are targeting.

6.-Equipment

It is not only about introducing the key members of your team, but also about explaining why this team is going to make the company the best in the market. Put a photo of the holder of each key position, his or her previous achievements or relevant milestones, countries, sectors and companies where he or she has worked, universities or business schools where he or she has studied., languages, previous experiences in entrepreneurship and the link to their profiles of LinkedIn (+). He thinks that the investor wants to know if the strategic roles are well covered. Highlight the complementarity between them so that they understand that it is a team capable of achieving the best levels of management.

6.-The business model (+)

HOW ARE YOU GOING TO MAKE MONEY WITH YOUR PROJECT?

If there are several business models e.g. SaaS and transactional, state what percentage of revenue comes from each of the models. Describe in simplified form your pricing model ticket media pricing If you have hardware, you could indicate how you finance it. Don't talk about future lines of business as you may give an idea of a possible loss of focus, distrust in your original model etc.

7.-Go to Market

HOW DOES YOUR COMPANY ATTRACT AND RETAIN CUSTOMERS?

This slide will be designed according to the business model, and explaining whether the company has a sales machine in place to make growth scalable:

- B2C (+): Traffic, Channels (+), conversion funnels (+), CPC, CPL, CPA, etc.

- B2B: How many leads you generate per month, which channels they come from, conversion rates per stage in your funnel, SDR/KA parity, differentiate inbound and outbound, etc.

WHAT IS THE COMPANY DOING TO INCREASE THE RETENTION AND UP-SELLING RATE OF EXISTING CUSTOMERS?

It is highly recommended, in order to B2B companies (+), annex to your investor deck the customer pipeline (transformation of potential customers into customers), and how much these customers represent in the company's sales.

8.-Competition

HOW IS THE LONG-TERM SURVIVAL OF THE COMPANY TO BE ENSURED?

DETAIL IN YOUR INVESTOR DECK WHY:

- The proposed solution (product/service) is the most appropriate solution for the target market niche (+).

- The company (business model, funding, team, traction, competitive advantages, etc.) is the best of all.

Explain what advantage places the company in a position of superiority over its competitors.

9.-Financials

WHAT IS THE TRACTION (+) HOW CONSISTENT IS THE COMPANY'S REVENUE?

This is the time to show investors the real strength of the company: traction, retention, margins, etc.

THE INDICATORS TO BE HIGHLIGHTED ARE:

- KPI's (+): no. customers, MRR, churnn (churn rate), retention, burn rate (+) (financial resources invested before reaching a positive cash flow, runway (+) (how far we can go with the resources we have), average ticket, repetition, cohorts, etc.

- Financial metrics: GMV, gross margin, turnover, etc.

If the company already has traction, this slide could be brought forward after explaining the USP slide.

10.-Units Economics

WHAT IS THE POTENTIAL OF THE STARTUP (+)?

To avoid complexity in the process of determining the degree of economic success of a company, a tool called unit economics has been developed that simplifies all this complexity by measuring revenues, costs and profitability per unit of product sold. In other words, it is a profitability indicator, which measures the ratio of the margin provided by a unit of sale to the costs of acquiring that sale. Following the example of Netflix, thehe first step is to identify the base unit, which will be the subscribers, the second step is to identify the customer acquisition costs (+) (CAC) and, finally, the value that a subscriber will bring us throughout his or her life cycle (CLV).

CLV: 144 / CAC: €42 = €3.5. This ratio means that for every Euro invested in customer acquisition you get €3.5 margin.

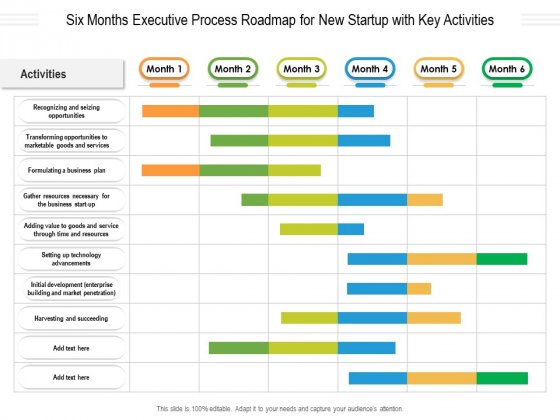

11.-Road Map

IS YOUR PROJECT AMBITIOUS ENOUGH?

The investor deck should contain a roadmap explaining what is to be achieved at different levels as explained in the table below.

Some efficiency metrics could be explained with respect to capital raised (if there have been previous rounds), because investors will measure the efficiency of the capital. For example, how CACs have decreased over time.

12.-Investment Size & Use of Funds

HOW MUCH DOES THE COMPANY NEED AND FOR WHAT PURPOSES?

Here we must define the size of the round, how long it will cover and what objectives are to be achieved with the funds raised. It is not recommended to put a valuation, as this is very sensitive information and can close doors before you have generated interest.

13.-Why should I invest in this Startup?

Summarise the reasons why the company will be successful in the sector and why it is worth investing in it.

- History of exits in the sector.

- Sector exits, if it is a market where there are many M&A transactions or IPOs.

- Why you?

- Competitive advantages (+).

14.-Contact

And finally, a clean slide containing the CEO's contact details, company logo and company name must appear on the investor deck. You could include a link (CTA) to the CEO's calendar to schedule a meeting directly with the CEO. As additional recommendations for the Investor Desck, it is not advisable to innovate too much.

IN ANY CASE, SOME ANNEXES CAN BE INCLUDED TO PROVIDE INFORMATION TO THE MOST INTERESTED INVESTORS:

- More technical description of the product and/or the problem it solves.

- Description of current clients.

- Customer pipeline.

- Cap table.

- Usage cohorts, retention cohorts, monetisation cohorts,

- Contact current customers or investors to request feedback (+).

- More comprehensive market quantification, etc.

An "investor deck" is an investor presentation, which is a a written and searchable document (google drive) that is used to present your company to potential investors. In general, an investor deck should be short, to the point and containing the key information investors need to understand the business and make a decision on whether or not to invest in it. The aim of this "deliverable" document is for you to develop the investor deck you need based on your reflection on each of the fundamental points that every startup needs to address, with the help of expert advice from each TIP. In addition, startups in the acceleration programme have a webinar where they can present their Investor deck to a Lead investor to gather further feedback and improve their action plan (see+ TIP).

APPLY THIS TIP TO YOUR PROJECT

TASK

Now that you have read this TIP, can you answer these questions?

- You could define your unique sales offer.

- What competitive advantages you assign to your business.

- Can you give two or three reasons why an investor should put money into your project?

QUIZZES

An investor deck is an important tool for presenting a company to potential investors. It must be brief, concise and focused on the key aspects of the business, including the problem being solved, the solution, the market, the business model and the team. A well prepared and presented investor deck can help entrepreneurs get the funding they need to take their business to the next level.

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK y this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇