STARTUP INVESTMENT ECOSYSTEM IN SPAIN

Accelerate your company with these expert tips on "Startup investment ecosystem in Spain". Analyse and discover this TIP!

In this tip you will find information concerning the current situation of the investments that various agents are making in startups in Spain.

Current situation

Spain is experiencing a sweet moment in terms of the amount of investment that people and organisations of various kinds are making to support entrepreneurs who want to launch their start-up in Spain.

Proof of the good health of investment activity in start-ups is that the amount invested has multiplied by 6 in the last 5 years and by 3 in the last year. On the other hand, capital increases of 200 and even 400 million euros are beginning to be recorded, which shows that Spain is heading in the right direction in terms of catching up with the indicators recorded in the rest of Europe.

Startup investment in Spain

Investment in Spanish startups, including fintechs, reached a record €4.3 billion in 2021, which is almost three times (+287%) the volume of the previous year (€1.107 billion), according to the Bankinter Innovation Foundation's Startup Ecosystem Observatory.

Throughout 2021, 409 investment transactions were closed. The fact that the volume of investment in Spain grew by 287% and deals by 20% is explained by a significant growth in the average size of the rounds, from 3.27 million in 2020 to 10.5 million in 2021 (up 221%), with a median of one million euros (up 25%).

According to the authors of the study, one of the defining elements of 2021 was the strong growth of more mature Series C and Growth rounds (with 35 deals in 2021 compared to six in 2020). These scaleups are the ones that generate the greatest impact on employment and wealth, and attract the most international investment.

In which sectors?

In 2021, the productivity sub-sector (which includes all those companies focused on providing services to other companies, very often through SaaS products), takes the lead in startup investments in Spain, displacing Mobility & Logistics, which moves to third place and includes everything from product delivery to mobility platform models or last mile logistics.

Investing in startups productivity 790 million in investment in 2021, with some 40 transactions.

The second place in the ranking of investments goes to '.Real Estate & Proptechwhich overcomes the dependence on a few mega-rounds and closes with 689 million raised in 21 transactions.

But one of the sectors in which most investment has taken place in the wake of Covid is healthcare. Before the spread of the Covid pandemic, nobody invested in healthcare, not least because of the long payback cycles required for start-ups in the sector.

With Covid, the obsession to take care of ourselves has arisen. Hospitals have realised that they are not digitised and this has led to a significant increase in the demand for healthcare technology products.

Where?

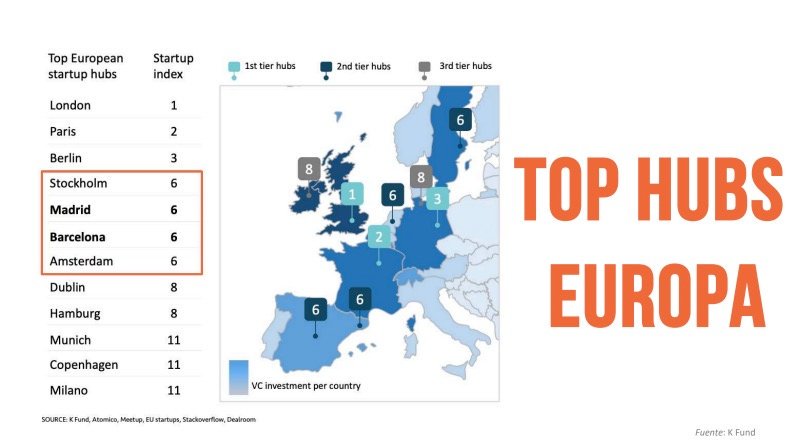

90% of startup investment in Spain between 2018-2021 is concentrated in Barcelona and Madrid. In 2021, Madrid with €2,487 million of investment (+587% compared to 2020) overtook Barcelona, which reached €1,510 million (+212% compared to 2020). There are also interesting movements in Valencia and Bilbao. But this concentration is normal throughout Europe. It occurs in France and England, where there is a high percentage of investment concentrated in two or three cities.

Barcelona and Madrid are among the most important startup hubs in Europe, and Spain ranks second in investment growth at 2.9%. It is also one of the countries with the highest investment growth in the second half of 2021.

However, we are still below the European average and there is still a lot of room for growth. It is estimated that over the next 5 years there will be around one billion euros available from investment funds in technology-based companies.

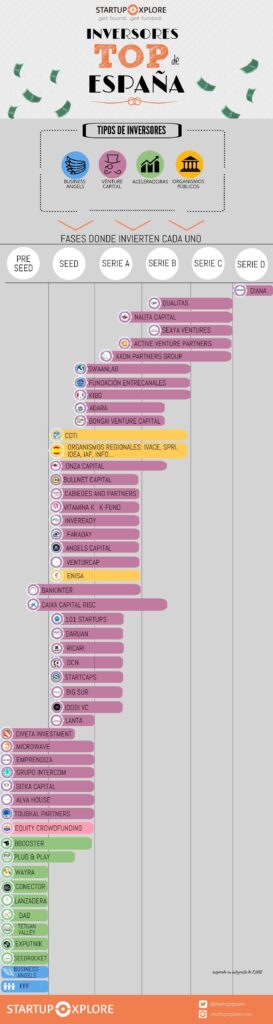

Who invests and at what stage?

PRE-SEED PHASE (PRE-SEED): INVESTMENT OF AROUND 100.000 EUROS

This refers to the moment when the idea is generated, the product is not very well developed and there are few or no sales. Investments in this phase are in the first instance made by the entrepreneurial partners themselves, either with their own resources or with resources from family, friends and fools. This phase concentrates the activity of the accelerators, which are responsible for starting up the projects and launching them on the market. Investment is mainly concentrated in the Seed phase. 60% of the rounds in Spain are seed/Preseed and series A.

SEED PHASE (SEED): INVESTMENT OF AROUND 300,000 EUROS

At this stage, we already have a finished product, a business model (+) and a going concern. There is a team working at full capacity and turnover is becoming stable and recurrent. In this phase, the accelerators (+) that have taken a stake in their accelerations, and there appear the funds of venture capital (+). But it is in the seed phase that the bulk of the so-called business angels (+). Public funds such as ENISA or CDETI and also participative loans appear as a means of financing.

GROWTH: BETWEEN EUR 1 MILLION AND EUR 20 MILLION

This is a stage dedicated to managing growth by scaling sales and optimising operations, for which new capital injections are necessary. This is where the presence of venture capital or venture capital is intensified. risk capital (+). The rounds (+) at this stage are categorised into series:

- A: Up to EUR 1 million.

- B: up to EUR 3 million.

- C: up to EUR 16 million.

- D: Up to EUR 20 million.

75% of startup investment comes from Venture Capital funds. The data shows that corporations are starting to invest in technology for both strategic and financial purposes.

The largest share of the investment volume comes from foreign capital than in 2021. S2.17 billion, 335% more than in 2020. Spanish funds are more focused on early stage investments and do not have access to investments of 10 million euros. There is a need for more funds to invest in growth phases but at the moment only foreign funds reach that level.

In any case, the balance of the arrival of foreign funds in the Spanish market has been very positive, as it has shown us the way followed in other more developed environments in the field of start-ups and represents a challenge for the locals, who are forced to improve.

Why invest in startups in Spain?

There are plenty of reasons to invest in startups in our country. Firstly, the digital economy currently represents more than 19% of Spain's GDP, either directly or indirectly. It is essential that the digital economy continues to grow as it is a strategic issue for the future.

SOME COMPARATIVE DATA WITH OTHER NATIONS:

- Global 16%

- Spain 19%

- United States 22%

- China 30%

Moreover, the digital economy is a natural creator of skilled jobs and will demand more and more talent. Another consideration, regarding startup investment in Spain, is explained from the investor's point of view, as the digital economy offers a better risk-risk balance.-It also provides multiple options for portfolio diversification.

The 100 most active Business Angels in Spain link of interest (+)

APPLY THIS TIP TO YOUR PROJECT

TASK

Now that you have read this tip, can you answer these questions?

- Could you define what stage your project is at?

- Depending on the stage of your project, what investor profile do you think would be most interesting?

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇