WHY ARE STARTUP VALUATIONS SO HIGH?

Accelerate your business with these expert tips "Why are startup valuations so high?" Analyse and discover this TIP!

One of the most common areas of shock when approaching the world of investing in high-potential innovative companies is the million-dollar valuations of companies. Startup valuations can be high because they are often based on the future potential of the company rather than its current performance. The idea behind investing in startups is that, if the company grows and develops as planned, the valuation will multiply and the initial investment will turn into a significant return. Therefore, a high valuation reflects the investor's confidence in the future success of the company. It is common to find companies that are just starting to turn over and have a valuation of more than one million euros, which, compared to the more traditional economy, is absurd.

The motivation for these assessments is twofold

- Different models. A more traditional company grows in a linear fashion, i.e., in its business model, costs and revenues grow evenly (to sell more, you have to produce more). However, high-potential innovative companies always have business models with the capacity for exponential growth. In other words, they are scalable models (+) where costs do not grow in line with revenues and are therefore able to generate growth by several orders of magnitude, without their costs increasing much (usually thanks to technology). This implies that it is impossible to value a company with high potential with traditional company valuation models. (e.g. multiples on EBITDA), as these are designed for non-exponential growth, and not for companies capable of growing 10-fold in a few years, sometimes in months (see+ TIP).

- Dilution (+). These types of businesses are somewhat similar to R&D companies: they require investing a lot of capital at the beginning, with hardly any revenue generation, in order to generate explosive growth later on. If we were to value one of these companies using traditional (accounting) methods, we would be forgetting the spirit of the company, the scalability, the exponential growth and the value of the idea-team-execution equation. That way we would find that Whatsapp or Instagram would have negative valuations in their beginnings, when in fact they ended up being worth and being bought for many millions of euros.

For example:

Let's imagine a company with a high potential but which currently has a turnover of €1,000 per month, so we decide to value it at €100,000. If we invest €150,000 in that company, we will obtain the 60 % (150,000 / 250,000 post-money valuation), and the founders in their first round of financing would no longer be majority shareholders (between all of them they would have a 40%). Therefore; What incentive would they have to continue working for years in a company with a high probability of failure rate and of which they have a small percentage? It is therefore common that, in an investment round, at most, the company decides to divest between 15 % and 25 % of its capital.

IF WE TAKE IT TOWARDS VALUATION, VALUATION GROWS PROPORTIONALLY:

If 150.000 € is 20 %, the 100 % will be 750.000 €. (their pre-money valuation (see+)).

However, it is important to keep in mind that the valuation of a startup is subjective and may vary according to the perception and expectations of each investor. This is why startup valuations can be very high compared to other, more established forms of investment.

Reasons why startup valuations are rising:

One of the relevant changes in 2021 in Spain was the general increase in the pre-money valuations of companies in the transactions carried out. This is not just a Spanish phenomenon or a phenomenon of the angel investment sector, but has also occurred in the rest of Europe and the United States. In Europe, the average valuation of startups that received angel and seed funding increased by €4 million, increasing by 30% compared to 2020.

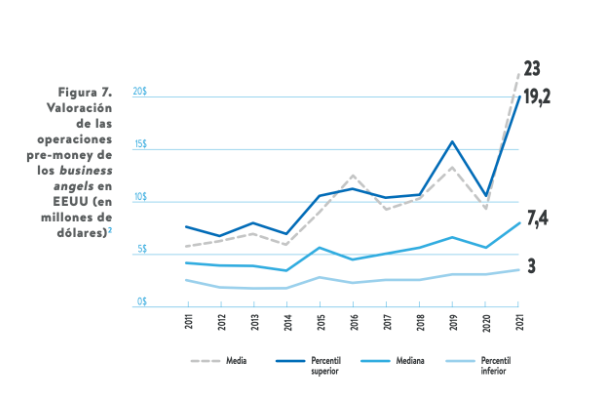

Investors' fear of missing out on good opportunities contributed to their signing significantly larger deals, especially in those companies showing early traction. This phenomenon is not unique to early stage, but in the more advanced stages of venture capital, a number of new European unicorns have also emerged. In total, there are already 128, with a combined valuation of 329.7 billion euros, almost three times their value in 2020 (Pitchbook, 2022). In the United States, valuations in the angel (unseeded) segment have risen sharply (see figure).

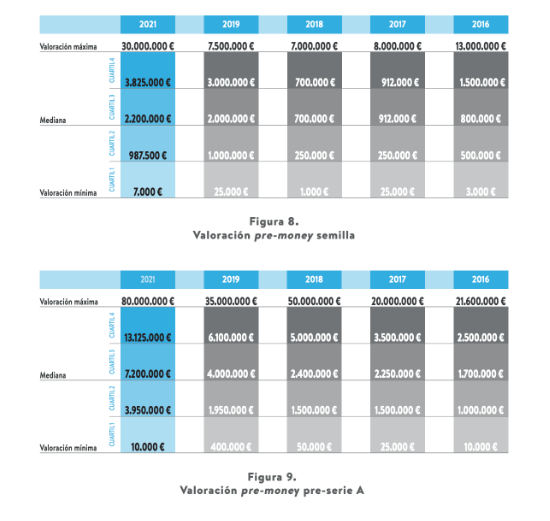

As can be seen in the graph below, the median has reached $7.4 million, with the average jumping to $23 million due to the effect of large deals involving venture capital funds. A quarter of the deals exceed $19.2 million. Spain has also seen a significant increase in valuations in 2021 compared to 2019 for both seed stage (see Figure 8) and pre-Series A (see Figure 9) investments, mainly due to the overheating of the supply of available capital.

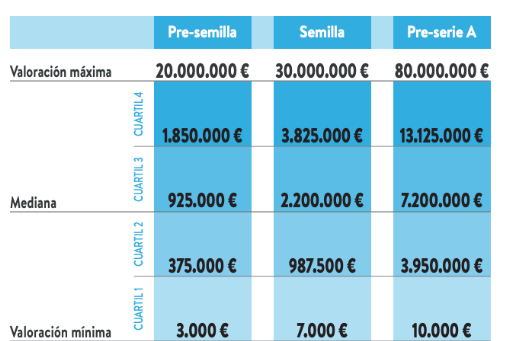

The maximum valuation is particularly striking in the case of the former (with prototype and validation of the business model, which can pivot (+)), 30 million euros, a figure that has never been recorded before and which is four times higher than the figure achieved in 2019. However, this figure should be treated with some caution, as it could correspond to a one-off. The pre-seed sector (idea phase) experienced extremely high peak valuations in 2021 (see figure 10), although the sample could be distorted by some one-offs.

As seen in both Europe and the United States, the entry of private equity funds into the early stage investment segment has significantly increased their valuations. The overheating of available capital also influences the evolution of post-seed stage company valuations. The increase in valuations in the pre-series A segment (characterised by strong market demand, recurring customers, turnover, profitability and equipment hiring) 1 million to 5 million, in line with the market trend.

The increase is similar in all quartiles analysed, but there is a drastic drop in the minimum investment amount, which is reduced to an atypical level for this phase of evolution, not seen since 2016. In this regard, the 2021 data reflect the conclusions and reflections shared by investors in previous editions and in comments gathered informally, in which they point to the entry of new players in the angel investment tranche as the reasons for this overheating of the supply of capital. These are mainly venture funds, which are increasingly integrated in this stage of maturity of companies; new angel investors with available capital due to the scarcity of supply in the market, seeking to diversify their portfolios; family offices; and crowdequity platforms.

APPLY THIS TIP TO YOUR PROJECT

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "1" - Average " - Average5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP