WHAT RETURNS CAN BE EXPECTED FROM INVESTING IN STARTUPS?

Accelerate your business with these tips "What returns can you expect from investing in startups? Analyse and discover this TIP!

Although the upside potential of a well-designed portfolio of high-growth companies is very high, it is hardly predictable: investing in such companies basically implies that the return on our investment will go hand in hand with the success of the companies in which we invest. It is therefore extremely important, have access to the best investment opportunities (good deal flow (see+)) and, for that reason, it is very unpredictable to know what return we will get on our investment.

It is not possible to predict with certainty the returns that can be expected when investing in startups, as most startups are young and developing companies and therefore have a high risk of failure. In addition, profitability depends on many factors, such as sector, business strategy, management team, etc. However, when a start-up is successful, it can generate a very high return for its investors, including business angels. As these are companies with high growth potential, the successful ones are often able to multiply their value more than 10 times within 5 years, but only the successful ones. It is often said that out of every 10 investments made, only 1 or 2 will have the capacity to generate sufficient returns (not only to cover losses but to generate capital gains). This implies that the other 8 or 9 will not be able to deliver sufficient returns, so it is key to build a good portfolio. diversified (+).

Real returns obtained by business angels in Spain

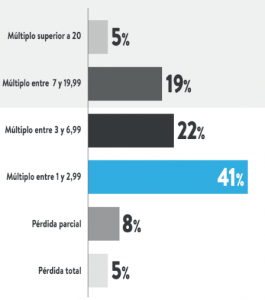

Business angels reporting divestments in Spain accounted for 66% of those surveyed during 2022. Of them, 41% achieved multiples between 1 and 3; 8% indicated a partial loss, while 5% suffered a total loss of the amount invested. (see figure 12). The most common positive return experienced by Spanish business angels in some of their divestments was a 1 to 2.99 times increase in invested capital.

41% of the respondents obtained this return on some of their divestments, with seed stage startups contributing the highest number of responses to the sample. Moving towards more attractive returns, 22% of investors achieved multiples of between 3 and 6.99, and almost one in five multiplied their investment by between 7 and 20. Divestments with multiples above 20 correspond to 5% of the investors in the sample, with these returns concentrated in the pre-seed and seed tranches. The fact that there was no response from divestments with multiples above 20 in the pre-series A tranche, shows that, returns are higher the higher the risk taken due to the lack of maturity of the start-ups.

Investors' expectations for the performance of their portfolio companies in 2022 are quite optimistic (see figure 13), with the highest median (38%) being high growth expectations, followed by low growth (30%). In addition, the median is high growth, followed by low growth (30%), It is worth noting that very few investors believe that 100% of their companies will have moderate or very high growth in 2022.

How does return on investment in startups come about?

Although usually the capital gains from investing in startups come from the sale of our shares to a third party and the exit from the company (exit; (ver+)), really, there are four possible scenarios:

- Dividend distribution. Although unusual, as most startups reinvest their dividends in growth, it is possible to get a return when the company we have invested in makes a profit.

- Purchase by other investors. One of the most common exit scenarios is when our stakes are acquired by later stage investors (such as venture capital funds) who come in for subsequent capital increases.

- Sale of the company. The target scenario for many investors is to wait for the possible sale of the company to a third party, be it an international competitor or a large company.

- IPO/MAB. Although this is not very common in Spain, it is one of the most interesting scenarios for an investor as it makes our holdings much more liquid.

A business angel recoups its investment in a start-up through an exit or exit (+). An exit can be a full or partial sale of the company to another company or investor, an initial public offering (IPO) or an acquisition. The return on the investment in a startup is through the appreciation in the value of the company and thus the increase in the value of the shares held by the business angel.

PAYBACK PERIOD FOR STARTUP INVESTMENT?

The payback period for a business angel's investment in a startup depends on several factors, such as the industry in which the startup operates, its speed of growth, its ability to generate revenue and its potential for success in the market. In general, investing in start-ups is a high-risk, high-reward investment and can take several years before a profitable exit occurs. Some business angels can recoup their investment within three to five years, while others may take much longer. It is important to note that, Investing in startups is a long-term investment that requires patience and a good risk assessment.

QUIZ

ARE YOU INTERESTED IN INVESTING AS A BUSINESS ANGEL? (see EBOOK)

Register for the Business Angels School mentorDay, where you will practice with all the tools and concepts to make money investing in startups.

ARE YOU A STARTUP LOOKING FOR PRIVATE FUNDING? (see+ EBOOK)

Sign up for the Acceleration Programme (+) mentorDay in order to gain access to a Business Angel by participating in the CoInvest.

I answered that they would have a return on investment of 10 times the amount invested because I went by the exceptions and not the rule, but on re-reading the statistics I understood that 41% achieved multiples of between 1 and 3; 8% indicated a partial loss, while 5% suffered a total loss of the amount invested.