AVERAGE TICKET PER INVESTOR IN A START-UP.

HOW MUCH MONEY DOES A BUSINESS ANGEL INVEST IN EACH STARTUP?

Accelerate your company with these expert tips on "Average ticket per investor in a startup". Analyse and discover this TIP!

The "average ticket per investor" is the average amount that each investor invests in a particular company or project. This value can vary widely among investors and depends on factors such as the investor's financial situation, the number of investments held, the investment strategy and the degree of confidence in the project or company in question. In general, business angels, usually invest a significant amount in each project, as they seek to deliver both financial and strategic value. However, the average ticket may vary from project to project and from investor to investor.

The amount of a business angel's investment in a startup can vary considerably, depending on many factors, such as the startup's stage of development, its size, its growth potential and its sector. In general, business angels can invest from a few thousand euros up to several million euros and can be involved in various types of investments. financing rounds (+) over time. It is important to note that business angels tend to invest in early-stage startups, when the company is still in the process of growth and its return potential is more uncertain. Therefore, their investment tends to be riskier than other forms of investment, but also with a significantly higher potential return. This is why, it is important that business angels diversify your portfolio (+) and do not invest all your money in a single start-up.

Average ticket in Spain

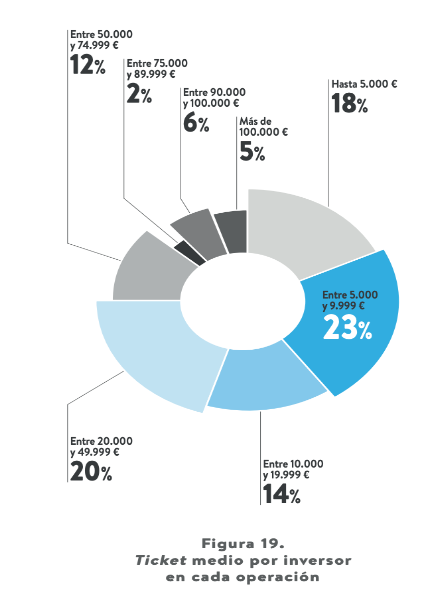

The average ticket invested per investor in each start-up in Spain is €8,600. The majority of angel investors (57%) make investments with ticket sizes of between €5,000 and €49,000 (see Figure 19).

This can be explained by the natural organisation of the market, the entry into the ecosystem of novice investors who are making their first operations with rather low tickets, the strengthening of co-investment activity (which also increases the dispersion in the amount contributed by each investor) and the strong emergence of more or less structured investment groups or clubs that are more resolutely seeking to diversify their portfolios. While this is positive for investors, it forces entrepreneurs to spend more time articulating transactions and ensuring that they are operational and efficient.

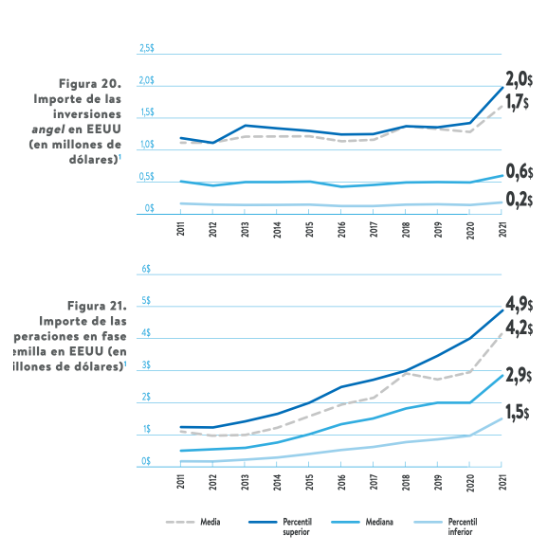

The least frequent amounts are in the range between 75,000 and 90,000 euros, as this is a high ticket range for angels and low for family offices and funds starting to operate in the seed stages of the value chain. As we have said, the size of the individual tickets of business angels means that the entry of funds into this segment is very positive for entrepreneurs, as it increases the size of operations. Even so, in Spain we are far from the magnitudes of the United States. During 2021 and 2022 the increase in the volume of investment, and also in valuations, which has also been accompanied by an increase in the size of investment rounds, giving greater potential and bandwidth to early-stage startups.

Average ticket in the United States

According to Pitchbook's analysis, the entry of venture capital funds has pushed business angels out of their comfort zone, traditionally with smaller rounds and smaller valuations. The average valuation of seed investments in the US grew by 34.3% (see Figure 20). In the US, the average size of an angel deal is $1.7 million, with a median of $600,000. The 25% of deals exceed $2 million. In the US seed segment, where angel investors are also involved, the size of deals has also increased significantly (see Figure 21).

APPLY THIS TIP TO YOUR PROJECT

QUIZ

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!.

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "8" - Average " - Average4.5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP

Very interesting, it helps to make investment decisions in start-ups.