BOOSTRAPPING

RESUMEN

Bootstrapping es una estrategia de financiamiento empresarial que se centra en utilizar los recursos internos y generar ingresos sin depender de financiación externa. Esta metodología permite a los emprendedores mantener control total sobre su negocio, minimizando la dilución de su participación. Incluye prácticas como la gestión eficiente del flujo de caja, la reducción de costos, y la maximización de los recursos tecnológicos y de networking. Aunque desafiante, el bootstrapping fomenta la creatividad, la autosuficiencia, y puede resultar en un crecimiento sostenible y controlado de la empresa.

Tabla de contenidos

BOOTSTRAPPING

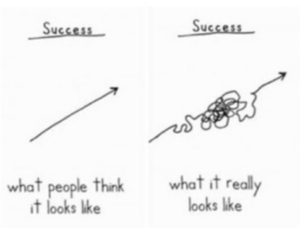

Bootstrapping is the the process of starting and growing a business with limited resources and without external financing, through the use of the company's internal resources. It is a popular strategy for entrepreneurs who want to maintain full control of their company and avoid dilution of their shareholding. Therefore, Bootstrapping is to self-finance your business with the proceeds from sales to your customers, i.e. to finance the activities of the company with what you invoice, rather than seeking external financing.

Bootstrapping is a term that refers to starting something with little or no resources. In business, therefore, it means to carry out an entrepreneurial activity with little or no capital, i.e. to start something with only the means at one's disposal (a garage, an old telephone, etc.). In practice, bootstrapping means doing more with less and maximising available resources.

Some forms of bootstrapping include

Enfoque en el flujo de caja

Carefully controlling expenses and ensuring that cash flow is positive at all times is fundamental to bootstrapping.

Minimizar el costo de los productos y servicios

Reducing the costs of the products and services offered by the company can help maximise profit margins.

Utilizar redes personales y profesionales

Connecting with other entrepreneurs, mentors and contacts can help to obtain valuable resources, such as advice, technical support or even funding.

Seek opportunities for collaboration:

Partnerships with other companies can provide access to new markets, resources and opportunities.

Making the most of technology:

Using technological tools to automate tasks and improve efficiency can save time and reduce costs.

Bootstrapping is not an easy strategy and may require additional effort and a creative approach to overcome challenges. However, it can be an effective way to start and grow a business with limited resources and can often lead to greater independence and control for the entrepreneur. In short, bootstrapping is a business start-up strategy that focuses on the utilisation of the company's internal resources and the maximisation of available resources. Although it is a challenging strategy, it can be effective for entrepreneurs seeking to maintain full control of their company and avoid dilution of their shareholding.

I propose a practical exercise for an entrepreneur to apply bootstrapping in the creation of his company:

Identifica tus necesidades

Make a list of all the needs your company has to start operating, such as: company registration, logo and website design, purchase of equipment, etc.

Prioriza tus necesidades

Once you have a list of all your business needs, identify those that are essential to start operating and those that can wait a little longer. Prioritise these needs so that you know what to focus on first.

Busca opciones de bajo costo

Investigate low-cost options to meet your business needs. You can consider free or low-cost options for things like website creation, software implementation, logo design, etc.

Reduce los gastos

Look for ways to reduce costs in all areas of your business. One option is to start working from home, rather than renting office space. You may also consider buying second-hand equipment or renting rather than buying.

Genera ingresos rápidamente

Identify ways to generate income quickly to fund your business. For example, you could sell products or services online or set up an affiliate programme.

Mide tus resultados

Measure the results of your bootstrapping efforts to see what worked and what did not. Use this information to adjust your strategy and improve in the future.

Remember that bootstrapping can be a great way to start your business without the need for large capital. Apply it in your business strategy to save on costs and maximise your profits!

ADVANTAGES OF BOOTSTRAPPING:

One of the biggest advantages of Bootstrapping is the risk, almost zero, as we don't owe anything to anyone and if we fail, we won't have lost too much, we can always try again.

ALTERNATIVA

It is an alternative to the difficulty of accessing external financing.

DEPENDENCIA FINANCIERA

As the project is self-financed, it will not be financially dependent on third parties, and the company's indebtedness will be minimal.

CULTURA DEL AHORRO

Encourage a savings culture.

CREATIVITY

It develops creativity, given that resources are limited and have to be made sufficient. forces entrepreneurs to be more creative and find innovative ways to solve problems with limited resources. This can help develop important business management skills, such as the ability to be agile and adapt quickly to changes in the market and customer needs. It can also foster a more efficient and results-focused working culture, as every resource and expense is carefully analysed and evaluated.

MÁS CONFIANZA, MÁS OPORTUNIDADES

Bootstrapping can help entrepreneurs establish trusting and collaborative relationships with other entrepreneurs and companies in the same sector, which can open up new business and collaboration opportunities in the future.

MAYOR CONTROL

Bootstrapping allows entrepreneurs to have more control over their business and make long-term strategic decisions without pressure from external investors. Moreover, by not having to distribute profits or pay interest on loans, entrepreneurs can reinvest more in their business and accelerate its growth. It can also increase the trust and credibility of customers and suppliers, as it demonstrates that the company is able to generate its own resources and stay afloat without external help.

BOOTSTRAPPING DRAWBACKS

Bootstrapping presents several challenges:

Limitaciones de Crecimiento por Autofinanciación

Lack of funding may limit the growth of the project due to lack of investment.

Aceleración de la Generación de Ingresos

It reduces maturity time in the creation and management of projects, as they need to generate revenue quickly.

Restricciones en Operaciones Comerciales

Difficulty in accessing certain commercial operations that require a financial margin. The difficulty that may arise in accessing certain operations without a financial cushion.

Vulnerabilidad ante Fluctuaciones de Mercado

It makes the project or company more permeable to market and economic fluctuations.

Riesgo Personal en la Inversión

Bootstrapping can also present a higher risk at a personal level, as entrepreneurs may be investing their own savings or even mortgaging their personal property to finance their business (which should always be avoided).

Desafíos en la Atracción de Talento

It can also be more difficult for entrepreneurs to attract talent and build a strong team without being able to offer competitive salaries or social benefits.

Impacto en Investigación y Desarrollo

Another potential disadvantage is that the focus on short-term revenue generation may lead to a lack of investment in research and development or long-term marketing, which may limit the company's growth potential in the future.

Presión por el Éxito sin Red de Seguridad Financiera

Finally, entrepreneurs who rely solely on bootstrapping may feel more pressure to succeed, as they do not have the security of an external investor who can provide a financial safety net.

EXISTEN MÁS CAMINOS QUE LA FINANCIACIÓN

Although it is a slow way to get started, it may be the only way for many entrepreneurs. Of particular note, that if successful, it can provide a priceless experience, of great value that will often have an impact on the services, products offered and work capacity. There are many entrepreneurs who are obsessed with starting out by "raising" investment from the public. business angels and funds, something to which they dedicate themselves body and soul as if it were their only option... to the point of losing sight of the most important thing in their business: the customers. The usual justification for this attitude is very sensible: if we don't get enough money we won't be able to continue, since the cash we have now is only enough to last us until X months from now.

PÉRDIDA DE FOCO

That pushes them to become obsessed with getting good traction metrics for an investor... and of course, as they don't have enough customers yet, they focus on the wrong metrics that they think will attract an investor: visits, media mentions, Facebook followers... etc. Or even worse, they focus on accumulating a lot of "free" users by giving away the service instead of trying to charge as soon as possible... in order to have what they call "critical mass" (which is really only applicable in a few business models).

BONITO ENVOLTORIO

All of this means that the project, little by little and inadvertently, stops focusing on generating value for the client and focuses on creating a "pretty wrapper" for an investor... which implies superfluous marketing expenses, wasting efforts on generating "buzz" long before it makes sense (remember that the product has to be launched twice on the market), and above all, a tremendous loss of focus for the company and an absolutely wrong mentality.

NO PERDER DE VISTA A LOS CLIEENTES

A company's goal is not to convince investors how great its company is, but to persuade customers how great its product is.

This, from my point of view, is a stage that every founder should burn into his or her heart. Because it is very easy, as you read this, to say that yes, it is common sense and blah blah blah..., but the reality is that when you are in the arena, it is easy to fall into the siren songs of "raise money to go faster and be bigger" (something that makes sense only in markets where there is already a leader, although not very clear, and where with a large investment it is feasible to position yourself).

But there is one rule we must not forget:

A startup with a mediocre product and hardly any customers but which has raised money is a startup that has a very expensive death certificate.

THE 11 PRINCIPLES OF BOOTSTRAPPING ACCORDING TO GUY KAWASAKI

Guy Kawasaki, a well-known investor and entrepreneur, has proposed 11 principles for Bootstrapping, which are as follows:

- Do-it-yourself attitude: This principle implies a willingness to do everything oneself as far as possible, from product design to website construction.

- Keep your costs down: The aim is to minimise expenses and reduce costs. This can be achieved by working in a low-cost location, making use of free software, using low-cost marketing tools, among others.

- Cash is king: This principle means that cash flow is the backbone of any business. It is necessary to keep track of expenses and to know where the money is being spent.

- Learn how to sell: Learning how to sell is crucial for any business. It is important to have a complete understanding of your market, your customers and how to sell your product or service to them.

- Keep your day's work: This principle involves maintaining a full-time job while working in the new enterprise. This will provide a steady stream of income and reduce financial risk.

- Focus on money: Attention should be paid to key financial indicators such as revenues, costs and profits, and these indicators should be constantly monitored.

- Avoid indebtedness: It is important to avoid indebtedness and seek other forms of financing, such as equity or capital from friends and family.

- Don't reinvent the wheel: Instead of creating something completely new, you can use an existing idea and improve it. This will reduce the risk and increase the chances of success.

- Harness the power of the community: Communities can provide support, feedback and advice. It is important to build and participate in communities that are relevant to the business.

- Be creative: Creativity is fundamental to the success of bootstrapping. You have to look for new ways of doing things and think outside the box.

- Keep things in perspective: Maintaining a realistic perspective is important. It is necessary to have a clear understanding of resources, competition and the market in general.

These principles are based on the idea that successful bootstrapping depends on the company's ability to generate revenue and control costs, while making maximum use of available resources and being able to adapt to market changes. The idea is that, by following these principles, a successful business can be built without having to rely on external investors or large bank loans.

There are several success stories of companies that applied Bootstrapping, here are some of them:

MailChimp:

The email marketing platform MailChimp started as a side project of its founders, who worked at a digital marketing agency. Instead of seeking outside investors, they used their own resources to develop the platform, and focused on organic growth through word of mouth and content marketing. Today, MailChimp is one of the leading platforms in its sector, with more than 18 million customers worldwide.

Shutterstock:

The popular stock image platform Shutterstock started as a small startup in 2003, founded by a photographer and a graphic designer. Instead of seeking external funding, they used their own resources to develop the platform and focused on organic growth. In 2006, the company reached profitability, and in 2012 it went public at a valuation of more than $2 billion.

Hootsuite:

The social media management platform Hootsuite started as a side project of its founder, who worked as a social media consultant. Instead of seeking outside investors, he used his own resources to develop the platform and focused on organic growth. Today, Hootsuite has more than 18 million users worldwide and has been valued at more than $1 billion.

Basecamp:

The Basecamp project management platform started as an internal tool for the web design agency 37signals. Instead of seeking external funding, they used their own resources to develop the platform and focused on organic growth. Today, Basecamp is one of the leading platforms in its sector, with more than 3 million users worldwide.

GitHub:

The software development platform GitHub started as a side project of its founders, who worked at a gaming startup. Instead of seeking outside investors, they used their own resources to develop the platform and focused on organic growth. In 2018, the company was acquired by Microsoft for $7.5 billion.

These are just a few examples of successful companies that applied bootstrapping to finance their growth and development.

Practical examples of where bootstrapping can be applied by an entrepreneur building his or her company

An entrepreneur can apply Bootstrapping in different areas of his company, for example:

- Product development: Instead of spending large amounts of money on product development, the entrepreneur can use open source tools or free software to build prototypes and do proof-of-concepts.

- Marketing: the entrepreneur can take advantage of social media and content marketing to raise awareness of their product or service instead of spending large sums of money on advertising.

- Working premises: instead of renting an expensive office, the entrepreneur can work from home or from a shared workspace to reduce costs.

- Recruitment of staff: the entrepreneur can hire freelancers instead of full-time employees to reduce payroll and benefit costs.

- Finance: the entrepreneur can effectively manage their finances and track income and expenses to make informed financial decisions and maximise available cash.

These are just a few examples of how an entrepreneur can apply Bootstrapping in different areas of their business to reduce costs and maximise available resources.

HOW TO APPLY BOOTSTRAPPING IN YOUR COMPANY?

In times of crisis and uncertainty, starting and scaling up a business is more difficult than usual. However, it is not impossible. In this sense, techniques such as bootstrapping make it possible to set up a business with very limited resources, prioritising the areas of the company that are most important when starting up. The advantages of this technique are shown in examples of companies that have achieved outstanding success starting with minimal investment. This is the case of Amazon, Airbnb or Cabify. For example, the absence of resources constantly encourages the creativity of the entrepreneur, who must find new ways to be productive with such limited resources.

Moreover, not involving third parties as investors significantly increases the project's independence and reduces its indebtedness. On the other hand, bootstrapping can become part of the company's internal culture, even when it has become a successful model, optimising resources at all stages.

-

Rapid cash flow.

This is one of the keys to success by applying bootstrapping in your company, as defined by the expert Guy Kawasaki. Shortening the time it takes from when the customer receives the product or service until it is paid for will allow you to make payments without needing a line of credit or other types of financing.

"For a bootstrapper, cash is not only king, it's queen and prince too," Kawasaki reflects.

-

Refine it after launching the product.

Another feature of bootstrapping also has to do with shortening deadlines, this time on the product itself. You should launch as soon as you consider that you can fulfil its function, although there may still be some aspects to improve. In this sense, it will be the customer's own feedback that will define the shortcomings of the product and the most urgent improvements. Human resources in the background. Bootstrapping puts human resources management to one side in favour of the product itself. With such limited resources within the company, it is necessary to prioritise other more urgent areas. On this issue, Kawasaki recommends relying on freelancers to scale the project, and only consider hiring your own staff when the business starts to grow in a proven way.

-

Cut out the middlemen.

Intermediaries tend to waste time, money and a much-needed direct relationship with the end customer in bootsrapping. For this reason, it is recommended to eliminate them completely, something relatively simple in digital businesses. In addition, soliciting customer feedback and rewarding customer loyalty is a must for building a business with minimal resources. Listen to this podcast case study of an entrepreneur (see+). In this article you have more ideas on how to apply it in your company.

I know that there are many businesses, especially those of a disruptive nature or those with large capital requirements, that cannot follow these rules and that do or do not need investment (and quite a lot of it) from the start... but unfortunately the journey is complicated, because there are very few investors willing to invest their capital without proof of the "real" viability of the business (risk capital?).

This is consequence of a "blunderbuss" investment strategyThe EU is suffering from an oversupply of "investable" projects on the market and an increasingly low risk tolerance (which is understandable). This is a topic that we will discuss in the future...

How much money does my business need to get started?

The more funding I need, the more risk I take.

How can I reduce/mitigating riskWhat needs to be financed?

Investment and anything you overspend during the months where it does not cover fixed costs (increased working capital).

How to reduce the NF. Advance collections and delay payments but go beyond the critical month.

Entrepreneur's salary, the vital minimum to have all basic needs well covered.... profit-sharing.

Entrepreneur's salary?

At the beginning the vital minimum to survive, bearing in mind that the more I put in the more funding I will have to get.... I can accrue it, write it down in the accounts, but not pay it until after the critical month.

Articles that investors are looking for

Article 1

Article 2

APPLY THIS TIP TO YOUR PROJECT

TASK

NOW THAT YOU HAVE READ THIS TIP, ANSWER THE QUESTIONS:

- How can you finance yourself just by collecting from your customers?

- How can you reduce your financing needs to reduce your dependence on banks, investment partners?

- How are you going to advance payments to customers?

- How are you going to delay payments of expenses and investments?

QUIZZES

- 💻 PRACTICE with an expert in the next practical webinar.

- 🔎 CONSULT more related TIPs with this same theme.

- 📖 AMPLIA your knowledge by downloading this EBOOK y this EBOOK.

THINK ABOUT YOU

- 🚀 IMPULSA your company in the next acceleration programme, ¡book your place now!

- 🥁 PRACTICE with your project in this practical webinar, ¡apply for your place!

- 🌐 CONTACT with other entrepreneurs and companies, ¡register and take part in the next Networking!

THINK ABOUT HELPING OTHERS

- 🤝COLLABORATE as a volunteer: expert, mentor, inverter, awarding, Spreading the word, challenging, innovating, creating a TIP...

- 💬 RECOMMENDS this programme to reach out to more entrepreneurs by Google.

- 👉 SHARE your learning!

- 📲 SEND this TIP 👇

Rate this TIP!

Click on the stars to rate

Rating "57" - Average " - Average4.5"

No votes yet, be the first to vote!

We are sorry you did not find it useful.

Help us improve this TIP!

Leave us a comment and tell us how you would improve this TIP

A company's goal is not to convince investors how great its company is, but to persuade customers how great its product is.

Bringing investment risk close to zero is a very powerful reason to try it.