El método de valoración de empresas es un proceso que se utiliza para determinar el valor económico actual o futuro de una empresa. Hay varios métodos de valoración, cada uno con sus propios supuestos y limitaciones. Es importante tener en cuenta que la valoración de una empresa es una estimación y no una cifra exacta.

En el caso de empresas con métricas, maduras en funcionamiento los métodos más comunes son

- Método del flujo de caja descontado: calcula el valor actual de los flujos de caja futuros que se esperan de la empresa, descontados a una tasa de descuento.

- Método del múltiplo de mercado: utiliza el precio de mercado de la acción de una empresa similar para determinar su valor.

- Método del valor contable: se basa en el valor en libros de la empresa, incluyendo activos tangibles e intangibles.

- Método de la relación precio/beneficio: compara la tasa de crecimiento de los ingresos y ganancias con la tasa de crecimiento de la industria.

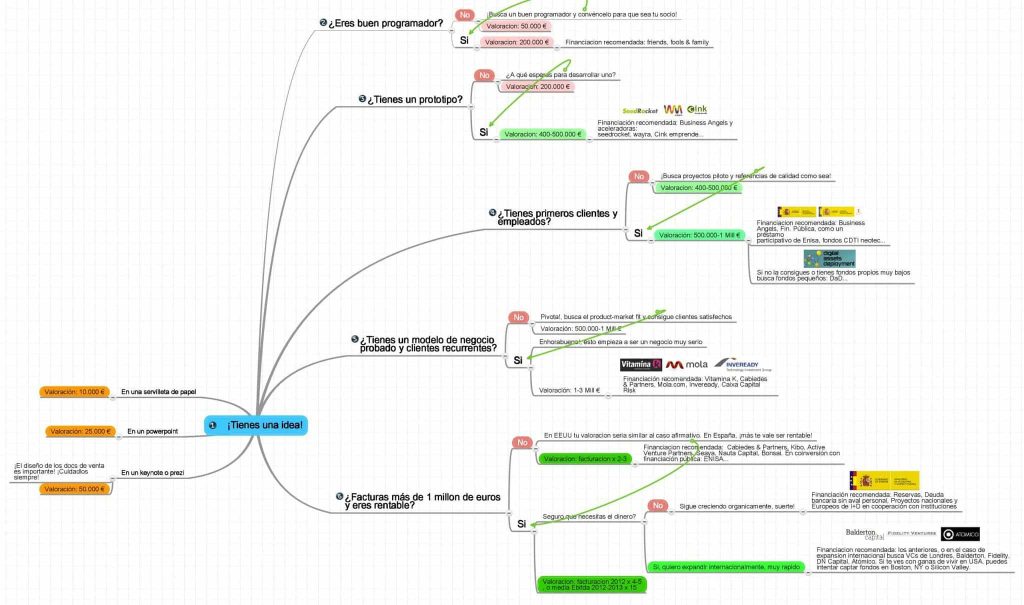

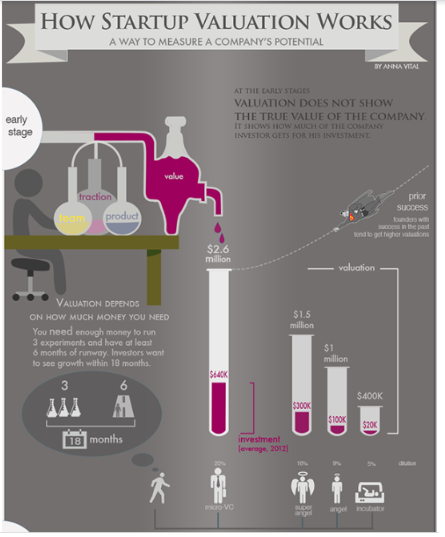

El método de valoración que se utilice depende de la información disponible, la industria y el objetivo de la valoración. Es bastante más fácil y existen muchos referentes para valorar startups en fases posteriores cuando ya están creciendo, facturan…etc. Pero; ¿Y en fase seed/semilla? ¿Cómo valoras una compañía mediante un análisis financiero que no factura o si lo hace no es con grandes cifras, que no tiene un producto maduro y empieza a recorrer la senda del crecimiento pero todavía no tiene métricas consolidadas? Muchos opinan que una startup en fase semilla vale 0 ya que aún no ha probado su valor en el mercado… mientras que otros opinan que vale muchísimo dado su potencial. Y, realmente, ambas visiones son correctas… ¡¡pero con matizaciones!! Una idea vale cero (ver+). La realidad al final es que normalmente las startups están infravaloradas (no es muy habitual) o super-valoradas (más habitual)… pero que cualquier aproximación está matizada por una cosa: la absoluta incertidumbre del negocio

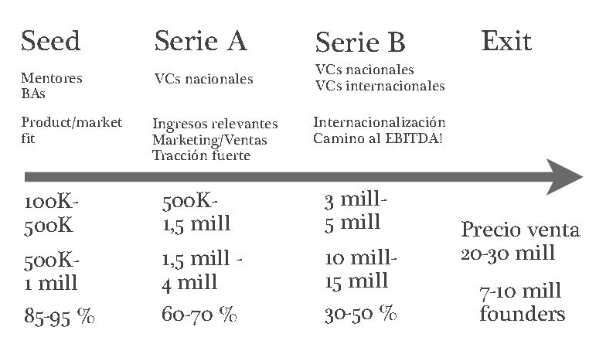

Método de valoración de startups por dilución

La valoración por dilución es el método que recomendamos para establecer un valor aproximado de una startups en fase semilla. Se trata de analizar cuánto dinero necesito para llevar mi compañía a la “siguiente fase», y confrontar esta cifra con la dilución (+) máxima que estoy dispuesto a asumir (se recomienda habitualmente que por ronda nunca sea mayor de 10-20%). Al final se trata de comprender qué valor aparca mi proyecto en los 4 principales ejes que utiliza un inversor para valorar una startups invertible (ver+) e intentar encontrar la cifra que mejor lo representa dentro de ese rango.

¿CUÁNTO VALE MI TARTUP EN FASE SEED?

Básicamente, sugiero que para valorar el proyecto se empiece al revés, por el tejado y entonces la pregunta no es cuánto vale mi proyecto, si no; ¿Cuánto dinero necesito para llevar a mi proyecto a su siguiente fase significativa de desarrollo?

¿Y QUÉ SIGNIFICA LA SIGUIENTE FASE?

Pues depende de cada proyecto, puede ser pasar de no tener ingresos a encontrar algún modelo de negocio inicial que produzca los primeros clientes recurrentes, puede ser dar el siguiente empujón al prototipo para poder lanzar una beta decente… Pero ojo, añado, de forma significativa, porque no basta con que avancemos un poco, tiene que notarse una fuerte evolución en los 6 meses siguientes. De modo que se haya creado valor en el proyecto y que sea posible justificar una nueva valoración, que permita conseguir el dinero suficiente para alcanzar el siguiente hito, sin que la dilución de los fundadores sea excesiva. Es un salto que se repite ronda a ronda, hasta el exit final (+), y que se debe gestionar con cuidado y cabeza desde el principio. Por desgracia, muchos fundadores no piensan en estas cosas y se van diluyendo excesivamente en fases iniciales, o por el contrario hacen una ronda a una valoración tan alta que no les será posible hacer que el valor aumente lo suficiente en la ronda siguiente. Equilibrios…

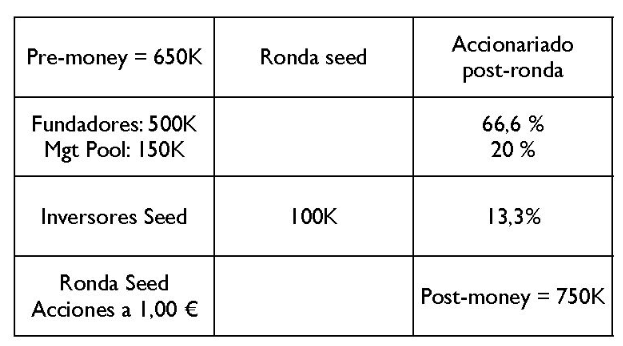

Así que, volviendo al principio, una vez definido lo que queremos conseguir y calculado el dinero que necesitamos para ello, ¡voilá!, tenemos la valoración pre-money. Porque la dilución en esta fase debe estar dentro de un margen razonable, aproximadamente entre el 10-20 % para los fundadores. Es decir, considerando este rango de diluciones, si necesitamos 100K (cantidad que me parece coherente para esta fase pre-seed) la valoración post-money será de un rango de 500K a 1 millón. Y la pre-money en el rango (400K-900K).

¿Qué el rango es demasiado amplio?, bueno, al menos ya sabemos de qué estamos hablando. Dentro de ese rango, el emprendedor deberá plantearse cuáles son los fundamentos reales de su proyecto a día de hoy, no los futuros.

EN LOS SIGUIENTES PUNTOS CLAVE:

- Equipo: cómo de consolidado está, qué experiencia previa tiene. Cuál es el riesgo de que se rompa o no pueda enfrentarse a los cambios y retos que vendrán.

- Modelo de negocio: sigue estando totalmente en el aire, o ya tiene clientes y un plan de desarrollo, comercial y marketing que encaja.

- Tecnología: el prototipo hace aguas o es robusto y tiene ya una gran inversión previa en tiempo y esfuerzo o es un código espagueti para salir del paso.

Oportunidad de mercado: cómo de obvia y sostenible es la ventaja competitiva y cómo de caliente está el mercado.

Si todo pinta bien, estarás en la parte alta del rango, 1 mill (o incluso algo más, ¿por qué no?, ya se ven pre-moneys seed de 1,5 a 2 millones en España, pero no muchos consiguen inversión), si en cambio tienes lagunas que resolver en todos los apartados estarás en la parte baja (o incluso menos) y, dios no lo quiera, podrías llegar a no ser siquiera invertible. Así que tus discusiones con los inversores de esta fase no se van a centrar en múltiplos comparables o en modelos Excel con estimaciones a 5 años, etc. Si no en fijar la necesidad concreta de financiación y después en convencerles de que te puedes mover en el rango más alto de lo razonable porque tu riesgo percibido es menor. Nadie espera que tengas todo resuelto, pero al menos que tengas sentido común, un plan, iniciativa y expertise en tu sector.

Por eso, es tan importante, contar con algún mentor o inversor inicial que te ayude a detectar tus deficiencias antes de presentarlas al mundo y que por otro lado, elimine parte del riesgo inherente a ser el primero en apostar por ti. Si todo esto no os ha servido, y queréis una aproximación más ingenieril, en formato de árbol de decisión, aquí tienes la infografía de cuánto vale tu startup seed en España, actualizado:

P.s.- Este sistema funciona sobre todo para fase seed, a partir de las rondas A, hay más información sobre la ejecución y métricas de la startup para poder predecir los flujos de caja futuros, y también pueden entrar en juego múltiplos comparables. Pero en general, el ejercicio de empezar la valoración atendiendo a las necesidades financieras reales primero, no se debe dejar de lado nunca.

Reflexiones para un business angel sobre la valoración

Sobre el asunto de la valoración de una startup hay muchas teorías, pero con independencia de todas ellas, realmente la valoración no importa demasiado, porque, al fin y al cabo, qué más da entrar a 1 millón que a 1,3 millones. Si vas a meter como business angel, por ejemplo, un 10 por ciento, tu inversión será de entre 100.000 y 130.000. Esa horquilla no es lo que va a definir la rentabilidad. Lo que importa realmente a un inversor es ver que en ese proyecto puede multiplicar por diez o por más. En cambio, los emprendedores sí le dan mucha importancia, demasiada, a la valoración de su startup, porque consideran que es una especie de nota que le han puesto en el examen de la que pueden presumir en bares y blogs. Por fin alguien les refrendó que su idea es valiosa y, por fin, pueden contarlo a los demás.

Es como si ya hubiera conseguido el éxito. Lo piensa el emprendedor, y muy posiblemente también su cuñado y sus suegros, y esto, cuando se lleva mucho tiempo vendiendo humo, importa y mucho, aunque sólo sea para recuperar la autoestima. Pero para un inversor la valoración es casi irrelevante. Al menos no es el factor determinante a la hora de entrar o no en una inversión. Lo habitual es que un business angel se mueva en la horquilla de inversiones entre 100.000 y 200.000 euros, que vienen a representar entre un 10 y un 20 por ciento de participación, así que, hablando en términos relativos, que la valoración suba o baje un poco es casi irrelevante respecto al monto final invertido y, sobre todo, respecto a lo que de verdad le interesa a un inversor, que es el retorno final de su inversión.

Si una compañía se vende por 80 millones, como Trovit; ¿Qué más da haber entrado a un millón que a dos? Tu 10 por ciento vale ahora ocho millones. ¿Quién se acuerda de si te costó 100 o 130? El verdadero objetivo de una valoración, a ojos del inversor, es pues visualizar de algún modo la empresa que se piensa que acabará siendo al cabo de unos cinco años, horizonte habitual de una inversión de business angel. ¿De qué facturación podemos estar hablando dentro de cinco años? Esto sí permite estimar qué tipo de rentabilidad y qué operación de salida cabe esperar. En la práctica, este proceso de valoración, se suele hacer a la inversa. El inversor le suele preguntar al emprendedor: para lograr ese objetivo de, pongamos, 20 millones a cinco años, ¿qué inversión necesitas ahora? Pongamos que el emprendedor dice que 300.000 euros. Bien, pues como el inversor necesita poder multiplicar por diez lo que va a dar ahora, querrá recibir en el momento de la salida, dentro de cinco años, unos 3 millones, y como se supone que entonces la empresa valdrá 20, para sacar esos tres a los que aspira, debe tener un 6 por ciento de la sociedad. Así que ya está la valoración. El inversor dará 300.000 a cambio de un 15 por ciento de la compañía.

Este sencillo cálculo se complica si entre ahora y el momento de la salida van a ser necesarias nuevas ampliaciones de capital (+) y va a haber diluciones (+), pero el concepto es siempre el mismo:

- ¿Qué empresa vamos a tener dentro de cinco años?

- ¿Cuánto dinero necesitas del inversor para ello?

- ¿Qué rentabilidad exige el inversor a su dinero?

Con todo ello, se obtiene un tanto por ciento de participación en la compañía, que se le tendrá que dar ahora. Y ésa es la valoración. Ésta es la esencia de lo que los inversores llaman venture capital method, método de valoración de empresas que solemos utilizar mayoritariamente los business angels y el venture capital. Pero quitemos dramatismo, si en este cálculo de la valoración y, por tanto, en esta discusión de la participación del inversor no se llega a un acuerdo con los emprendedores, para el inversor no pasa realmente nada.

“es mejor tener un amigo que no sea socio, que un socio que no sea amigo”.

Porque, además, esto va a ser una relación a largo plazo y conviene que sea de total mutuo acuerdo, cada uno velando por sus particulares intereses.

¿CUÁNTA APRTICIPACIÓN DESEA UN BUSINESS ANGEL?

Los business angel, sea cual sea la cuantía a aportar, siempre toman participaciones minoritarias. Es un gran error los inversores que quieren llevar la empresa, que anhelan ser empresarios y controlar las compañías participadas. Es mejor que el equipo fundador mantenga el control más o menos de un 60 por ciento de las acciones y, que el otro 40 por ciento, se reparte a partes iguales entre dos inversores, porque al verdadero business angel no le gusta invertir en solitario, fundamentalmente, para eludir esa situación incómoda en que parece que los emprendedores se sitúan de un lado, en un bando, y, de otro, enfrente, en el bando adversario, el inversor.

Como sabemos todos, las mesas son mucho más estables con tres patas que con dos.

Muchos inversores se mueven alrededor del 10 al 20 por ciento de participación para una inversión de entre 100.000 y 200.000 euros que, completada con otra idéntica del coinversor, totalice esos 300.000 o 400.000 euros que, de media, creo que son suficientes hoy para poner en marcha un negocio digital. Así que suelo quedarme con no menos de un 10 por ciento de participación, para conseguir que me escuchen en los consejos, pero nunca con más de un 20 por ciento, para que, si las cosas no van bien, el que no duerma sea el emprendedor. El problema es suyo y la empresa es suya. A mí me parece un acuerdo justo.

“…En mi propio business plan me fijo como objetivo que en cada año de los cuatro en que divido la vida útil de cada fondo, he de hacer diez inversiones de 200.000 euros, es decir, 40 inversiones. De ellas, sé que el 80 por ciento va a desaparecer o me voy a olvidar de ellas, y que al 20 por ciento restante —o sea, ocho empresas — le voy a meter de media otro millón de euros más. Ésa es mi estrategia de inversión. Clara y sencilla, con pocas excepciones…”.

Es habitual, además, hacer rondas de seguimiento en las empresas que funcionan muy bien, meto aproximadamente hasta dos o tres millones de euros. Eso en cuanto a la inversión y a mis criterios de actuación como business angel.

ALGUNOS CONSEJOS PARA VALORAR LAS STARTUPS:

Es importante transmitirte algunas reflexiones sobre el tema de la valoración, porque a menudo no sólo nos equivocamos en la valoración sino lo hacemos por los motivos equivocados.

- Separa la valoración de tu ego: desgraciadamente más a menudo de lo que nos atrevemos a decir el terna de la valoración lo asumimos como un medidor de nuestro éxito. Como una cuestión de tamaño… cuando es un instrumento de nuestra empresa, nada más y nada menos. Y, por tanto, dedicamos meses a buscar una valoración que pensemos que nos refleja a nosotros y no a nuestra empresa (que es diferente). Así que recuerda que tu trabajo no es buscar inversores, sino clientes.

- Tamaños de rondas: al principio es mala idea hacer rondas faraónicas enormes que requieren muchos meses cerrar ¿Por qué no partir la ronda en «fases»? Aunque depende mucho del sector, en mi opinión deberías buscar dinero suficiente para aguantar 6-8 meses y dar el salto al siguiente nivel… y con esas métricas buscar la siguiente ronda y mi consejo es que siempre pidas algo más de lo que crees que vas a necesitar, dado que normalmente los gastos siempre son superiores de lo esperado, y los ingresos inferiores. ¿Cuánto? Pues quizás un 20-30% más, pero es más una apreciación personal basada en mi experiencia que una cifra sacada con un método científico.

- El perfil del inversor también determina la valoración… y el valor: normalmente, cuanto más experimentado es el inversor con el que vayas a hablar, más se acabará ajustando la valoración… lo que implica que te diluirás más. Eso es negativo, sin duda, pero hay que confrontarlo con otro factor: el valor que te puede dar un inversor experimentado es varias órdenes de magnitud mayor que el que aporta un socio sólo financiero. Así que sopesa ambas aproximaciones con todos los datos en la mano

- Cuantos más tangibles, mejor: mi consejo es que intentes retrasar al máximo esa primera ronda para darte espacio para generar una tracción suficiente que respalde tu valoración, y que ofrezca la confianza necesaria a los inversores. Ya nadie invierte en powerpoints sino en las métricas correctas, y por este orden: ingresos -> usuarios -> sociales (concursos, medios…)

- Valor y valoración, primos hermanos: la clave es comprender que la valoración de tu startup tiene que estar «pareja» al valor que se crea en el proyecto… y entre ronda y ronda se deben justificar saltos claros y cuantitativos de valor. Míralo desde el punto de vista del inversor: si invierte en tu startup es porque espera multiplicar su inversión (entre otras cosas)… y el primer requisito para ello es que tu seas capaz de multiplicar el valor de la compañía. Si entre una ronda y otra no hay un salto cualitativo importante, los nuevos inversores seguramente dudarán de tu habilidad para crear ese valor

- El impacto de una valoración alta: una valoración alta puede comprometer el futuro de tu proyecto, aunque ahora estés muy feliz porque has conseguido convencer a 10 inversores para que aporten 200K a una valoración de 2M estando en fase semilla, lo más probable, es que acabes de poner el primer clavo de tu ataúd, tal como se comenta en el punto anterior, tendrás que dar un salto cualitativo importante para conseguir la siguiente ronda… y ¿de verdad crees que serás capaz de justificar que tu empresa vale 4 o 5M en 6 meses un año? El camino está lleno de startups que han muerto por esto. ¿Cuántas rondas? Se suele decir que el número ideal de rondas es igual o inferior a cero… porque unirse nace que pierdas poco a poco el control de tu compañía, y que tengas que tratar con más gente, lo que aumenta la complejidad de gestión. Pero también es cierto que, tener a bordo a gente experimentada en tu empresa, es absolutamente clave para ir más rápido y mejor. Además, si estás orientado al exit tener a inversores experimentados es habitualmente la diferencia entre el casi» y lograrlo (pero claro, depende mucho de lo que sea para ti el éxito)

Y RECUERDA, ES CLAVE COMPRENDER QUE:

“En fases iniciales, la valoración no es una función del valor real de la compañía sino del potencial que tiene y, sobre todo, del porcentaje que se cede a los inversores”

DIFERENTES TÉCNICAS PARA VALORAR STARTUPS

Una de las cosas que más de cráneo traen a la gente del mundo tradicional es que piensan que las valoraciones de las startups son disparatadas y a veces lo son…) pero el problema en su forma de enfocarlo es que no puedes valorar igual una compañía con años de historial con un crecimiento estable (más o menos) que una empresa que crece de forma exponencial. En este sentido te puedes imaginar las técnicas tradicionales del mundo del M&A (mergers and acquisitions) no tienen sentido: ¿Cómo vas a aplicar descuentos de flujo de caja o múltiplos de EBITDA sobre una empresa que apenas factura y que crece un 20% mensual?… ¿Va a seguir creciendo así? ¿Cuánto va a facturar? ¿Cuál es su potencial?

POR ESO TE CUENTO ALGUNAS DE LAS TÉCNICAS MÁS USADAS PARA VALORAR UNA STARTUP:

Existen diferentes métodos de valoración de una startup, dependiendo de su fase de desarrollo, la industria en la que opera, entre otros factores. Algunos de los métodos más comunes son:

MÉTODO DE COMPARABLES O POR SEMEJANZAS:

Se compara la startup con otras compañías similares que hayan sido adquiridas o hayan realizado una salida exitosa. Se trata a arar a una cifra de valoración buscando compañías con un perfil similar al tuyo (por sector y rapidez, por ejemplo), y tras hacer ese análisis llegar a una horquilla de valoración basada en el precio pagado en operaciones anteriores por startups parecidas… y, sobre esos números, decidir en qué punto nos situamos, utilizando para matizado lo comentado anteriormente (equipo —> modelo de negocio —> producto/tecnología —> mercado). Eso si, seamos sensatos y comparemos peras con peras: no tiene ningún sentido comparar tu empresa con la primera ronda que realizó en Tel Aviv o Silicon Valley el líder del sector.

Mi consejo es que acudas a Startupxplore y te dediques a buscar startups de tu sector y trabajes como punto de partida con sus valoraciones. También puede ser buena idea que hables con gente del entorno que tenga experiencia en el sector (las aceleradoras de startups aquí pueden ayudar muchísimo), y les preguntes qué valoración opinan que es correcta para tu startup… pero ojo, que conozcan el proyecto.

MÉTODO DE FLUJOS DE CAJA DESCONTADOS:

Se proyectan los flujos de caja futuros de la startup y se descuentan a una tasa de interés para determinar su valor actual.

SOBRE BUSINESS PLAN

En mi opinión una pésima aproximación… porque normalmente los business plan no se cumplen. Se trata de descontar como ciertas tus previsiones de ventas y gastos sobre el plan de negocio, y creerte que dentro de 2 años estarás facturando esos 4M€… algo con lo que soy MUY escéptico. Aunque sin duda es algo que se hace en otros hubs de emprendimiento, en realidad no es tan habitual y sólo sucede con compañías que han demostrado un rendimiento tremendo (como Slack y er Vico!, Valley)

MÉTODO DE MULTIPLICADORES DE MERCADO:

Se utiliza un multiplicador de mercado específico para la industria en la que opera la startup para estimar su valor.

POR UN RATE

Cuando ya estamos facturando es todo mucho más fácil, porque podemos hacer una aproximación más financiera a la valoración, aunque sinceramente creo que es complejo este enfoque porque si hay algo seguro en el ciclo de vida de la startup es la incertidumbre, y el hecho de que este mes hayas facturado 10.000€ no quiere decir que vayas a facturados el que viene. En cualquier caso, la idea es identificar el run rate, que es el rendimiento financiero de tu empresa previsto en un periodo de tiempo (por ejemplo 1 año) y eso multiplicarlo por un factor que matice la oportunidad (habitualmente 8>). Como en este ejemplo, si tenemos un rendimiento (no facturación) de 15.000€ al mes (poco habitual en startups seed), podríamos extrapolar un rendimiento de 1 año de 180.000€ (=15.000€ x 12). Sobre esta cifra aplicaríamos un multiplicador 8, tendríamos una valoración de 1,440M€

MÉTODO DE LA RONDA DE FINANCIACIÓN:

El valor de la startup se basa en la cantidad de capital que recibe en una ronda de financiación.

POR INVERSIÓN PROPIA

Una técnica de valoración que estaba de moda hace unos años para startups en fases MUY iniciales, pero que ya no se usa demasiado, básicamente porque al final es una forma de hacer ingeniería inversa hasta llegar a la valoración que quieres. Se trata de calcular lo invertido en el proyecto, a precio de mercado, y luego meterle un factor de corrección que matice la oportunidad.

Por ejemplo, si has invertido un año en tu startup (1.800 horas, a un precio de mercado de 40€/h), has gastado 10.000€ en diversos proveedores y además has comprado equipamiento por valor de 3.000€… se podría argumentar que lo que te has gastado (13.000€) + tu coste de oportunidad (1.800 horas x 40€/hora=72.000€, o lo que habrías ganado si no estuvieras haciendo esto) serían 85.000€. Si usamos un factor de corrección de 1,5 que indica que la oportunidad es interesante, podríamos partir de una valoración de 127 500€.

MERCADO:

Seguramente la más sensata, se basa en un dicho popular: «Las cosas valen lo que la gente está dispuesta a pagar por ellas». Si hay 3 inversores dispuestos a invertir 200K€ entre todos a una valoración de 1,5M€, seguramente sea porque para ellos tu startup vale 1,5M€.

POR HITOS SUPERADOS

¿Cuál debes usar? Pues en mi experiencia, la realidad es que todas las anteriores son una forma de justificar o de llegar a una valoración de mercado, pero ante la duda a mi la que más me gusta es la técnica por dilución, la primera que hemos compartido. Cómo deberían ser y cómo suelen ser las relaciones del inversor con la empresa invertida.

Muy interesante, ya había usado algunos de estos métodos, pero es bueno refrescar los que siguen vigentes.