TIME TO TOMB (TTT)

Acelera tu empresa con estos consejos de expertos que cuenta sobre «Time To Tomb (TTT)». ¡Analiza y descubre esta TIP!

- ¿Qué es el Time-to-Tomb (TTT)?

- ¿Qué información se necesita para calcular el TTT?

- ¿Cuál es la fórmula para calcular el TTT en modalidad catástrofe?

- ¿Cómo se calcula el TTT en un modelo de negocio de suscripción?

- ¿Qué se debe tener en cuenta al calcular el TTT en un modelo de negocio con ingresos variables?

- ¿Por qué es importante conocer el TTT en una startup?

- ¿Qué información puede proporcionar el TTT a los emprendedores?

- ¿Qué se puede hacer si el TTT indica que la empresa tiene poco tiempo antes de quedarse sin caja?

- ¿Cómo se puede mejorar el TTT en una startup?

El Time-to-Tomb es una métrica muy importante en la gestión financiera de una startup. Esta métrica mide el tiempo que tiene la empresa hasta que se quede sin liquidez y tenga que cerrar. Es fundamental porque nos da una idea de cuántos meses nos quedan para tomar medidas y hacer ajustes en la estructura de costos, facturación y presupuesto. El TTT se puede calcular de diferentes formas, dependiendo de si la startup ya está facturando o no, y de si los ingresos son variables o estables. En cualquier caso, la fórmula básica es la misma: dividir la caja que tenemos en ese momento entre los gastos mensuales. Si no hay ingresos, el TTT se convierte en la TTT Catástrofe. Conocer el Time-to-Tomb nos ayuda a tomar decisiones estratégicas en la gestión de nuestra startup, cómo saber cuántos meses podemos permitirnos sin apenas facturación, si es rentable contratar a más personal o invertir en marketing, o cuándo es el momento de buscar financiación externa. Además, nos permite explorar nuevas oportunidades de negocio y pivotar el modelo de negocio si es necesario, sin poner en riesgo la viabilidad financiera de la empresa. En resumen, es una métrica clave que no debemos descuidar en la gestión de nuestra startup.

El asunto de las métricas es un asunto espinoso. Tendemos a buscar métricas que digan lo que nosotros querernos escuchar, o peor aún, que reflejan sólo una parte del negocio… lo que nos lleva a tomar decisiones equivocadas. Pero también debemos tener en cuenta métricas de supervivencia que nos ayuden a comprender en qué *momento’ estamos… Porque aunque es cierto que deberíamos poner toda nuestra atención en las métricas clave de la startup (que nos ayudan a modelar el negocio junto con los embudos de relación), no debemos dejar de lado una métrica muy simple pero informativa que yo llamo el Time-to-Tomb:

«El Time-to-Tomb o M es una métrica que indica cuántos meses de «vida» tiene la empresa hasta que tenga que cerrar por falta de liquidez, o dicho de otra forma, nos muestra la esperanza de vida de la empresa»

Hay dos formas complementarias de plantear, que en mi opinión deberían estar en el cuadro de mando de cualquier startup:

- TTT Catástrofe = Caja (saldo inicial actual) / Gastos. Nos sirve para valorar, en caso de que no tuviésemos ningún ingreso, la esperanza de vida de la empresa antes de quedarse sin caja, y es la más habitual en startups que empiezan y aún no están generando ingresos.

TIME TO TOMB= CAJA / GASTOS X (MESES)

- TTT Proyectado = (Caja-ingresos) / Gastos. En este caso partimos de la idea que la empresa puede facturar algo, y el TTT se convierte en una fecha móvil que nos indica cuánto tiempo tenemos de vida al ritmo de ingresos actual, se aleja si conseguimos más ingresos cada mes y mejoramos nuestra entrada de dinero, y se acerca si disminuyen los ingresos.

TIME TO TOMB= CAJA + INGRESOS / GASTOS

Los componentes principales para calcular esta métrica son:

- Gastos – Cash Burn Rate (CBR): El bum tate indica cuánto dinero «quemamos» al mes, ya sea en salarios, compras…etc. Da una idea del gasto operativo de la empresa y nos permite comprender el coste de tenerla abierta y funcionando.

- Caja: El elemento más importante de cualquier empresa, sobre todo si es una startup. Como bien dice mi amigo Pedro Bisbal la mayoría de las startups mueren de ataque al corazón… siendo el corazón la caja. Aunque está muy bien tener unas buenas previsiones, para conocer nuestro horizonte debemos valorar lo que tenemos ahora en el bolsillo.

- Ingresos/previsiones: El aspecto más complejo de modelizar. Pretende tener en cuenta la probabilidad de ingresos que tenemos en los próximos meses. Para ello debemos considerar no sólo los ingresos comprometidos (es decir, si nuestro negocio tiene embebida la recurrencia) sino también los ingresos que esperamos ajustados por probabilidad (es decir, si esperamos un ingreso de 1.1200€ el mes que viene con un 20% de probabilidad, contaremos 200€)

Ejemplos prácticos de Time-to-Tomb (TTT)

Aquí hay algunos ejemplos prácticos de cómo se podría aplicar el Time-to-Tomb (TTT) en diferentes situaciones:

Startup de comercio electrónico: una empresa de comercio electrónico ha recibido una inversión de € 200,000 y ha estado gastando € 25,000 al mes en gastos operativos. La startup ha estimado que tardará al menos 12 meses en generar suficientes ingresos para cubrir sus gastos. En este caso, el TTT sería:

TTT = € 200,000 / (€ 25,000 * 12) = 6,67 meses

Esto significa que la startup tiene aproximadamente 6 meses y medio antes de quedarse sin dinero si no genera ingresos adicionales.

- Startup de software: una empresa de software ha estado generando ingresos durante varios meses y ha acumulado € 100,000 en efectivo. La empresa ha estado gastando € 20,000 al mes en gastos operativos y ha estimado que tardará al menos 6 meses en generar suficientes ingresos para cubrir sus gastos. En este caso, el TTT sería:

TTT = € 100,000 / (€ 20,000 * 6) = 0,83 meses

Esto significa que la startup sólo tiene alrededor de 3 semanas antes de quedarse sin dinero si no genera ingresos adicionales.

- Startup de servicios: una empresa de servicios ha estado generando ingresos durante varios meses y ha acumulado € 50,000 en efectivo. La empresa ha estado gastando € 15,000 al mes en gastos operativos y ha estimado que tardará al menos 9 meses en generar suficientes ingresos para cubrir sus gastos. En este caso, el TTT sería:

TTT = € 50,000 / (€ 15,000 * 9) = 3,70 meses

Esto significa que la startup tiene aproximadamente 3 meses y medio antes de quedarse sin dinero si no genera ingresos adicionales. Es importante tener en cuenta que el TTT es solo una métrica que puede ayudar a una startup a comprender cuánto tiempo puede sobrevivir con su efectivo actual. También es importante tener en cuenta que el TTT no tiene en cuenta posibles fluctuaciones en los ingresos o gastos imprevistos que pueden afectar la supervivencia de una empresa.

3 EJEMPLOS PRÁCTICOS DE USO DEL TTT

TIME-TO-TOMB CATÁSTROFE

Por ejemplo, digamos que tenemos 20.000€ en caja, y gastamos 4.000€ al mes en sueldos del equipo, marketing y el alquiler de nuestra oficina. La forma de tradicional de calcular el Time-to-tomb en modalidad catástrofe sería:

TTT Catástrofe: 20.000€ / 4.000€ = 5 meses

O lo que es lo mismo, si no tuviéramos ningún ingreso, nuestra empresa aguantaría como máximo 5 meses antes de quedarse sin dinero.

TIME-TO-TOMB PROYECTADO – MODELO SUSCRIPCIÓN

Pero veamos un ejemplo más complejo: Imaginemos el escenario anterior, pero en este caso nuestra startup está facturando ya y tiene un modelo de negocio de suscripción. Si cada cliente nos deja unos ingresos de 15€ al mes y a priori esperamos tener 120 suscriptores podríamos concluir que aproximadamente (no hay que volverse loco) esperarnos unos ingresos de 1.800€ al mes (120 suscriptores x 15€ al mes).

TTT Catástrofe: 20.000€ / (4.000€4800€) = 9,09 meses

Si quisiéramos que este número fuera más sofisticado deberíamos tener en cuenta el aumento/decremento de suscriptores que esperamos al mes y el churn rate… o tasa de clientes que se dan de baja.

Caso práctico para que un emprendedor practique con Time-to-Tomb (TTT)

Supongamos que un emprendedor ha lanzado una startup que ofrece servicios de marketing digital para pequeñas empresas y ha estado en el mercado durante 6 meses. Ha invertido 50,000 euros en la empresa y actualmente tiene 25,000 euros en caja. Los gastos mensuales de la empresa son de 10,000 euros, lo que incluye el salario del equipo, los gastos de marketing y los costos generales.

Para calcular el TTT de la empresa en modalidad catástrofe, se puede utilizar la siguiente fórmula:

- TTT Catástrofe = Caja / Gastos.

- TTT Catástrofe = 25,000 / 10,000.

- TTT Catástrofe = 2.5 meses.

Esto significa que si la empresa no tiene ningún ingreso, podría sobrevivir durante 2.5 meses antes de quedarse sin caja. Ahora, para calcular el TTT proyectado, se debe tener en cuenta los ingresos actuales de la empresa. Supongamos que la empresa tiene 10 clientes que pagan un promedio de 2,000 euros al mes por sus servicios. Entonces, los ingresos mensuales totales de la empresa son de 20,000 euros. En este caso, la fórmula a utilizar sería:

- TTT Proyectado = (Caja – Ingresos) / Gastos

- TTT Proyectado = (25,000 – 20,000) / 10,000

- TTT Proyectado = 0.5 meses

Esto significa que si la empresa mantiene su nivel actual de ingresos, podría sobrevivir durante 0.5 meses antes de quedarse sin caja. El emprendedor debe tener en cuenta estos cálculos al tomar decisiones importantes, como contratar a un nuevo empleado, invertir en marketing o buscar financiamiento externo. Si el TTT es muy bajo, debe tomar medidas para aumentar los ingresos o reducir los gastos para prolongar la vida de la empresa. Si el TTT es lo suficientemente alto, puede permitirse tomar algunos riesgos y explorar nuevas oportunidades de negocio sin comprometer la supervivencia de la empresa.

TIME-TO-TOMB PROYECTADO – MODELO VARIABLE

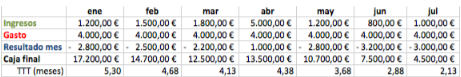

Por último, veamos otro modelo diferente, para comprender cómo se calcula: un modelo en el que los ingresos son muy variables (como en servicios, por ejemplo). En éste modelo, al igual que el anterior, nuestro objetivo es conocer cuánto esperarnos facturar de media cada mes para poder predecir el «M… algo más complicado, ya que la facturación no suele ser lineal. Para eso, nada mejor que disponer de el clásico embudo comercial donde tener controlados los ingresos que esperamos obtener cada mes matizados por su probabilidad (es decir, si el mes que viene tengo previstos 1.000€ potenciales de ingresos pero con un 20% de probabilidad, cuento con 200€…etc.). Todo esto lo podemos plasmar en una sencilla hoja de cálculo o similar como en la siguiente, en la que se vaya actualizando el TTT en función de las dos variables que más le afectan: el CBR (lo que gastamos) y los ingresos previstos (ajustados con su probabilidad).

¿POR QUÉ ES IMPORTANTE CONOCER EL TIME-TO-TOMB?

Es una métrica clave porque nos da una idea del «espacio» (en meses) que tenemos para hacer cosas antes de que nos quedemos sin dinero (asumiendo que no hay gastos importantes inesperados o de una sola vez).

Nos va a ayudar a comprender varios aspectos importantes para una startup corno por ejemplo:

- Cuántos meses ‘malos’ (sin apenas facturación) nos podemos permitir (si baja la facturación el TTT disminuye).

- Si tiene sentido contratar a una persona más o invertir más en marketing (si eso no repercute en ingresos).

- Cuánto espacio hay para explorar, o dicho de otra forma, cuánto tiempo podernos utilizar en pivotar el modelo de negocio o buscar nuevos negocios sin facturar

- Cuando montar una ronda. De forma complementaria a lo anterior, y sabiendo que con suerte puedes tardar entre 4-6 meses como mínimo en cerrar una ronda, te indica cuándo deberías ponerte a buscarla (ya que es una pésima idea hacerlo cuando lo necesitas).

¿Qué diferencia hay entre Runways y Time-to-Tomb (TTT)?

La principal diferencia entre Runway y Time-to-Tomb (TTT) es que Runway se enfoca en el tiempo que una startup puede funcionar con el dinero que tiene en caja antes de quedarse sin fondos, mientras que TTT se enfoca en el tiempo que una startup puede funcionar antes de cerrar por falta de liquidez. En otras palabras, Runway se enfoca en el tiempo de funcionamiento de la startup en el corto plazo (en función del dinero disponible actualmente en caja), mientras que TTT se enfoca en la viabilidad a largo plazo de la startup (en función de los gastos y los ingresos esperados). Ambas métricas son importantes para que los emprendedores puedan tomar decisiones informadas y planificar la estrategia financiera de su startup en función de su viabilidad económica y financiera.

APLICA ESTE TIP EN TU PROYECTO

QUIZZES

- 💻 PRACTICA con un experto en el próximo webinar práctico.

- 🔎 CONSULTA más TIPs relacionadas con este mismo tema.

- 📖 AMPLIA tus conocimientos descargando este EBOOK.

PIENSA EN TI

- 🚀 IMPULSA tu empresa en el próximo programa de aceleración, ¡reserva tu plaza ya!

- 🥁 PRACTICA con tu proyecto en este webinar práctico, ¡solicita tu plaza!.

- 🌐 CONTACTA con otros emprendedores y empresas, ¡inscríbete y participa en el próximo Networking!

PIENSA EN AYUDAR A LOS DEMÁS

- 🤝COLABORA como voluntario: experto, mentor, inversor, premiando, difundiendo, retando, innovando, creando una TIP…

- 💬 RECOMIENDA este programa para que llegue a más emprendedores por Google.

- 👉 ¡COMPARTE tu aprendizaje!

- 📲 REENVÍA esta TIP 👇