Breve descripción del Continente Europeo:

En este artículo te explicamos qué es Europa desde diferentes puntos de vista. El objetivo es aportar una visión general de lo que es y de lo que ofrece el continente europeo a los emprendedores procedentes de otras regiones del mundo. Europa podemos analizarla desde el punto de vista geográfico.

Es uno de los continentes que conforman el supercontinente euroasiático, sin embargo, dado el deseo de Rusia de destacar su presencia a caballo entre Europa y Asia, se ha pasado en ver Europa como un continente en si mismo que se extiende desde la península ibérica hasta los Urales y desde la rivera norte del Mediterráneo hasta el Ártico.

Europa es el segundo continente más pequeño del mundo y abarca un 2% de la superficie del planeta y un 6,8% de las tierras emergidas. Una historia no exenta de convulsiones históricas ha dado lugar a un continente dividido en multitud de países soberanos, de los cuales el más grande en extensión en Rusia. Europa, y en concreto, la península griega se considera la cuna de la civilización occidental, a ella le sucedió el imperio romano que dejó su impronta cultural en toda la cuenca del Mediterráneo llegando hasta las actuales islas británicas.

La caída del imperio fue seguida de un importante desplazamiento de pueblos procedentes de Asia que coincide con el inicio de la Edad Media. A esta la sucedió la edad Moderna cuyo inicio viene marcado por el Renacimiento.

Durante esta época se produce la expansión de países europeos a otros continentes como América, África y Asia. El hito de esta expansión fue el descubrimiento de América y la globalización del comercio mundial. A grosso modo, la revolución industrial llega en el siglo XVIII.

Ya en el siglo XX, las pugnas entre países europeos generan importantes conflictos: la primera y, posteriormente, la segunda guerra mundial, que marcaron el ascenso de los Estados Unidos a la condición de nación hegemónica.

La guerra fría llega hasta finales del siglo XX con la desintegración de la Unión Soviética que había liderado hasta entonces el denominado Bloque del Este, antagónico con el bloque occidental, que acabaría fundando, la denominada Comunidad Económica Europea. Es durante estos años cuando nace el llamado Mercado Común Europeo.

La población europea:

- Cuenta con una población de 510 millones de personas. El estado miembro más poblado es Alemania (82,2 millones de personas y el 16,1% del total) y el que menos Malta (0,4 millones y 0,1%). España, con 46,4 millones, que representa el 9,1% de la UE.

- En la última década, el número de personas que tienen la condición de europeos ha aumentado en casi 12 millones. Francia encabeza el crecimiento con un aumento de más de 3 millones, el números relativos Luxemburgo crece el 21%.

- Los países con una merma mayor son Rumanía con casi 1,4 millones y en términos relativos Letonia y Lituania con un 11%.

- En la UE el 16% tiene menos de 15 años y 65 o más años el 19%. El país con más personas menores de 15 años es Irlanda (22%) separándole 9 puntos de Alemania la menor proporción. España ocupa una posición intermedia con 15% de personas menores.

- La media de edad en Europa es de 43 años con un rango que va desde los 46 años de Alemania, el país más envejecido, hasta los 40 años de Irlanda el país con las personas más jóvenes.

- La tasa de fertilidad en el conjunto de los 28 países es de 1,6 descendientes por mujer y una edad media materna de 30,6 años.

- La Esperanza de vida al nacer (EVn) en la UE es de 80,9 años. España con 83,4 años presenta la mayor EVn de los países UE

- Las principales causas de muerte de las personas que viven en la UE son las enfermedades del aparato respiratorio 38%, cáncer el 26%, y causas externas un 5%.

El mercado común europeo:

- También denominado, Mercado Único Europeo o Comunidad Económica Europea, tiene sus orígenes en el Tratado de Mercado Común Europeo del Carbón y del Acero (CECA).

- En 1957 se decide llevar el acuerdo más allá del carbón y el acero y se firma los denominados tratados de Roma que dan lugar a la Comunidad Económica Europea y a la Comunidad Europea de la Energía Atómica.

- Hitos fundamentales a partir de entonces ha sido la firma del Acta Única Europea, en 1986, y la creación de la Unión Europea en 1992, que marca el inicio de la Unión Económica y Monetaria.

- La tendencia unificadora a nivel institucional continúa acentuándose y el tratado de Lisboa de 2007 establece tres clases de materias en las que pueden intervenir las Instituciones de la Unión Europea.

Las de competencia exclusiva de la UE:

Serán competencia exclusiva de la Unión Europea, no pudiendo intervenir los Estados, las materias referentes a unión aduanera; establecimiento de las normas sobre competencia necesarias para el funcionamiento del mercado interior; política monetaria de la eurozona; y política comercial común.

COMPETENCIAS COMPARTIDAS CON LOS PAÍSES MIEMBROS:

- Se atribuye una competencia compartida residual en todo lo relativo al mercado interior.

COMPETENCIA DE LOS PAÍSES MIEMBROS CON APOYO DE LA UE:

- Los aspectos en que no exista regulación comunitaria.

- El mercado interior es un espacio libre de fronteras y barreras entre los distintos Estados. A tal efecto, el sistema descansa sobre una serie de elementos básicos, configuradores de un marco jurídico que haga posible la efectiva realización de un mercado interior.

- Entre esos elementos, hay que destacar, lo que la doctrina tradicionalmente ha denominado «Cuatro Libertades Fundamentales», integradas por la libre circulación de mercancías, trabajadores, servicios y capitales. En relación con dichas libertades, los Tratados distinguieron el llamado derecho de establecimiento.

- Igualmente, el mercado interior se apoya sobre las políticas comunes, entre las que se puede destacar la política de transportes; de competencia; de agricultura y pesca; y la política comercial común.

Las 4 Libertades

Se consagran en el Tratado de la Unión son y lo hace prohibiendo de cualquier restricción de las mismas:

LIBRE CIRCULACIÓN DE MERCANCÍAS:

- La libre circulación de mercancías supone el establecimiento de una unión aduanera que “abarcará la totalidad de los intercambios de mercancías y que implicará la prohibición, entre los Estados miembros, de los derechos de aduana de importación y exportación”.

- En igual sentido, se establece la adopción de un arancel aduanero común en sus relaciones con terceros países. El 1 de enero de 1993, se suprimió el Documento Único Administrativo (DUA), con carácter general, para los intercambios intracomunitarios.

LIBRE CIRCULACIÓN DE TRABAJADORES:

- La libre circulación de trabajadores se establece en el artículo 45.1 del Tratado de Funcionamiento de la Unión Europea. Se prohíbe taxativamente la discriminación por razón de nacionalidad con respecto al empleo, la retribución y las demás condiciones de trabajo, estableciéndose expresamente los derechos de desplazamiento, residencia y permanencia de los trabajadores comunitarios y, excluyendo de dicha regulación, a los empleados de las Administraciones Públicas.

LIBRE CIRCULACIÓN DE SERVICIOS:

- La libre circulación de servicios es definida en el Tratado de Funcionamiento de la Unión Europea. De esta manera, el reconocimiento de dicha libertad se realiza mediante la exclusión de las restricciones a la libre prestación de servicios dentro de la Unión para los nacionales de los Estados miembros establecidos en un Estado miembro que no sea el del destinatario de la prestación.

- Así pues, la libre circulación de servicios incluye dos supuestos esenciales. El primero, relativo a la prestación de un servicio en el país de establecimiento del prestador, cuyo destinatario no es nacional de dicho país, sino de otro Estado miembro.

- Y el segundo, referente a la prestación de un servicio en un país distinto a aquel en que esté establecido el prestador. En tal caso, el prestador no estará obligado a ejercer su derecho de establecimiento en el país miembro para poder prestar el servicio, bastando con cumplir las mismas condiciones que el país miembro receptor del servicio impone a sus nacionales.

LIBRE CIRCULACIÓN DE CAPITALES:

- La libre circulación de capitales es definida por el Tratado de Funcionamiento de la Unión Europea. De forma paralela, se menciona la libre circulación de pagos, que dada su naturaleza, recibe idéntica regulación que la de capitales.

- Así pues, por norma general se prohíbe cualquier restricción a los movimientos de pagos y capitales, tanto entre Estados miembros, como entre países extracomunitarios y Estados miembros.

- Se contemplan, no obstante, algunas excepciones a la prohibición de restringir los movimientos de pagos y capitales. En primer lugar, subsisten las restricciones anteriores al 31 de diciembre de 1993, existentes entre países extracomunitarios y Estados miembros, y relativas a inversiones directas, incluidas las inmobiliarias, el establecimiento, la prestación de servicios financieros o la admisión de valores en los mercados de capitales.

- También, hay que destacar, el supuesto en que el Consejo decide, por unanimidad, retroceder en la liberalización de los movimientos de capitales entre terceros países y Estados miembros. Dicho acto se adoptará mediante un procedimiento legislativo especial, que incluye la consulta al Parlamento Europeo.

DERECHO DE ESTABLECIMIENTO:

- Adicionalmente a las Cuatro Libertades, el derecho de establecimiento de los nacionales de un Estado miembro sobre el territorio de otro Estado miembro distinto es definido de forma negativa, es decir, prohibiendo las restricciones que pudieran impedirlo u obstaculizarlo.

- El Tratado de Funcionamiento de la Unión Europea afirma que el derecho de establecimiento comprende el acceso a las actividades no asalariadas y su ejercicio, así como la constitución y gestión de empresas. En todo caso, habrán de sujetarse a las condiciones que el país de establecimiento imponga a sus propios nacionales.

Indicadores básicos de la Unión Europea:

| Extensión | 4 millones de Kilómetros |

| Población | 510 millones de habitantes |

| PIB (2019) | 16,4 billones de € |

| Relación con PIB Mundial | 16% |

| 3ª Economía del mundo | China 16,4%. Estados Unidos 16.3% |

| 27 Países miembros | Alemania, Austria, Bélgica, Bulgaria, Chipre, República Checa, Croacia, Dinamarca, Eslovaquia, Eslovenia, España, Estonia, Finlandia, Francia, Grecia, Hungría, Irlanda, Italia, Letonia, Lituania, Luxemburgo, Malta, Países Bajos, Polonia, Portugal, Rumania y Suecia. |

| PIB per cápita en Europa | 30.600€ |

| PIB per cápita más alta | Luxemburgo 101.000€ |

| PIB per cápita España | 25.400€ |

| PIB per cápita Canarias | 21.000€ |

| Moneda | € Euro (19 Países de la Zona Euro) |

| Moneda: Casos específicos | Corona danesa (Dinamarca al margen del €). 7 Países que aún no cumplen criterios necesarios. |

| Lenguas oficiales | 24 lenguas. De trabajo: Francés, alemán e inglés |

| ORGANISMO | UBICACIÓN | FUNCIONES |

| Parlamento Europeo | Bruselas / Estrasburgo /Luxemburgo | Órgano Legislativo de la Unión Europea. |

| Consejo Europeo | Bruselas | Define las orientaciones y las prioridades políticas generales de la Unión Europea. |

| Consejo de la Unión Europea | (Bruselas / Luxemburgo): | Consejo de Ministros Europeo. |

| ORGANISMO | UBICACIÓN | FUNCIONES |

| Parlamento Europeo | Bruselas / Estrasburgo /Luxemburgo | Órgano Legislativo de la Unión Europea. |

| Consejo Europeo | Bruselas | Define las orientaciones y las prioridades políticas generales de la Unión Europea. |

| Consejo de la Unión Europea | (Bruselas / Luxemburgo) | Consejo de Ministros Europeo. |

| Comisión Europea | (Bruselas / Luxemburgo / Representaciones en los Estados miembros) | Orienta el poder ejecutivo y la iniciativa legislativa. |

| Tribunal de Justicia de la Unión Europea | Luxemburgo | Acepta recursos de particulares y de Estados y tiene competencias consultiva y contenciosa. |

| Banco Central Europeo | Frankfurt | Es el banco central de los Países de la Unión Europea que tiene el euro como moneda. |

| Tribunal de Cuentas Europeo | Luxemburgo | Encargada de la fiscalización y el control de las cuentas de la Unión Europea. |

Vivir en Europa:

Es un continente de grandes dimensiones y muy heterogéneo desde el punto de vista económico y social. Los niveles de vida, varían notablemente de un País a otro y eso, hace que sea muy difícil exponer una visión general válida para todo el continente.

En la medida en la que Europa avanza en su unificación económica y, también política, es probable que tienda a una mayor homogeneización de sus estándares de vida. Existen multitud de estudios sobre el nivel de vida en los diversos países europeos. Pero, desde el punto de visto del inversor-emprendedor extracomunitario, hay algunos factores que deben ser tenidos en cuenta a la hora de decidir donde vivir.

Aportamos algunas sugerencias al respecto sin dar mayor o menor importancia a cada una de ellas:

- En primer lugar, parece lógico que el lugar de residencia coincida con los entornos en los que se desea poner en marcha el negocio. Como hemos visto, Europa, es un mercado muy grande y, es normal, que se decida de antemano cuáles serán los lugares prioritarios de actuación.

- El segundo criterio que sugerimos es que se tome en consideración los aspectos culturales. Parece lógico que un inversor hispanoamericano prefiera vivir en Países más relacionados con su cultura de origen, España, Italia o Portugal, que en los Países del norte. Prestaciones sociales, calidad de vida, etc. Esto incluye la vivienda, la educación, la sanidad y también la seguridad, el clima, etc.

En todo caso, la decisión, debe ser el resultado de un análisis minucioso. Aportamos alguna información adicional útil:

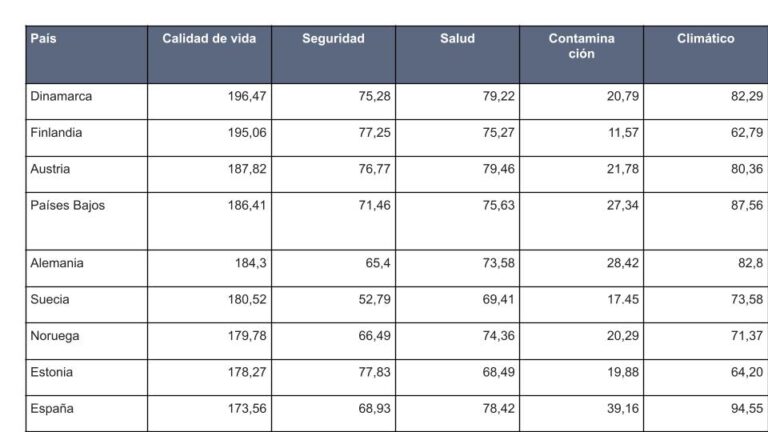

Calidad de vida:

Europa es un continente con un elevado standard de vida. El nivel de vida se calcula midiendo el precio de determinados bienes y servicios en cada país en relación con la renta en este. Para ello, se utiliza una moneda nacional común, denominada «estándar de poder adquisitivo» (EPA). La comparación del producto interior bruto (PIB) por habitante en EPA proporciona una visión general del nivel de vida en toda la UE.

Los Países con mayor PIB per cápita son Luxemburgo con 101.000 Euros y el que menos Bulgaria con 8000. Alemania tiene un PIB per cápita de de 43.000 Euros, Francia alcanza los 33000 euros e Italia y España los 27 y 25.000 euros respectivamente.

Además de la EPA, otro indicador, para medir la calidad de vida es el Social Progress Imperative que combina el grado de satisfacción de las necesidades sociales básicas, cimientos de bienestar y oportunidades.

Estos criterios dan como resultado este ranking publicado por Bankinter:

Educación en la Unión Europea:

Como en todas las variables que analizamos, la educación es una competencia que corresponde a cada uno de los países miembros. Sin embargo, la Unión Europea, interviene en determinados aspectos estratégicos encaminados a garantizar la igualdad de oportunidades, la calidad y la competitividad.

Un ejemplo, de estas políticas, es el Digital Education Action Plan, que persigue una serie de objetivos estratégicos esenciales:

- Fomentar el desarrollo de un ecosistema educativo digital de alto rendimiento.

- Mejorar las competencias y capacidades digitales para la transformación digital.

La educación junto a la sanidad son los dos caballos de batalla del llamado estado del bienestar en Europa. Esto implica que el Estado se convierte en garante y proveedor de la educación en todos los países de la comunidad.

Así, en Europa los Estados siguen conservando el control de la mayor parte de las funciones relacionadas con la provisión educativa, en mayor o menor medida según se trate de sistemas más o menos centralizados.

La educación universitaria en algunos países de la UE:

Los Países que analizamos a continuación ofrecen la educación universitaria gratuita.

ALEMANIA:

El prestigio de la educación alemana y la potencia de su economía convierten a este país en un destino muy demandado por los estudiantes internacionales. La educación universitaria es gratuita en algunos Länder, y en los restantes, tan solo hay que pagar unas tasas administrativas que no superan los 100 euros anuales. La lengua de enseñanza es el alemán, un idioma de gran importancia en campos como la ingeniería.

GRECIA:

La matrícula en los cursos de grado es gratuita en todas las universidades públicas del país excepto en la Hellenic Open University, que es una universidad de educación a distancia. Las clases son, generalmente en griego, pero se pueden encontrar algunos grados impartidos en inglés, especialmente, aquellos dedicados a materias con una perspectiva más internacional. De nuevo las playas y el buen tiempo son un incentivo para elegir este país como destino de estudios.

DINAMARCA:

Los estudiantes de la Unión Europea pueden acceder gratis a la educación de alta calidad que ofrecen las universidades danesas. Es difícil encontrar grados impartidos en inglés pero existen algunos. También se imparte alguno en alemán. Es un país caro para vivir pero si encuentras trabajo puedes solicitar el Statens Uddannelsesstøtte (SU), que es una ayuda de alrededor de 750 euros mensuales que otorga el gobierno danés a los estudiantes universitarios.

SUECIA:

Como es habitual en los países nórdicos, Suecia ofrece educación gratuita y de calidad y un alto nivel de vida, pero también es un país caro. Los grados suelen ser en sueco, pero se encuentran algunos programas en inglés diseñados para estudiantes internacionales, especialmente en la Universidad de Estocolmo.

Veamos otros casos de otros países:

ESPAÑA:

La mayoría de las universidades son públicas, por lo que están financiadas por el Estado, a través de la administración central y de las Comunidades Autónomas, se rigen por el sistema de admisión de alumnos de carácter general y el costo de la matrícula es establecido por la administración correspondiente. El sistema universitario está compuesto por 85 universidades (50 públicas y 35 privadas), además de 322 institutos de investigación y 78 parques científico- tecnológicos.

FRANCIA:

En Francia, la titulación de licenciatura (Diplôme National de Licence) se cursa durante seis semestres. A su finalización, los estudiantes pueden acceder a una titulación de máster, de una duración de cuatro semestres (corresponde a una licenciatura bac + 5 años de estudios). Había 71 universidades y 1 instituto nacional polytechnique en abril de 2016. No existe en Francia el concepto de Universidad privada aunque si el de Facultad privada.

Los derechos de inscripción en Francia son bajos porque el Estado cubre la mayor parte de los gastos de las formaciones accesibles en instituciones públicas de educación superior. El coste real de los estudios es igual que en cualquier otra parte del mundo: unos 10.000 euros por año.

ITALIA:

En Italia, la educación universitaria se divide en tres ciclos, en los cuales se pueden obtener las siguientes titulaciones: un diploma universitario, después de 2 o 3 años de estudio. Un diploma de licenciatura, luego de cursar una carrera de 4 o 6 años. Un título de especialización, que lleva dos años mínimos. Italia cuenta con 96 Universidades de las cuales 17 son privadas.

Las tasas de matrícula promedio para una educación superior pública en Italia pueden oscilar entre 900 y 4,000 € por año, dependiendo de si eres de la UE o no, la institución específica, así como tu programa y nivel de estudio.

Sanidad en la Unión Europea:

Cada Estado miembro es responsable de su propia política sanitaria, de su organización y de su financiación, escenarios que pueden dar lugar a diferentes situaciones de accesibilidad, disponibilidad y nivel de pagos de las personas enfermas cuando utilizan los servicios de atención.

La crisis económica ha hecho que en los últimos años el foco haya recaído fundamentalmente sobre la rentabilidad de cada sistema pero existen otros factores que tienen una marcada influencia en el aspecto más cotidiano de la sanidad.

- ¿Quiénes están más satisfechos con su propio sistema sanitario?

- ¿En qué países tardamos más en poder ver al médico?

- ¿Existen pediatras en Atención Primaria?

En el siguiente análisis recogemos los diferentes parámetros que definen el día a día de la atención sanitaria en Europa. La UE complementa las políticas sanitarias nacionales apoyando a los gobiernos de sus países miembros para alcanzar objetivos comunes, compartir los recursos y superar los retos comunes.

Además de, formular leyes y normas, a escala de la UE para los productos y servicios sanitarios, también proporciona financiación para proyectos sanitarios en toda la UE. La política de salud de la UE se centra en la protección y la mejora de la salud, la igualdad de acceso a una asistencia sanitaria moderna y eficiente para todos los europeos, y la coordinación frente a amenazas graves para la salud que afecten a más de un país de la UE.

La prevención y la respuesta a las enfermedades desempeñan un papel destacado entre las prioridades de la UE en materia de salud pública. Esta prevención afecta a numerosos ámbitos, como la vacunación, la lucha contra la resistencia a los antibióticos, la lucha contra el cáncer y el etiquetado responsable de los alimentos.

Hay dos agencias específicas que apoyan a los gobiernos nacionales en cuestiones de salud. El Centro Europeo para la Prevención y el Control de las Enfermedades evalúa y supervisa las amenazas de enfermedades emergentes con el fin de coordinar la respuesta. La Agencia Europea de Medicamentos, por su parte, se encarga de la evaluación científica de la calidad, seguridad y eficacia de todos los medicamentos de la UE.

MODELOS DE SALUD PÚBLICA IMPERANTES EN EUROPA:

En primer lugar conviene hacer una diferenciación básica entre Servicios Nacionales de Salud (modelo Beveridge) y Sistemas de Seguros Sociales (modelo Bismark).

SERVICIOS NACIONALES DE SALUD:

- Controlados directamente por el gobierno.

- La financiación procede de los presupuestos estatales. (Impuestos estatales)

- Acceso universal.

- Facultativos asalariados.

- Control y gestión gubernamental con cierta participación del sector privado.

- Algunos copagos por parte de los usuarios.

SISTEMAS DE SEGUROS SOCIALES (MODEL BISMARK):

- Organizados en torno a mutuas.

- Financiación cubierta con cuotas de empresarios y trabajadores.

- Gestión mancomunada de empresarios y trabajadores.

- Los recursos van a parar a fondos, que son entidades no gubernamentales reguladas por ley.

- Los «fondos» contratan hospitales, médicos de familia, etc. para que provean los servicios a los asegurados mediante contratos basados en un presupuesto o mediante pago por acto.

La sanidad privada en Europa:

En Europa, la oferta de servicios sanitarios privados coexiste con la pública. De hecho existe un espíritu de colaboración entre ambos aunque no con la misma intensidad en todos los países. En todo caso, la sanidad privada, juega sus cartas y ofrece unos mayores niveles de agilidad en el servicio y mayor eficiencia en la gestión.

Por ello, son cada vez, más los ciudadanos europeos complementan las coberturas sanitarias públicas (de carácter universal) con pólizas de seguro privadas. El sector sanitario privado no deja de crecer y se erige en una excelente alternativa para empresarios que llegan a Europa con su cobertura sanitaria contratada a través de compañías de seguros.

Vivienda en Europa:

Dentro de la Europa de los 27 existen grandes diferencias sobre cómo viven los europeos en términos de tamaño y tipo de vivienda, sus calidades o si predomina la propiedad o el alquiler. La evolución de los precios de las casas en venta y los arrendamientos también cambian significativamente entre los países.

Analizamos la situación de la vivienda en la UE con los datos de la oficina estadística europea Eurostat.

- ¿Cómo han evolucionado los precios de compra y alquiler de una vivienda?

- ¿Hay más propietarios o inquilinos?

En la Unión Europea (UE), el 70% de la población vivía en hogares en propiedad, mientras que el 30% restante vivía en una casa alquilada a cierre de 2019. Los datos de esta publicación interactiva de Eurostat muestran cifras anuales hasta ese año y, por lo tanto, no reflejan el impacto de la crisis del covid-19 que ha golpeado a todo el continente en todos los aspectos en 2020.

En España, la proporción sube hasta el 76,2% de propietarios, pero lejos de rumanos, húngaros o eslovacos. Estos datos y muchos más se pueden encontrar en el informe. El porcentaje de la población que vive en propiedad o alquila la casa en la que se vive es significativamente diferente entre los estados miembros. En la UE, el 69,8% de la población vive en su propia vivienda, mientras que el 30,2% restante vivía en casas alquiladas.

PERO, ¿DÓNDE HAY MÁS PROPIETARIOS?

En Rumanía (el 95,8% de la población es propietaria de una casa), acompañado por Hungría (91,7%) y Eslovaquia (91%) o Lituania (90,3%). En todos los Estados miembros, la propiedad es la manera de vivir más común. Solo en Alemania, el alquiler es capaz de acercarse a la propiedad, con un 49% de la población como inquilino, frente al 51% de propietarios.

Le siguen Austria, con un 44,8% de arrendatarios y Dinamarca, donde el 39,2% de la población reside en pisos en arrendamiento. España supera la media europea, con hasta un 76,2% de propietarios frente a un 23,8% de inquilinos, aunque todo hay que decir que esta proporción lleva creciendo hacia el mercado del alquiler, en los últimos años, sobre todo, desde la crisis económica de 2008 y el estallido de la burbuja inmobiliaria.

Vivir en una casa o apartamento también difiere entre los Estados miembros y depende de si se reside en una ciudad o en el campo. En 2019, el 53% de la población vivía en una vivienda unifamiliar, donde se incluyen los chalets adosados, mientras que el 46% vivía en un piso (solo el 1% vivía en otro tipo de alojamiento).

Irlanda (92%) registró la mayor proporción de la población que vive en una casa individual, seguida de Croacia y Bélgica (ambos con el 77,6%) y los Países Bajos (74,8%). Las casas son más comunes en dos tercios de los estados miembros.

Adquirir una vivienda en Europa:

Cada país tiene su legislación a la hora de establecer métodos y sistemas impositivos a los ciudadanos extracomunitarios que desean adquirir una vivienda en Europa. En general, no hay restricciones para los extracomunitarios. Solo se pide un documento de identificación válido y una cuenta corriente abierta en el país del que se trate.

VALE DAR ALGUNOS CONSEJOS DE CARÁCTER GENERAL:

ASEGÚRESE DEL PRECIO TOTAL:

Normalmente los precios de las viviendas que aparecen en los portales inmobiliarios no son los precios finales. Conviene que averigüe qué comisiones y que impuestos habrá de pagara al final del proceso.

Estos conceptos pueden suponer entre un 10 y un 15% adicional.

PLANIFICAR BIEN LA COMPRAVENTA:

No desembolsar reservas o adelantos sin tener una idea clara del trayecto a recorrer hasta tener la llave de la vivienda en la mano, ni estar absolutamente seguro de la opción más adecuada.

Si por alguna razón cambia de opinión una vez hecho algún abono previo (arras), pude perder el dinero a manos de la inmobiliaria

IMPUESTOS:

Normalmente, los ciudadanos extracomunitarios pagan los mismos impuestos que los comunitarios, sin embargo, ojo con las diferencias legislativas entre países. En España, los impuestos varían, en función de si se trata de una vivienda usada o de una nueva (obra nueva adquirida directamente del promotor).

El impuesto en la compraventa es el IVA en la Europa continental o el IGIC en Canarias. El monto de este impuesto puede oscilar entre el 10 y el 21%. (Ojo con las diferencias entre naciones). Este Impuesto se paga en el momento de firmar la escritura de compraventa.

Siguiendo el ejemplo español deberá abonar el Impuesto de Actos Jurídicos Documentados y su pago se realizará en el momento de registrar la propiedad. En caso de adquisición, de una vivienda usada, habrá que abonar el Impuesto de Transmisiones Patrimoniales.

OTROS GASTOS:

Gastos notariales, Tasas de Registro de la Propiedad y, cambios de utilidades (gas, agua y electricidad, Comisión inmobiliaria 2 año 15%, gastos hipotecarios (tasación y tipo de interés acordado con el banco).

El caso de Francia:

Insistimos en la importancia de identificar estos conceptos en cada país. En el caso de Francia tendrá que pagar los aranceles del notario. Estos son controlados por el gobierno y dependen del nivel de impuestos de la propiedad, pero la suma de los honorarios no puede exceder el 10 % del valor de la propiedad.

El impuesto de timbre también se cobra al 5,8 % para las propiedades de más de cinco años de antigüedad, mientras que los hogares más nuevos incurren en un coste del 0,7 % más el IVA. Sin embargo, compruebe su contrato inicial y los precios, ya que, las propiedades se venden ocasionalmente como «toutes tax comprises» (TTC), lo que significa que todos los impuestos están incluidos.

Una vez que usted sea propietario de una propiedad residencial en Francia, también, tendrá que pagar un impuesto sobre la tierra e impuestos locales:

- La “Taxe d’habitation” (impuesto a la vivienda): lo deben las personas que se alojan en la vivienda. De manera que, si la vivienda se alquila, es el inquilino el que pagará el impuesto. Se calcula en base al valor locativo del bien, pero la tasa aplicable depende de cada municipio.

- La “Taxe foncière” (impuesto de la propiedad): está a cargo de los propietarios de bienes inmuebles;

- “Cotisation foncière des entreprises” (CFE): es un impuesto a cargo de las empresas, calculada en base al valor locativo del bien ocupado por un profesional. Se tendrá que pagar este impuesto, si el bien es utilizado a de fines profesionales. El deudor del impuesto será el ocupante del local.

- “Taxe des logements vacants”: es un impuesto aplicable a viviendas desocupadas, en ciertas áreas urbanas a cargo de los propietarios.

- “Taxe d’enlèvement des ordures ménagères”: este impuesto es recaudado para financiar la recolección servicio de recolección de residuos domésticos y existe en la mayoría de municipios en Francia. La liquidación del impuesto está a cargo del propietario o usufructuario de la vivienda o local. Sin embargo, si la vivienda está alquilada, se puede recuperar el impuesto pagado repercutiéndolo en concepto de gastos del contrato de alquiler.

ALQUILAR UNA VIVIENDA EN FRANCIA:

Es muy importante saber que en Francia para poder alquilar un inmueble, el inquilino debe poder demostrar que tiene como mínimo ingresos 3 veces mayor al precio del alquiler, esto quiere decir que, si el alquiler es de 500 euros el inquilino debería percibir mensualmente al menos 1500 euros netos y fijos. Los franceses se quejan de la burocratización existente en el proceso de alquiler de una casa. (Paperasse).

Por ello, recomiendan que el aspirante a inquilino elabore su dossier de alquiler: solo un dossier de alquiler bien elaborado le permitirá sobrepasar a todos los demás candidatos de alquiler.

ESTE ES EL PROCEDIMIENTO A SEGUIR:

- Prepare los documentos básicos para alquilar su inmueble.

- Proporcione documentos opcionales (pero que a veces marcan la diferencia).

- Niéguese a revelar cierta información confidencial.

- Asegúrese de que su caso se destaque.

- Encuentre rápidamente un garante en el caso de que tengas unos ingresos bajos.

LOS DOCUMENTOS OBLIGATORIOS SON:

- Fotocopia de su documento de identidad (o pasaporte). Últimos tres nóminas o boletines de pago (si es empleado) o dos últimos balances (si trabaja por cuenta propia autónomo).

- Comprobante de domicilio (recibo de electricidad, teléfono fijo, box internet, gas, etc).

- Si alguien lo respalda es decir si necesita un fiador éste deberá proporcionar los mismos documentos.

DOCUMENTOS NO OBLIGATORIOS PERO QUE APOYAN EL PROCESO:

- Último aviso fiscal (avis d’imposition suyo y/o del fiador, si lo tuviere).

- Tarjeta de estudiante si es el caso.

- Permiso de residencia.

- Certificado del empleador.

- Fotocopia de impuestos locales (taxe d’habitation, taxe foncière) si el garante es dueño de su vivienda.

- RIB.

- Recibos de alquiler del alquiler anterior.

GARANTÍAS ADICIONALES:

Para protegerse contra posibles impagos, no es raro que un arrendador requiera que su inquilino le proporcione un garante. Claramente, es su garantía, es decir, la persona que lo respaldará, a quién su arrendador le pedirá que pague el alquiler si usted no puede hacerlo.

Pero, dadas las consecuencias económicas que implica, el rol de garante no siempre es fácil de cumplir…

Sin embargo, si no tienes garante, hay alternativas:

- La garantía bancaria.

- El depósito de Visale.

- El depósito en línea.

Alquilar una vivienda en Irlanda:

Terminamos estos ejemplos de compra o alquiler en Europa en distintos países europeos analizando el proceso de alquiler en Irlanda.

Documentación:

POR PARTE DEL ARRENDADOR DEBE APORTAR LA SIGUIENTE DOCUMENTACIÓN:

- Documentos de la casa.

- Pasaporte.

- Cuenta bancaria en la que recibirá los pagos mensuales.

- Registro del Private Residential Tenancies Board, este es un organismo que se encarga de regular y autorizar a los propietarios para alquilar en Irlanda. De acuerdo con la ley irlandesa, todos los propietarios deben tener este registro para poder alquilar, así que pide este papel al arrendador.

POR PARTE DEL ARRENDATARIO:

- Contrato laboral o cartas del curso de inglés.

- Estado de la cuenta bancaria en Irlanda.

- Pasaportes de todas las personas que van vivir en el lugar.

- Referencias del último arrendador.

- Carta de presentación.

El contrato:

Por lo general, el contrato especifica cada uno de los objetos que se encuentran en la propiedad. De esta manera, cuando desocupes el lugar, el propietario podrá verificar que todo lo señalado en el contrato está allí. Al mismo tiempo, estarás seguro de que, ¡¡todo lo que compres mientras estés en dicha propiedad es tuyo, y no habrá ningún tipo de confusión!!

Por otra parte, el contrato debe incluir otras condiciones del alquiler, como, qué puede suceder si se daña algo en la propiedad, cómo se debe actuar en una situación de este tipo y quién se hace responsable.

La renta:

Según la ley irlandesa, el arrendatario está obligado a pagar la renta a tiempo y también debe estar muy atento a que la propiedad se mantenga en excelentes condiciones. Asimismo, es importante mencionar que el arrendador tiene derecho a inspeccionar el estado del inmueble siempre y cuando te dé a conocer la fecha de esta visita con anticipación.

Del mismo modo, si tienes intenciones de irte de ese inmueble, necesitas avisar con antelación para que el arrendador pueda buscar otra persona que lo ocupe. Como puede apreciarse no existen grandes diferencias en lo requisitos y normativos establecidos en los diferentes países europeos en los procesos de compra o alquiler.

El transporte en Europa:

Se ocupa de las necesidades de movilidad de más de 700 millones de personas y su carga asociada. La geografía política de Europa divide el continente en más de 50 estados y territorios soberanos.

Esta fragmentación, junto con un mayor movimiento de personas desde la revolución industrial, ha llevado a un alto nivel de cooperación entre los países europeos en el desarrollo y mantenimiento de redes de transporte.

Las organizaciones supranacionales e intergubernamentales como la Unión Europea (UE), Consejo de Europa y la OSCE han dado lugar a la elaboración de normas y acuerdos internacionales que permiten a las personas y de carga para cruzar las fronteras de Europa, en gran medida con niveles únicos de libertad y facilidad.

Carretera, ferrocarril, transporte aéreo y el agua son frecuentes e importantes de toda Europa. Europa fue el lugar del mundo con los primeros ferrocarriles y autopistas y ahora es la ubicación de algunos de los puertos y aeropuertos más activos del mundo.

El espacio Schengen permite el viaje sin control en frontera entre 25 países europeos. El transporte de carga tiene un alto nivel de compatibilidad intermodal y el Espacio Económico Europeo, permite la libre circulación de mercancías a través de 30 estados.

CARRETERAS Y AUTOPISTAS

La Unión Europea puede presumir de contar con la mejor red de carreteras y autopistas del mundo. Las carreteras desempeñan un papel importante en el transporte de la UE ya que contribuye a unir regiones muy distantes entre sí, fomentan la cohesión, la competitividad y el crecimiento económico conectando de forma eficiente mercados y personas. Por las carreteras europeas circula el 76% de las toneladas/km y el 92% de personas/km (tanto en autobús como en turismos) de todo el movimiento interno de la unión.

Ello da una idea, de su gran importancia, y explica, por qué desde la comunidad se presta a atención a la mejora constante de la red, a su integración con el resto de redes (aérea, marítima y ferroviaria) y a velar por su sostenibilidad. La Comunidad ha destinado 78.000 millones de euros entre 2007 y 2020 a subvencionar proyectos en la red viaria del continente. En este enlace (+) puede ampliar información sobre la política europea en relación a carreteras.

TRANSPORTE AÉREO:

También, en transporte aéreo, Europa cuenta con una importante red de infraestructuras y aerolíneas que han visto muy mejorado sus actividad gracias a las políticas de unificación del cielo europeo (Cielos Abiertos) y a la liberalización de la actividad, lo cual ha contribuido a una mayor competitividad y a hacer del transporte aéreo algo accesible a todos los segmentos de población.

Este desarrollo tan positivo ha supuesto un impulso fundamental para sectores como el turismo, que salvo en los años de Covid, no ha dejado de crecer. En 2017 se realizaron en Europa 1,2 billones de desplazamientos aéreos relacionados con el turismo. Las compañías low cost han tenido un impacto positivo en este sentido. En ese mismo 2017 el sector aéreo europeo facturó unos 150.000 millones de euros, con una media de crecimiento interanual del 6,9%. Es de esperar que la actividad retome el mismo ritmo a corto medio plazo.

Las expectativas son que en el 2022 se alcance un valor del sector de 199.5 billones de dólares, un incremento del 33,1% desde 2017 con un crecimiento anual medio del 5,9%. En este período los pasajeros crecerán en un 24,7% con un crecimiento anual medio del 4,5%, alcanzando la cifra de 1,271 millones de pasajeros. A pesar de los cambios en los hábitos de los consumidores europeos. La penetración de internet en Europa ha pasado del 70% en 2014 al 90% en 2019. Además, el e-commerce en Europa ha aumentado un 11% en 2017.

En todo caso, los países europeos cuentan con una abundante red aeropuertos locales, nacionales e internacionales que conectan con fluidez todas los rincones del continente.

TRANSPORTE MARÍTIMO:

El transporte marítimo representa el 90% del comercio internacional de Europa y el 40% del comercio al interior de la UE. Con más de 1.200 puertos con movimiento de carga que permiten el comercio y la conexión entre los países miembro de la UE. En el mapa explica la ubicación de los 15 puertos marítimos más importantes de Europa que ofrecen conexiones regulares con puertos del mundo entero.

EL ESPACIO SCHENGEN:

El espacio Schengen es un área de Europa formada por 26 países que han acordado la abolición de controles en sus fronteras interiores para permitir la libre circulación sin restricciones de personas, bienes, servicios y capital, siguiendo unas normas comunes de control de fronteras exteriores. Cabe destacar que no todos los miembros de la Unión Europea (UE) o todos los países europeos forman parte del espacio Schengen porque se trata de dos zonas diferentes.

LOS PAÍSES FIRMANTES DEL ACUERDO SCHENGEN SON:

- Austria, Bélgica, República Checa, Dinamarca, Estonia, Finlandia, Francia, Alemania, Grecia, Hungría, Italia, Letonia, Lituania, Países Bajos, Polonia, Portugal, Eslovaquia, Eslovenia, España, Suecia, Luxemburgo.

- Islandia, Liechtenstein, Noruega y Suiza son parte de Shengen pero no de la Unión Europea.

- Los microestados Mónaco, Ciudad del Vaticano y San Marino son miembros de facto de Shengen.

Irlanda es miembro de la Unión Europea pero no forma parte del acuerdo de Shengen.