ECOSISTEMA DE INVERSIÓN EN STARTUPS EN ESPAÑA

Acelera tu empresa con estos consejos de expertos sobre «Ecosistema de inversión en startups en España». ¡Analiza y descubre esta TIP!

En esta tip encontrarás información concerniente a la situación actual de las inversiones que diversos agentes realizan en startups en España.

Situación actual

España vive un momento dulce en relación a las cifras de inversión que personas y organizaciones de diversa naturaleza realizan para apoyar a los emprendedores que quieren poner en marcha su startup en España.

Prueba de la buena salud de la actividad inversora en startups es que la cifra invertida se ha multiplicado por 6 en los últimos 5 años y por 3 en el último año. Por otra parte se empiezan a registrar ampliaciones de capital de 200 e incluso 400 millones de euros, lo cual demuestra que España va en la dirección correcta de cara a una equiparación de los indicadores registrados en el resto de Europa.

La inversión en startups en España

La inversión en startups españolas, incluidas las fintech, alcanzó en 2021 una cifra récord de 4.300 millones de euros, lo que casi triplica (+287%) el volumen del año anterior (1.107 millones), según el Observatorio del Ecosistema de Startups de la Fundación Innovación Bankinter.

A lo largo de 2021 se cerraron 409 operaciones de inversión. El hecho de que el volumen de inversión haya crecido en España un 287% y las operaciones un 20% se explica por un importante crecimiento en el tamaño medio de las rondas, que pasa de 3,27 millones en 2020 a 10,5 millones en 2021 (un 221% superior), con una mediana de un millón de euros (un 25% superior).

Según los autores del estudio, uno de los elementos definitorios del 2021 fue el gran crecimiento de rondas más maduras, Serie C y Growth (con 35 operaciones en 2021 frente a seis en 2020). Estas ‘scaleups’ son las que más impacto en empleo y riqueza generan, y son las que más inversión internacional atraen.

¿En qué sectores?

En 2021 el subsector productivity, (donde se incluyen todas aquellas compañías enfocadas en prestar servicios a otras compañías, muy a menudo mediante productos SaaS), toma la delantera en las inversiones de startups en España desplazando a Movilidad & Logística, que pasa al tercer lugar y que incluye desde el ‘delivery’ de productos hasta los modelos de plataformas de movilidad o logística de última milla.

La inversión en startups productivity alcanzó en 2021 los 790 millones de euros de inversión, contabilizándose unas 40 operaciones.

El segundo lugar en el ranking de inversiones corresponde a ‘Real Estate & Proptech‘ que supera la dependencia de unas pocas megarrondas y cierra con 689 millones captados distribuidos en 21 operaciones.

Pero uno de los sectores en que más se ha invertido a raiz del Covid es en salud. Antes de la propagación de la pandemia del covid nadie invertía en salud, entre otros factores por los ciclos largos de amortización que las startups del sector requerían.

Con el Covid surge la obsesión por cuidarnos. Los hospitales se han dado cuenta de que no están digitalizados y esto supone un crecimiento muy importante de incremento en la demanda de productos tecnológicos relacionados con la sanidad.

¿Dónde?

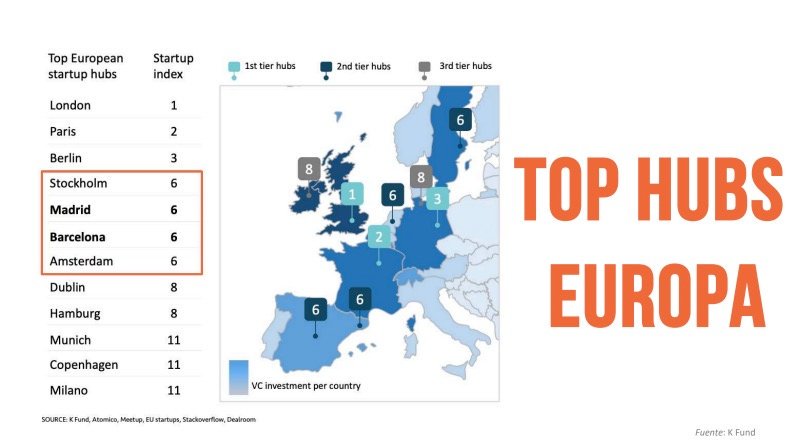

El 90% de la inversión en startups en España entre 2018-2021 se concentra en Barcelona y Madrid. En 2021, Madrid con 2.487 millones de inversión (+587% respecto a 2020) superó a Barcelona que alcanzó los 1.510 millones de euros (+212% respecto a 2020). Además se registran movimientos interesantes en Valencia y Bilbao. Pero esta concentración es normal en toda Europa. Ocurre en Francia y en Inglaterra, donde existe un alto porcentaje de inversión concentrado en dos o tres ciudades.

Barcelona y Madrid se encuentran entre los hubs más relevantes de startups en Europa, y España ocupa un segundo lugar en el crecimiento de la inversión que alcanza un 2,9%. Es además uno de los países con mayor crecimiento de la inversión durante el segundo semestre de 2021.

Sin embargo, aun estamos por debajo de la media europea y queda mucho margen para crecer. Se calcula que durante los próximos 5 años habrá disponibles unos mil millones de euros por parte de fondos de inversión en empresas de base tecnológica.

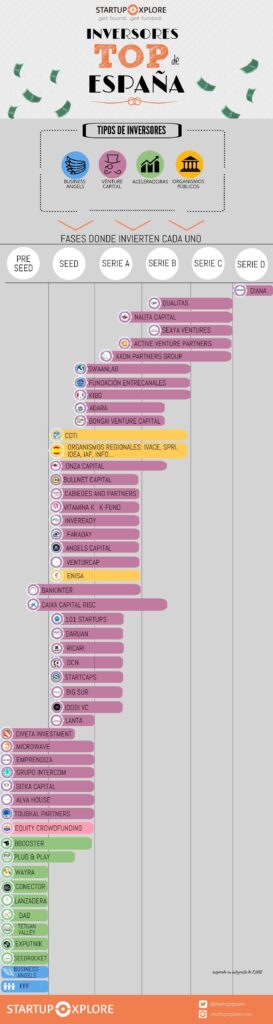

¿Quiénes invierten y en qué fase?

FASE PRE-SEMILLA(PRE-SEED): INVERSIÓN EN TORNO A LOS 100.000 EUROS

Se refiere al momento en el que se genera la idea, el producto no está muy desarrollado y las ventas son escasas o nulas. Las inversiones en esta fase corren en primera instancia a cargo de los propios socios emprendedores bien sea con recursos propios o con recursos provenientes de familys, friends and fools. En esta fase se concentra la actividad de las aceleradoras que se ocupan de poner en marcha los proyectos y lanzarlos al mercado. La inversión se concentra sobre todo en fase Seed. El 60% de las rondas en España son seed/Preseed y series A.

FASE SEMILLA (SEED): INVERSIÓN EN TORNO A LOS 300.000 EUROS

En esta fase, ya tenemos un producto terminado, un modelo de negocio (+) bien definido y una empresa en marcha. Hay un equipo trabajando a pleno rendimiento y la facturación se va haciendo estable y recurrente. En esta fase continúan presentes las aceleradoras (+) que han tomado participación en sus aceleradas, y aparecen los fondos de venture capital (+). Pero es en la fase semilla en la que entra en juego el grueso de los llamados business angels (+). Como vía de financiación aparecen los fondos públicos como ENISA o CDETI y también los préstamos participativos.

CRECIMIENTO (GROWTH): ENTRE 1 Y 20 MILLONES DE EUROS

Es una etapa dedicada a gestionar el crecimiento escalando ventas y optimizar operaciones, para lo que son necesarias nuevas inyecciones de capital. Aquí se intensifica la presencia de los venture capital o capital riesgo (+). Las rondas (+) en esta fase se categorizan en series:

- A: Hasta 1 millón de euros.

- B: Hasta 3 millones de euros.

- C: Hasta 16 millones de euros.

- D: Hasta 20 millones de euros.

El 75% de la inversión en startups provienen de fondos de Venture Capital. Los datos arrojan que las corporaciones empiezan a invertir en tecnología con fines tanto estratégicos como financieros.

La mayor parte del volumen de inversión proviene de capital extranjero que en 2021. Se disparó hasta los 2.170 millones de euros, un 335% más que en 2020. Los fondos españoles están más enfocados a entrar en fases iniciales y no acceden a inversiones de 10 millones de euros. Se necesita de más fondos que inviertan en fases de crecimiento pero de momento solo fondos extranjeros llegan a ese nivel.

De todos modos, el balance de la llegada de fondos extranjeros al mercado español, ha sido muy positivo ya que nos ha enseñado el camino seguido en otros entornos más desarrollados en ámbito de las startups y suponen un reto para los locales que se ven obligados a mejorar.

¿Por qué invertir en startups en España?

Existen sobradas razones para invertir en startups en nuestro país. En primer lugar la economía digital representa en este momento más de un 19% del PIB español y ello de forma directa o indirecta. Es esencial que, la economía digital, siga creciendo ya que es una cuestión estratégica de cara al futuro.

ALGUNOS DATOS COMPARATIVOS CON OTRAS NACIONES:

- Global 16%

- España 19%

- Estados Unidos 22%

- China 30%

Además, la economía digital Por otra parte, la economía digital es creadora nata de empleo cualificado y demandará cada vez más talento. Otra consideración, sobre la inversión de las startups en España, se explica desde el punto de vista del inversor ya que la economía digital ofrece un mejor equilibrio riesgo-rentabilidad, además de aportar múltiples opciones para la diversificación de cartera.

Los 100 Business Angels más activos en España enlace de interés (+)

APLICA ESTE TIP EN TU PROYECTO

TAREA

Ahora que has leído esta tip, ¿puedes contestar a estas preguntas?

- ¿Podrías definir en qué fase se encuentra tu proyecto?

- ¿En función de la fase en la que se encuentra tu proyecto, qué perfil de inversor crees que puede ser más interesante?

- 💻 PRACTICA con un experto en el próximo webinar práctico.

- 🔎 CONSULTA más TIPs relacionadas con este mismo tema.

- 📖 AMPLIA tus conocimientos descargando este EBOOK.

PIENSA EN TI

- 🚀 IMPULSA tu empresa en el próximo programa de aceleración, ¡reserva tu plaza ya!

- 🥁 PRACTICA con tu proyecto en este webinar práctico, ¡solicita tu plaza!.

- 🌐 CONTACTA con otros emprendedores y empresas, ¡inscríbete y participa en el próximo Networking!

PIENSA EN AYUDAR A LOS DEMÁS

- 🤝COLABORA como voluntario: experto, mentor, inversor, premiando, difundiendo, retando, innovando, creando una TIP…

- 💬 RECOMIENDA este programa para que llegue a más emprendedores por Google.

- 👉 ¡COMPARTE tu aprendizaje!

- 📲 REENVÍA esta TIP 👇